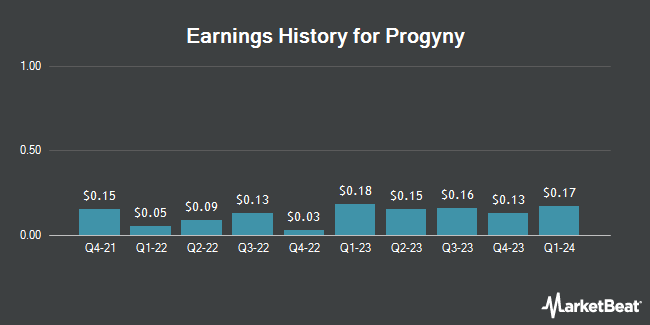

Progyny (NASDAQ:PGNY - Get Free Report) issued its earnings results on Thursday. The company reported $0.19 earnings per share (EPS) for the quarter, missing analysts' consensus estimates of $0.42 by ($0.23), Zacks reports. The business had revenue of $332.87 million for the quarter, compared to analysts' expectations of $315.70 million. Progyny had a return on equity of 11.13% and a net margin of 4.28%. The business's quarterly revenue was up 9.5% on a year-over-year basis. During the same period last year, the company posted $0.17 earnings per share. Progyny updated its Q3 2025 guidance to EPS and its FY 2025 guidance to 1.700-1.780 EPS.

Progyny Trading Down 0.9%

Progyny stock traded down $0.21 on Friday, reaching $22.85. 2,655,392 shares of the stock were exchanged, compared to its average volume of 951,696. The firm has a fifty day moving average price of $22.32 and a two-hundred day moving average price of $22.18. The stock has a market cap of $1.96 billion, a PE ratio of 38.73, a PEG ratio of 2.29 and a beta of 1.32. Progyny has a twelve month low of $13.39 and a twelve month high of $26.76.

Insider Transactions at Progyny

In other Progyny news, Director Cheryl Scott sold 2,675 shares of the company's stock in a transaction dated Wednesday, June 11th. The shares were sold at an average price of $22.07, for a total transaction of $59,037.25. Following the sale, the director directly owned 14,112 shares of the company's stock, valued at approximately $311,451.84. This represents a 15.93% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which can be accessed through this link. 9.40% of the stock is owned by company insiders.

Hedge Funds Weigh In On Progyny

Several large investors have recently bought and sold shares of PGNY. Amundi grew its position in Progyny by 103.8% in the first quarter. Amundi now owns 11,419 shares of the company's stock valued at $264,000 after purchasing an additional 5,817 shares in the last quarter. Royal Bank of Canada increased its position in Progyny by 384.8% during the 1st quarter. Royal Bank of Canada now owns 13,027 shares of the company's stock worth $291,000 after purchasing an additional 10,340 shares in the last quarter. Finally, UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC increased its position in Progyny by 6.0% during the 1st quarter. UBS AM A Distinct Business Unit of UBS Asset Management Americas LLC now owns 252,032 shares of the company's stock worth $5,630,000 after purchasing an additional 14,297 shares in the last quarter. 94.93% of the stock is currently owned by institutional investors and hedge funds.

Wall Street Analysts Forecast Growth

PGNY has been the topic of a number of analyst reports. Truist Financial increased their target price on Progyny from $24.00 to $27.00 and gave the company a "hold" rating in a report on Thursday, July 17th. Leerink Partnrs raised Progyny from a "hold" rating to a "strong-buy" rating in a research report on Tuesday, July 8th. Raymond James Financial set a $28.00 price objective on Progyny in a research report on Friday. Leerink Partners upgraded Progyny from a "market perform" rating to an "outperform" rating and set a $28.00 target price for the company in a research note on Tuesday, July 8th. Finally, Wall Street Zen upgraded Progyny from a "hold" rating to a "buy" rating in a research note on Saturday, July 26th. Four equities research analysts have rated the stock with a hold rating, seven have given a buy rating and one has given a strong buy rating to the company. According to data from MarketBeat.com, the company presently has a consensus rating of "Moderate Buy" and an average price target of $24.90.

View Our Latest Analysis on Progyny

About Progyny

(

Get Free Report)

Progyny, Inc, a benefits management company, specializes in fertility and family building benefits solutions in the United States. Its fertility benefits solution includes differentiated benefits plan design, personalized concierge-style member support services, and selective network of fertility specialists.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Progyny, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Progyny wasn't on the list.

While Progyny currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.