EQT (NYSE:EQT - Free Report) had its price target raised by Piper Sandler from $48.00 to $49.00 in a report published on Friday,Benzinga reports. They currently have a neutral rating on the oil and gas producer's stock.

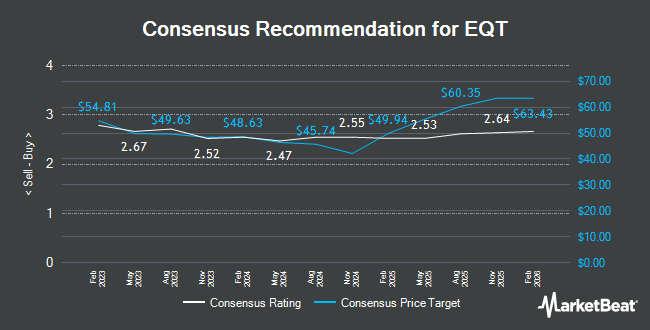

A number of other brokerages also recently issued reports on EQT. Royal Bank Of Canada boosted their price target on shares of EQT from $55.00 to $60.00 and gave the stock a "sector perform" rating in a research report on Tuesday, July 8th. TD Cowen raised shares of EQT from a "hold" rating to a "buy" rating and set a $54.00 price target on the stock in a research report on Tuesday, April 8th. Roth Capital began coverage on EQT in a report on Tuesday, June 24th. They set a "buy" rating and a $69.00 price target for the company. Jefferies Financial Group reissued a "buy" rating and issued a $70.00 price objective (up from $60.00) on shares of EQT in a research note on Tuesday, July 8th. Finally, Stephens cut their target price on EQT from $59.00 to $57.00 and set an "overweight" rating on the stock in a research report on Tuesday, April 15th. Two equities research analysts have rated the stock with a sell rating, four have given a hold rating and fourteen have issued a buy rating to the stock. Based on data from MarketBeat.com, EQT has a consensus rating of "Moderate Buy" and an average price target of $60.84.

View Our Latest Research Report on EQT

EQT Trading Up 2.8%

EQT traded up $1.48 during midday trading on Friday, hitting $53.39. 3,254,660 shares of the company were exchanged, compared to its average volume of 8,491,437. The firm's 50 day moving average price is $56.31 and its 200-day moving average price is $53.15. EQT has a 1-year low of $30.02 and a 1-year high of $61.02. The firm has a market capitalization of $33.32 billion, a P/E ratio of 28.85, a P/E/G ratio of 0.35 and a beta of 0.65. The company has a quick ratio of 0.71, a current ratio of 0.71 and a debt-to-equity ratio of 0.32.

EQT (NYSE:EQT - Get Free Report) last issued its quarterly earnings data on Tuesday, July 22nd. The oil and gas producer reported $0.45 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.52 by ($0.07). EQT had a return on equity of 6.24% and a net margin of 15.87%. The company had revenue of $1.60 billion for the quarter, compared to the consensus estimate of $1.78 billion. During the same quarter last year, the business earned ($0.08) earnings per share. As a group, equities analysts forecast that EQT will post 3.27 EPS for the current fiscal year.

EQT Announces Dividend

The firm also recently declared a quarterly dividend, which will be paid on Tuesday, September 2nd. Investors of record on Wednesday, August 6th will be given a $0.1575 dividend. The ex-dividend date is Wednesday, August 6th. This represents a $0.63 annualized dividend and a yield of 1.18%. EQT's payout ratio is 34.05%.

Insider Buying and Selling

In other news, EVP Sarah Fenton sold 12,438 shares of the stock in a transaction that occurred on Friday, July 25th. The stock was sold at an average price of $51.94, for a total value of $646,029.72. Following the completion of the sale, the executive vice president directly owned 13,297 shares of the company's stock, valued at $690,646.18. This represents a 48.33% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which is available through this hyperlink. Corporate insiders own 0.65% of the company's stock.

Institutional Investors Weigh In On EQT

Institutional investors have recently bought and sold shares of the stock. Allianz Asset Management GmbH boosted its holdings in EQT by 36.3% during the 1st quarter. Allianz Asset Management GmbH now owns 205,679 shares of the oil and gas producer's stock worth $10,989,000 after acquiring an additional 54,779 shares during the last quarter. Wedbush Securities Inc. purchased a new position in EQT during the first quarter worth about $216,000. Kingsman Wealth Management Inc. bought a new stake in EQT in the 1st quarter worth about $1,284,000. Teacher Retirement System of Texas bought a new stake in EQT in the 4th quarter worth about $244,000. Finally, Aviva PLC purchased a new stake in EQT in the 4th quarter valued at about $14,719,000. Institutional investors own 90.81% of the company's stock.

About EQT

(

Get Free Report)

EQT Corporation operates as a natural gas production company in the United States. The company sells natural gas and natural gas liquids to marketers, utilities, and industrial customers through pipelines located in the Appalachian Basin. It also offers marketing services and contractual pipeline capacity management services.

Read More

Before you consider EQT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and EQT wasn't on the list.

While EQT currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.