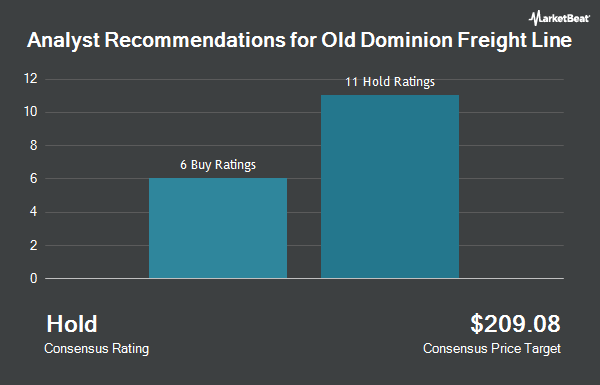

Shares of Old Dominion Freight Line, Inc. (NASDAQ:ODFL - Get Free Report) have earned a consensus recommendation of "Hold" from the twenty-two analysts that are currently covering the firm, MarketBeat.com reports. One equities research analyst has rated the stock with a sell rating, fourteen have issued a hold rating and seven have given a buy rating to the company. The average 12-month target price among brokers that have issued ratings on the stock in the last year is $174.85.

A number of analysts recently issued reports on ODFL shares. Wall Street Zen raised Old Dominion Freight Line from a "sell" rating to a "hold" rating in a research report on Friday, May 30th. Citigroup raised Old Dominion Freight Line from a "neutral" rating to a "buy" rating and decreased their price objective for the stock from $186.00 to $183.00 in a research report on Tuesday, April 8th. Baird R W raised Old Dominion Freight Line to a "hold" rating in a research report on Tuesday, July 1st. Bank of America increased their price objective on Old Dominion Freight Line from $167.00 to $183.00 and gave the stock a "neutral" rating in a research report on Friday, May 16th. Finally, Wells Fargo & Company raised their price target on Old Dominion Freight Line from $150.00 to $160.00 and gave the company an "underweight" rating in a report on Monday, July 7th.

Read Our Latest Report on Old Dominion Freight Line

Old Dominion Freight Line Stock Performance

Shares of NASDAQ ODFL traded down $0.70 during trading hours on Thursday, reaching $167.09. The stock had a trading volume of 1,747,264 shares, compared to its average volume of 1,615,868. The firm has a market cap of $35.31 billion, a price-to-earnings ratio of 31.35, a PEG ratio of 3.37 and a beta of 1.25. The company has a current ratio of 1.32, a quick ratio of 1.32 and a debt-to-equity ratio of 0.01. Old Dominion Freight Line has a fifty-two week low of $144.90 and a fifty-two week high of $233.26. The firm has a 50-day moving average of $163.55 and a 200-day moving average of $169.60.

Old Dominion Freight Line (NASDAQ:ODFL - Get Free Report) last announced its earnings results on Wednesday, April 23rd. The transportation company reported $1.19 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $1.14 by $0.05. The firm had revenue of $1.37 billion during the quarter, compared to analysts' expectations of $1.38 billion. Old Dominion Freight Line had a return on equity of 27.40% and a net margin of 20.04%. The business's revenue was down 5.8% on a year-over-year basis. During the same period in the prior year, the firm earned $1.34 EPS. Equities research analysts predict that Old Dominion Freight Line will post 5.68 earnings per share for the current year.

Old Dominion Freight Line Announces Dividend

The business also recently declared a quarterly dividend, which will be paid on Wednesday, September 17th. Stockholders of record on Wednesday, September 3rd will be given a dividend of $0.28 per share. This represents a $1.12 dividend on an annualized basis and a dividend yield of 0.67%. The ex-dividend date of this dividend is Wednesday, September 3rd. Old Dominion Freight Line's payout ratio is 21.01%.

Institutional Trading of Old Dominion Freight Line

Institutional investors and hedge funds have recently made changes to their positions in the stock. Ameriprise Financial Inc. increased its position in Old Dominion Freight Line by 2.9% in the 4th quarter. Ameriprise Financial Inc. now owns 1,267,640 shares of the transportation company's stock valued at $223,281,000 after acquiring an additional 35,778 shares during the period. GAMMA Investing LLC increased its position in Old Dominion Freight Line by 48.7% in the 1st quarter. GAMMA Investing LLC now owns 3,109 shares of the transportation company's stock valued at $514,000 after acquiring an additional 1,018 shares during the period. World Investment Advisors acquired a new stake in Old Dominion Freight Line in the 4th quarter valued at approximately $360,000. Wealth Enhancement Advisory Services LLC increased its position in Old Dominion Freight Line by 9.5% in the 1st quarter. Wealth Enhancement Advisory Services LLC now owns 17,595 shares of the transportation company's stock valued at $2,911,000 after acquiring an additional 1,529 shares during the period. Finally, Mercer Global Advisors Inc. ADV increased its position in Old Dominion Freight Line by 93.5% in the 4th quarter. Mercer Global Advisors Inc. ADV now owns 15,396 shares of the transportation company's stock valued at $2,716,000 after acquiring an additional 7,439 shares during the period. 77.82% of the stock is currently owned by institutional investors and hedge funds.

Old Dominion Freight Line Company Profile

(

Get Free ReportOld Dominion Freight Line, Inc operates as a less-than-truckload motor carrier in the United States and North America. The company offers regional, inter-regional, and national less-than-truckload services, as well as expedited transportation. It also provides various value-added services, including container drayage, truckload brokerage, and supply chain consulting.

See Also

Before you consider Old Dominion Freight Line, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Old Dominion Freight Line wasn't on the list.

While Old Dominion Freight Line currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.