Zacks Research upgraded shares of Petroleo Brasileiro S.A.- Petrobras (NYSE:PBR - Free Report) from a hold rating to a strong-buy rating in a report released on Wednesday, August 20th,Zacks.com reports.

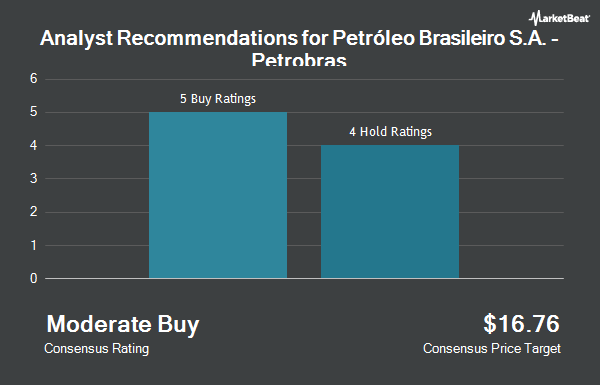

A number of other equities research analysts also recently weighed in on PBR. Bank of America downgraded Petroleo Brasileiro S.A.- Petrobras from a "buy" rating to a "neutral" rating in a report on Monday, June 9th. Jefferies Financial Group raised Petroleo Brasileiro S.A.- Petrobras from a "hold" rating to a "buy" rating and set a $15.30 target price for the company in a report on Thursday, May 15th. Finally, Wall Street Zen upgraded Petroleo Brasileiro S.A.- Petrobras from a "hold" rating to a "buy" rating in a research report on Wednesday, May 14th. Two investment analysts have rated the stock with a Strong Buy rating, five have assigned a Buy rating and one has issued a Hold rating to the company's stock. Based on data from MarketBeat, the company has a consensus rating of "Buy" and a consensus price target of $16.14.

Read Our Latest Stock Analysis on PBR

Petroleo Brasileiro S.A.- Petrobras Stock Up 0.6%

Shares of NYSE PBR traded up $0.08 during trading hours on Wednesday, hitting $12.17. The company had a trading volume of 7,294,869 shares, compared to its average volume of 21,087,418. The stock has a market capitalization of $78.40 billion, a P/E ratio of 5.68 and a beta of 0.85. The company has a quick ratio of 0.47, a current ratio of 0.72 and a debt-to-equity ratio of 0.76. Petroleo Brasileiro S.A.- Petrobras has a 1-year low of $11.03 and a 1-year high of $15.70. The firm's 50 day moving average is $12.54 and its 200-day moving average is $12.60.

Petroleo Brasileiro S.A.- Petrobras (NYSE:PBR - Get Free Report) last released its quarterly earnings data on Friday, August 8th. The oil and gas exploration company reported $0.64 EPS for the quarter, missing the consensus estimate of $0.70 by ($0.06). Petroleo Brasileiro S.A.- Petrobras had a net margin of 15.99% and a return on equity of 34.11%. The company had revenue of $21.04 billion during the quarter, compared to analyst estimates of $20.78 billion. On average, analysts expect that Petroleo Brasileiro S.A.- Petrobras will post 2.14 earnings per share for the current fiscal year.

Petroleo Brasileiro S.A.- Petrobras Cuts Dividend

The company also recently declared a -- dividend, which will be paid on Monday, December 1st. Stockholders of record on Monday, August 25th will be paid a dividend of $0.2471 per share. This represents a dividend yield of 1,750.0%. The ex-dividend date of this dividend is Monday, August 25th. Petroleo Brasileiro S.A.- Petrobras's dividend payout ratio (DPR) is presently 48.13%.

Hedge Funds Weigh In On Petroleo Brasileiro S.A.- Petrobras

A number of hedge funds and other institutional investors have recently made changes to their positions in PBR. Financial Gravity Companies Inc. acquired a new position in shares of Petroleo Brasileiro S.A.- Petrobras in the second quarter worth approximately $26,000. Financial Gravity Asset Management Inc. acquired a new position in shares of Petroleo Brasileiro S.A.- Petrobras during the 1st quarter valued at $29,000. Geneos Wealth Management Inc. lifted its position in shares of Petroleo Brasileiro S.A.- Petrobras by 74.9% during the 2nd quarter. Geneos Wealth Management Inc. now owns 2,438 shares of the oil and gas exploration company's stock valued at $30,000 after acquiring an additional 1,044 shares during the period. Chung Wu Investment Group LLC acquired a new position in shares of Petroleo Brasileiro S.A.- Petrobras during the 2nd quarter valued at $31,000. Finally, Wayfinding Financial LLC acquired a new position in shares of Petroleo Brasileiro S.A.- Petrobras during the first quarter worth approximately $32,000.

About Petroleo Brasileiro S.A.- Petrobras

(

Get Free Report)

Petróleo Brasileiro SA - Petrobras explores, produces, and sells oil and gas in Brazil and internationally. The company operates through three segments: Exploration and Production; Refining, Transportation and Marketing; and Gas and Power. The Exploration and Production segment explores, develops, and produces crude oil, natural gas liquids, and natural gas primarily for supplies to the domestic refineries.

Read More

Before you consider Petroleo Brasileiro S.A.- Petrobras, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Petroleo Brasileiro S.A.- Petrobras wasn't on the list.

While Petroleo Brasileiro S.A.- Petrobras currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.