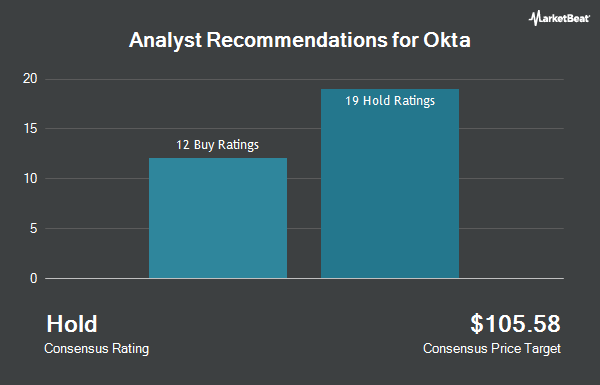

Shares of Okta, Inc. (NASDAQ:OKTA - Get Free Report) have received a consensus rating of "Hold" from the thirty-seven analysts that are covering the stock, Marketbeat reports. Three analysts have rated the stock with a sell rating, fourteen have issued a hold rating and twenty have issued a buy rating on the company. The average 12-month price objective among brokers that have covered the stock in the last year is $118.61.

A number of equities research analysts have commented on OKTA shares. Arete began coverage on Okta in a research report on Monday, July 7th. They set a "sell" rating and a $83.00 price objective for the company. Loop Capital initiated coverage on shares of Okta in a report on Monday, May 5th. They set a "buy" rating and a $140.00 price target for the company. DA Davidson dropped their price objective on shares of Okta from $145.00 to $140.00 and set a "buy" rating on the stock in a research note on Wednesday, May 28th. Morgan Stanley cut their target price on shares of Okta from $125.00 to $123.00 and set an "overweight" rating for the company in a research report on Wednesday, April 16th. Finally, Stephens reissued an "equal weight" rating and set a $127.00 target price on shares of Okta in a research note on Tuesday, May 27th.

Check Out Our Latest Analysis on OKTA

Insider Activity

In other Okta news, CFO Brett Tighe sold 10,000 shares of Okta stock in a transaction that occurred on Friday, July 18th. The stock was sold at an average price of $95.00, for a total value of $950,000.00. Following the transaction, the chief financial officer directly owned 132,288 shares of the company's stock, valued at $12,567,360. The trade was a 7.03% decrease in their position. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CRO Jonathan James Addison sold 9,000 shares of the stock in a transaction that occurred on Friday, July 25th. The shares were sold at an average price of $100.00, for a total value of $900,000.00. Following the completion of the sale, the executive directly owned 7,067 shares of the company's stock, valued at $706,700. This represents a 56.02% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 88,594 shares of company stock worth $8,382,790 over the last 90 days. Company insiders own 5.68% of the company's stock.

Institutional Trading of Okta

Hedge funds have recently bought and sold shares of the stock. Wealth Enhancement Advisory Services LLC raised its position in shares of Okta by 52.4% during the fourth quarter. Wealth Enhancement Advisory Services LLC now owns 12,126 shares of the company's stock valued at $956,000 after buying an additional 4,171 shares during the last quarter. Trek Financial LLC bought a new position in Okta during the first quarter valued at about $426,000. Merit Financial Group LLC acquired a new position in Okta in the 1st quarter valued at approximately $823,000. Stephens Investment Management Group LLC lifted its position in shares of Okta by 10.4% in the 1st quarter. Stephens Investment Management Group LLC now owns 499,125 shares of the company's stock worth $52,518,000 after acquiring an additional 46,818 shares during the period. Finally, Greenwood Capital Associates LLC lifted its position in shares of Okta by 165.7% in the 1st quarter. Greenwood Capital Associates LLC now owns 7,048 shares of the company's stock worth $742,000 after acquiring an additional 4,395 shares during the period. 86.64% of the stock is owned by institutional investors.

Okta Stock Down 2.7%

Shares of NASDAQ:OKTA opened at $95.13 on Friday. The firm has a 50 day simple moving average of $99.73 and a 200 day simple moving average of $102.25. Okta has a 52 week low of $70.56 and a 52 week high of $127.57. The company has a debt-to-equity ratio of 0.05, a quick ratio of 1.47 and a current ratio of 1.47. The company has a market cap of $16.65 billion, a PE ratio of 151.00, a price-to-earnings-growth ratio of 4.73 and a beta of 0.80.

Okta (NASDAQ:OKTA - Get Free Report) last released its earnings results on Tuesday, May 27th. The company reported $0.86 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.77 by $0.09. Okta had a return on equity of 2.79% and a net margin of 4.85%. The company had revenue of $688.00 million during the quarter, compared to analyst estimates of $680.14 million. During the same quarter in the prior year, the company earned $0.65 earnings per share. The company's revenue for the quarter was up 11.5% on a year-over-year basis. As a group, research analysts expect that Okta will post 0.42 earnings per share for the current year.

Okta Company Profile

(

Get Free ReportOkta, Inc operates as an identity partner in the United States and internationally. The company offers Okta's suite of products and services used to manage and secure identities, such as Single Sign-On that enables users to access applications in the cloud or on-premises from various devices; Adaptive Multi-Factor Authentication provides a layer of security for cloud, mobile, web applications, and data; API Access Management enables organizations to secure APIs; Access Gateway enables organizations to extend Workforce Identity Cloud; and Okta Device Access enables end users to securely log in to devices with Okta credentials.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Okta, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Okta wasn't on the list.

While Okta currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.