Oxford Asset Management LLP bought a new position in shares of Amneal Pharmaceuticals, Inc. (NASDAQ:AMRX - Free Report) during the 4th quarter, according to its most recent 13F filing with the Securities and Exchange Commission. The fund bought 55,526 shares of the company's stock, valued at approximately $440,000.

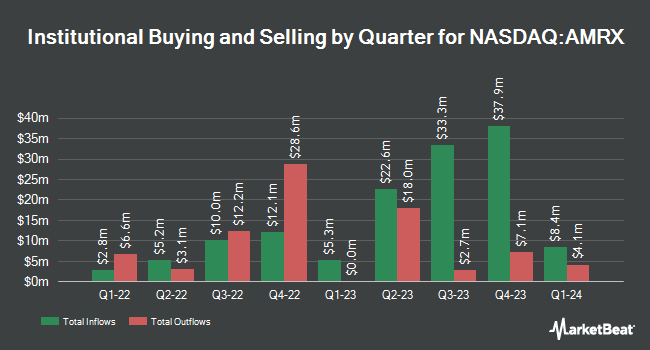

A number of other large investors have also made changes to their positions in AMRX. Mirae Asset Global Investments Co. Ltd. acquired a new stake in shares of Amneal Pharmaceuticals in the fourth quarter valued at $81,000. Straightline Group LLC purchased a new stake in Amneal Pharmaceuticals in the 4th quarter valued at $92,000. Cibc World Markets Corp acquired a new stake in Amneal Pharmaceuticals during the 4th quarter worth approximately $118,000. Janney Montgomery Scott LLC acquired a new stake in shares of Amneal Pharmaceuticals in the 4th quarter worth $121,000. Finally, Fox Run Management L.L.C. boosted its stake in shares of Amneal Pharmaceuticals by 69.0% in the fourth quarter. Fox Run Management L.L.C. now owns 20,435 shares of the company's stock valued at $162,000 after buying an additional 8,342 shares in the last quarter. 31.82% of the stock is currently owned by hedge funds and other institutional investors.

Wall Street Analyst Weigh In

Several analysts have weighed in on the company. Barclays upped their target price on Amneal Pharmaceuticals from $10.00 to $11.00 and gave the company an "overweight" rating in a report on Monday, March 3rd. JPMorgan Chase & Co. raised shares of Amneal Pharmaceuticals from a "neutral" rating to an "overweight" rating and boosted their target price for the stock from $9.00 to $12.00 in a research report on Monday, February 24th. Six research analysts have rated the stock with a buy rating, According to MarketBeat, Amneal Pharmaceuticals has a consensus rating of "Buy" and an average target price of $10.80.

View Our Latest Stock Report on AMRX

Insider Transactions at Amneal Pharmaceuticals

In other Amneal Pharmaceuticals news, major shareholder Tushar Bhikhubhai Patel sold 5,000,000 shares of the business's stock in a transaction that occurred on Friday, March 14th. The shares were sold at an average price of $8.35, for a total value of $41,750,000.00. Following the completion of the sale, the insider now directly owns 48,578,209 shares of the company's stock, valued at $405,628,045.15. The trade was a 9.33 % decrease in their ownership of the stock. The transaction was disclosed in a legal filing with the SEC, which is available at this hyperlink. Also, Director Gautam Patel sold 80,000 shares of the stock in a transaction dated Monday, February 3rd. The shares were sold at an average price of $8.14, for a total value of $651,200.00. Following the transaction, the director now directly owns 1,888,886 shares in the company, valued at approximately $15,375,532.04. This represents a 4.06 % decrease in their position. The disclosure for this sale can be found here. Insiders have sold 5,160,000 shares of company stock valued at $43,113,200 over the last three months. Company insiders own 26.56% of the company's stock.

Amneal Pharmaceuticals Price Performance

Shares of NASDAQ:AMRX traded up $0.17 during trading on Friday, reaching $7.91. 2,612,939 shares of the company's stock traded hands, compared to its average volume of 1,418,870. Amneal Pharmaceuticals, Inc. has a 12 month low of $5.81 and a 12 month high of $9.48. The stock has a market capitalization of $2.45 billion, a P/E ratio of -11.60 and a beta of 1.06. The company has a 50 day moving average of $8.03 and a 200-day moving average of $8.17.

Amneal Pharmaceuticals (NASDAQ:AMRX - Get Free Report) last announced its quarterly earnings results on Friday, May 2nd. The company reported $0.19 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.14 by $0.05. Amneal Pharmaceuticals had a negative return on equity of 346.26% and a negative net margin of 6.88%. Equities research analysts predict that Amneal Pharmaceuticals, Inc. will post 0.53 earnings per share for the current fiscal year.

Amneal Pharmaceuticals Profile

(

Free Report)

Amneal Pharmaceuticals, Inc, together with its subsidiaries, develops, manufactures, markets, and distributes generics, injectables, biosimilars, and specialty branded pharmaceutical products worldwide. The company operates through three segments: Generics, Specialty, and AvKARE. The Generics segment offers immediate and extended release oral solid, powder, liquid, sterile injectable, nasal spray, inhalation and respiratory, biosimilar, ophthalmic, film, transdermal patch, and topical products.

See Also

Before you consider Amneal Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Amneal Pharmaceuticals wasn't on the list.

While Amneal Pharmaceuticals currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Spring 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.