Neurogene (NASDAQ:NGNE - Get Free Report)'s stock had its "sell (d-)" rating reissued by equities research analysts at Weiss Ratings in a research note issued to investors on Saturday,Weiss Ratings reports.

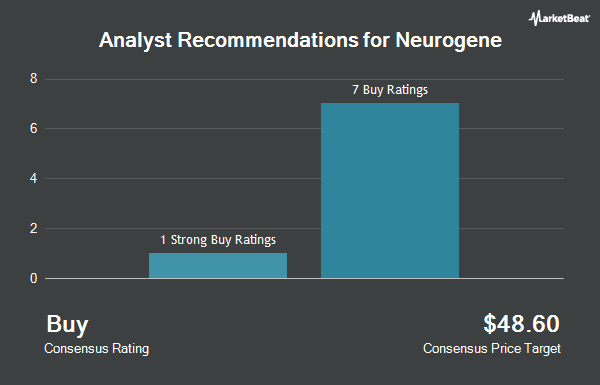

Separately, HC Wainwright reaffirmed a "buy" rating and set a $45.00 target price on shares of Neurogene in a research note on Thursday, October 9th. Six analysts have rated the stock with a Buy rating, two have assigned a Hold rating and one has given a Sell rating to the stock. According to MarketBeat, Neurogene presently has an average rating of "Moderate Buy" and an average target price of $46.17.

View Our Latest Analysis on Neurogene

Neurogene Stock Up 4.1%

Shares of Neurogene stock opened at $29.89 on Friday. The company has a market cap of $426.53 million, a price-to-earnings ratio of -6.94 and a beta of 1.58. The company's 50 day moving average is $22.22 and its 200 day moving average is $19.51. Neurogene has a twelve month low of $6.88 and a twelve month high of $74.49.

Neurogene (NASDAQ:NGNE - Get Free Report) last issued its quarterly earnings data on Monday, August 11th. The company reported ($1.05) earnings per share for the quarter, beating analysts' consensus estimates of ($1.15) by $0.10. Sell-side analysts expect that Neurogene will post -4.27 EPS for the current fiscal year.

Institutional Investors Weigh In On Neurogene

Several large investors have recently modified their holdings of NGNE. Bank of America Corp DE raised its stake in shares of Neurogene by 81.6% during the 2nd quarter. Bank of America Corp DE now owns 95,401 shares of the company's stock worth $1,426,000 after acquiring an additional 42,880 shares in the last quarter. Schroder Investment Management Group acquired a new stake in shares of Neurogene in the second quarter valued at about $451,000. PNC Financial Services Group Inc. raised its position in shares of Neurogene by 43.6% in the second quarter. PNC Financial Services Group Inc. now owns 4,055 shares of the company's stock valued at $61,000 after buying an additional 1,232 shares during the last quarter. Jennison Associates LLC increased its position in Neurogene by 55.0% during the second quarter. Jennison Associates LLC now owns 167,563 shares of the company's stock worth $2,505,000 after purchasing an additional 59,479 shares during the last quarter. Finally, MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its position in Neurogene by 17.9% during the first quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 6,983 shares of the company's stock worth $82,000 after purchasing an additional 1,059 shares during the last quarter. Institutional investors own 52.37% of the company's stock.

About Neurogene

(

Get Free Report)

Neurogene Inc, a biotechnology company, develops genetic medicines for rare neurological diseases. The company's product candidates include NGN-401 which is packaged in an adeno-associated virus 9 that is in Phase 1/2 clinical trial for the treatment of Rett syndrome; and NGN-101, a conventional gene therapy candidate that is in Phase 1/2 clinical trial to treat CLN5 Batten disease.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Neurogene, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Neurogene wasn't on the list.

While Neurogene currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.