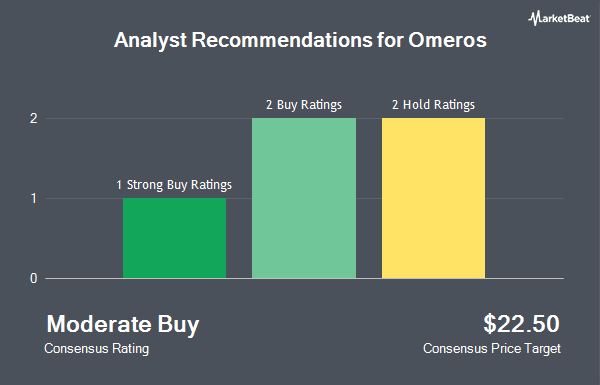

Shares of Omeros Corporation (NASDAQ:OMER - Get Free Report) have been assigned a consensus recommendation of "Moderate Buy" from the six analysts that are presently covering the stock, Marketbeat Ratings reports. Two research analysts have rated the stock with a hold rating, three have assigned a buy rating and one has issued a strong buy rating on the company. The average 1-year price target among brokerages that have issued a report on the stock in the last year is $18.00.

OMER has been the subject of a number of research reports. D. Boral Capital reiterated a "buy" rating and issued a $36.00 price objective on shares of Omeros in a research report on Friday, July 25th. Needham & Company LLC reaffirmed a "hold" rating on shares of Omeros in a research note on Friday, May 16th. HC Wainwright reissued a "buy" rating and set a $9.00 price target on shares of Omeros in a research note on Friday, June 27th. Finally, Wall Street Zen lowered shares of Omeros from a "hold" rating to a "sell" rating in a report on Friday, June 27th.

Check Out Our Latest Research Report on Omeros

Omeros Price Performance

Shares of OMER stock traded up $0.21 during trading hours on Tuesday, reaching $3.99. 528,059 shares of the company were exchanged, compared to its average volume of 890,592. Omeros has a fifty-two week low of $2.95 and a fifty-two week high of $13.60. The stock's fifty day moving average is $3.49 and its two-hundred day moving average is $5.99. The company has a market cap of $246.11 million, a price-to-earnings ratio of -1.49 and a beta of 2.26.

Omeros (NASDAQ:OMER - Get Free Report) last announced its quarterly earnings data on Thursday, May 15th. The biopharmaceutical company reported ($0.65) EPS for the quarter, missing analysts' consensus estimates of ($0.60) by ($0.05). On average, research analysts anticipate that Omeros will post -3.09 earnings per share for the current year.

Institutional Trading of Omeros

A number of institutional investors and hedge funds have recently modified their holdings of the stock. Nomura Holdings Inc. grew its holdings in Omeros by 136.2% during the fourth quarter. Nomura Holdings Inc. now owns 747,281 shares of the biopharmaceutical company's stock valued at $7,383,000 after purchasing an additional 430,932 shares during the period. Susquehanna Fundamental Investments LLC bought a new stake in shares of Omeros in the 4th quarter valued at $1,488,000. Wellington Management Group LLP acquired a new stake in Omeros during the 1st quarter worth $1,118,000. Nuveen LLC bought a new position in Omeros during the first quarter worth about $938,000. Finally, Jacobs Levy Equity Management Inc. acquired a new position in Omeros in the fourth quarter valued at about $1,033,000. 48.79% of the stock is owned by institutional investors.

Omeros Company Profile

(

Get Free Report)

Omeros Corporation, a clinical-stage biopharmaceutical company, discovers, develops, and commercializes small-molecule and protein therapeutics, and orphan indications targeting immunologic diseases, including complement-mediated diseases, cancers, and addictive and compulsive disorders. The company's products under development include Narsoplimab (OMS721/MASP-2) that has completed pivotal trial for hematopoietic stem-cell transplant-associated thrombotic microangiopathy (TA-TMA); that is in Phase III clinical trial for the treatment of immunoglobulin A nephropathy (IgAN); and Phase II clinical trial to treat COVID-19.

Featured Articles

Before you consider Omeros, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Omeros wasn't on the list.

While Omeros currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.