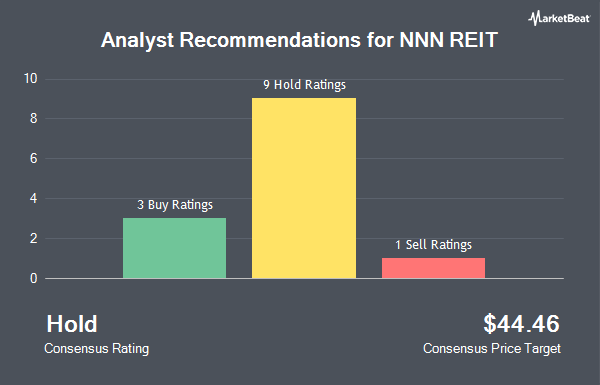

NNN REIT, Inc. (NYSE:NNN - Get Free Report) has received an average rating of "Hold" from the fourteen ratings firms that are presently covering the firm, MarketBeat.com reports. Two analysts have rated the stock with a sell rating, ten have given a hold rating and two have assigned a buy rating to the company. The average 12-month price objective among analysts that have issued a report on the stock in the last year is $44.38.

A number of equities analysts recently issued reports on NNN shares. Evercore ISI upped their price target on shares of NNN REIT from $43.00 to $44.00 and gave the stock an "in-line" rating in a research note on Wednesday, July 2nd. Barclays downgraded NNN REIT from a "strong-buy" rating to a "strong sell" rating in a research note on Tuesday, July 22nd. Finally, UBS Group lowered their price target on NNN REIT from $43.00 to $42.00 and set a "neutral" rating for the company in a research report on Wednesday, July 16th.

View Our Latest Stock Report on NNN REIT

Institutional Inflows and Outflows

A number of large investors have recently bought and sold shares of NNN. Sound Income Strategies LLC raised its stake in NNN REIT by 8.2% in the 2nd quarter. Sound Income Strategies LLC now owns 416,058 shares of the real estate investment trust's stock valued at $17,965,000 after purchasing an additional 31,505 shares during the last quarter. Goodman Financial Corp increased its position in NNN REIT by 3.3% during the first quarter. Goodman Financial Corp now owns 308,870 shares of the real estate investment trust's stock worth $13,173,000 after buying an additional 9,755 shares during the period. GAMMA Investing LLC increased its holdings in shares of NNN REIT by 3,301.7% in the first quarter. GAMMA Investing LLC now owns 98,138 shares of the real estate investment trust's stock valued at $4,186,000 after purchasing an additional 95,253 shares during the period. Pinebridge Investments L.P. increased its holdings in shares of NNN REIT by 42.7% in the fourth quarter. Pinebridge Investments L.P. now owns 49,642 shares of the real estate investment trust's stock valued at $2,028,000 after purchasing an additional 14,850 shares during the period. Finally, Red Spruce Capital LLC grew its holdings in NNN REIT by 0.7% during the second quarter. Red Spruce Capital LLC now owns 48,252 shares of the real estate investment trust's stock worth $2,084,000 after acquiring an additional 345 shares during the period. 89.96% of the stock is owned by institutional investors and hedge funds.

NNN REIT Price Performance

NNN REIT stock traded up $0.58 during mid-day trading on Friday, hitting $42.65. 1,255,552 shares of the company traded hands, compared to its average volume of 1,078,632. NNN REIT has a one year low of $35.80 and a one year high of $49.57. The stock has a market cap of $8.02 billion, a price-to-earnings ratio of 19.93, a price-to-earnings-growth ratio of 3.94 and a beta of 0.92. The company has a debt-to-equity ratio of 1.03, a quick ratio of 0.58 and a current ratio of 0.58. The stock has a fifty day moving average price of $42.53 and a 200-day moving average price of $41.49.

NNN REIT (NYSE:NNN - Get Free Report) last issued its quarterly earnings data on Thursday, May 1st. The real estate investment trust reported $0.87 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.83 by $0.04. The business had revenue of $230.85 million for the quarter, compared to the consensus estimate of $219.68 million. NNN REIT had a net margin of 45.09% and a return on equity of 9.23%. The company's quarterly revenue was up 7.2% compared to the same quarter last year. During the same period in the previous year, the firm earned $0.84 EPS. On average, equities analysts predict that NNN REIT will post 3.33 earnings per share for the current fiscal year.

NNN REIT Increases Dividend

The company also recently announced a quarterly dividend, which will be paid on Friday, August 15th. Investors of record on Thursday, July 31st will be issued a dividend of $0.60 per share. This is an increase from NNN REIT's previous quarterly dividend of $0.58. The ex-dividend date of this dividend is Thursday, July 31st. This represents a $2.40 dividend on an annualized basis and a dividend yield of 5.63%. NNN REIT's payout ratio is 108.41%.

About NNN REIT

(

Get Free ReportNNN REIT invests primarily in high-quality retail properties subject generally to long-term, net leases. As of December 31, 2023, the company owned 3,532 properties in 49 states with a gross leasable area of approximately 36.0 million square feet and a weighted average remaining lease term of 10.1 years.

See Also

Before you consider NNN REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NNN REIT wasn't on the list.

While NNN REIT currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.