Park West Asset Management LLC decreased its holdings in shares of Fulgent Genetics, Inc. (NASDAQ:FLGT - Free Report) by 10.1% during the fourth quarter, according to its most recent filing with the SEC. The firm owned 641,682 shares of the company's stock after selling 71,902 shares during the period. Park West Asset Management LLC owned 2.10% of Fulgent Genetics worth $11,852,000 at the end of the most recent reporting period.

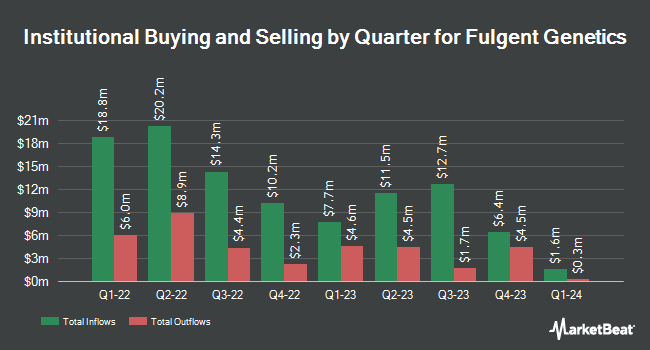

Several other large investors have also modified their holdings of the business. GAMMA Investing LLC boosted its stake in Fulgent Genetics by 45.5% in the fourth quarter. GAMMA Investing LLC now owns 2,133 shares of the company's stock valued at $39,000 after acquiring an additional 667 shares in the last quarter. Exchange Traded Concepts LLC boosted its position in shares of Fulgent Genetics by 5.0% in the 4th quarter. Exchange Traded Concepts LLC now owns 35,324 shares of the company's stock worth $652,000 after purchasing an additional 1,689 shares in the last quarter. Federated Hermes Inc. grew its stake in Fulgent Genetics by 4.4% during the 4th quarter. Federated Hermes Inc. now owns 41,882 shares of the company's stock worth $774,000 after buying an additional 1,774 shares during the last quarter. Russell Investments Group Ltd. grew its stake in Fulgent Genetics by 267.4% during the 4th quarter. Russell Investments Group Ltd. now owns 2,693 shares of the company's stock worth $50,000 after buying an additional 1,960 shares during the last quarter. Finally, Dynamic Technology Lab Private Ltd increased its position in Fulgent Genetics by 15.2% during the 4th quarter. Dynamic Technology Lab Private Ltd now owns 15,129 shares of the company's stock valued at $280,000 after buying an additional 1,995 shares in the last quarter. Institutional investors own 48.06% of the company's stock.

Insider Buying and Selling at Fulgent Genetics

In related news, CFO Paul Kim acquired 100,000 shares of the stock in a transaction on Wednesday, March 5th. The shares were acquired at an average price of $15.96 per share, for a total transaction of $1,596,000.00. Following the transaction, the chief financial officer now owns 348,282 shares in the company, valued at approximately $5,558,580.72. This trade represents a 40.28 % increase in their position. The purchase was disclosed in a filing with the Securities & Exchange Commission, which is accessible through the SEC website. 31.76% of the stock is owned by corporate insiders.

Fulgent Genetics Price Performance

FLGT traded up $3.29 on Friday, reaching $20.54. 851,635 shares of the stock were exchanged, compared to its average volume of 266,165. The company's 50-day moving average price is $17.46 and its 200 day moving average price is $18.08. The firm has a market capitalization of $633.99 million, a PE ratio of -3.72 and a beta of 1.36. Fulgent Genetics, Inc. has a fifty-two week low of $14.57 and a fifty-two week high of $25.11.

Fulgent Genetics (NASDAQ:FLGT - Get Free Report) last released its earnings results on Friday, May 2nd. The company reported $0.04 EPS for the quarter, topping analysts' consensus estimates of ($0.18) by $0.22. Fulgent Genetics had a negative return on equity of 1.81% and a negative net margin of 59.39%. The firm had revenue of $73.46 million during the quarter, compared to the consensus estimate of $71.26 million. During the same quarter in the previous year, the company posted ($0.01) earnings per share. The company's revenue was up 14.0% compared to the same quarter last year. As a group, equities analysts forecast that Fulgent Genetics, Inc. will post -0.85 earnings per share for the current fiscal year.

Analyst Ratings Changes

FLGT has been the topic of several recent analyst reports. StockNews.com upgraded shares of Fulgent Genetics from a "sell" rating to a "hold" rating in a report on Wednesday, March 5th. Piper Sandler cut their price target on shares of Fulgent Genetics from $22.00 to $16.00 and set a "neutral" rating on the stock in a research note on Tuesday, March 4th.

Read Our Latest Report on Fulgent Genetics

Fulgent Genetics Company Profile

(

Free Report)

Fulgent Genetics, Inc, together with its subsidiaries, provides clinical diagnostic and therapeutic development solutions to physicians and patients in the United States and internationally. The company's clinical diagnostic solutions include molecular diagnostic testing; genetic testing; anatomic pathology laboratory tests and testing services, such as gastrointestinal pathology, dermatopathology, urologic pathology, breast pathology, neuropathology, and hematopathology; oncology tests and testing services; and sequencer services related to hereditary cancer, reproductive health, and other diseases.

Further Reading

Before you consider Fulgent Genetics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Fulgent Genetics wasn't on the list.

While Fulgent Genetics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for June 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.