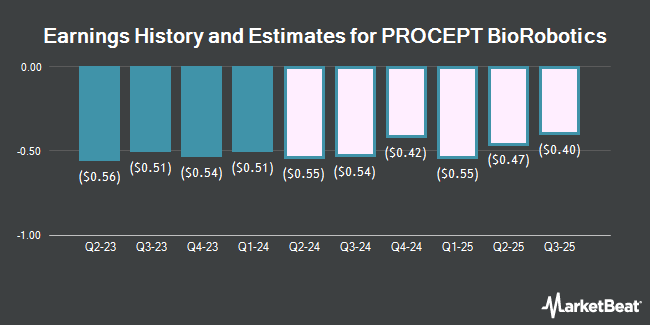

PROCEPT BioRobotics Corporation (NASDAQ:PRCT - Free Report) - Research analysts at Leerink Partnrs boosted their Q3 2025 earnings per share estimates for shares of PROCEPT BioRobotics in a report issued on Tuesday, October 14th. Leerink Partnrs analyst M. Kratky now forecasts that the company will post earnings per share of ($0.44) for the quarter, up from their previous forecast of ($0.45). The consensus estimate for PROCEPT BioRobotics' current full-year earnings is ($1.75) per share. Leerink Partnrs also issued estimates for PROCEPT BioRobotics' Q4 2025 earnings at ($0.26) EPS, FY2025 earnings at ($1.50) EPS, FY2026 earnings at ($1.15) EPS, FY2027 earnings at ($0.78) EPS and FY2028 earnings at ($0.23) EPS.

PRCT has been the subject of several other research reports. Morgan Stanley cut their target price on PROCEPT BioRobotics from $71.00 to $68.00 and set an "overweight" rating for the company in a research note on Tuesday, July 15th. Stephens started coverage on PROCEPT BioRobotics in a research note on Wednesday, July 9th. They issued an "overweight" rating and a $70.00 target price for the company. Wall Street Zen upgraded PROCEPT BioRobotics from a "sell" rating to a "hold" rating in a research note on Saturday, August 9th. Wells Fargo & Company cut their target price on PROCEPT BioRobotics from $75.00 to $58.00 and set an "overweight" rating for the company in a research note on Thursday, August 7th. Finally, Truist Financial cut their target price on PROCEPT BioRobotics from $64.00 to $50.00 and set a "buy" rating for the company in a research note on Wednesday. Seven equities research analysts have rated the stock with a Buy rating, two have issued a Hold rating and one has given a Sell rating to the stock. According to data from MarketBeat, the company currently has a consensus rating of "Moderate Buy" and an average target price of $67.50.

Check Out Our Latest Analysis on PROCEPT BioRobotics

PROCEPT BioRobotics Trading Down 0.5%

Shares of PRCT opened at $33.76 on Thursday. The business has a 50-day moving average of $37.94 and a 200 day moving average of $49.92. PROCEPT BioRobotics has a fifty-two week low of $32.11 and a fifty-two week high of $103.81. The firm has a market cap of $1.88 billion, a P/E ratio of -21.78 and a beta of 0.99. The company has a debt-to-equity ratio of 0.13, a quick ratio of 7.86 and a current ratio of 9.21.

PROCEPT BioRobotics (NASDAQ:PRCT - Get Free Report) last announced its earnings results on Wednesday, August 6th. The company reported ($0.35) earnings per share (EPS) for the quarter, beating the consensus estimate of ($0.41) by $0.06. PROCEPT BioRobotics had a negative return on equity of 23.73% and a negative net margin of 30.60%.The firm had revenue of $79.18 million during the quarter, compared to analyst estimates of $75.67 million. During the same period last year, the firm posted ($0.50) EPS. The business's revenue was up 48.3% compared to the same quarter last year.

Hedge Funds Weigh In On PROCEPT BioRobotics

Large investors have recently bought and sold shares of the stock. GAMMA Investing LLC increased its stake in shares of PROCEPT BioRobotics by 7,021.1% during the first quarter. GAMMA Investing LLC now owns 6,409 shares of the company's stock valued at $373,000 after buying an additional 6,319 shares during the period. Blue Trust Inc. increased its stake in shares of PROCEPT BioRobotics by 28.8% during the first quarter. Blue Trust Inc. now owns 4,996 shares of the company's stock valued at $291,000 after buying an additional 1,118 shares during the period. Avior Wealth Management LLC increased its stake in shares of PROCEPT BioRobotics by 138.5% during the first quarter. Avior Wealth Management LLC now owns 4,918 shares of the company's stock valued at $287,000 after buying an additional 2,856 shares during the period. Bessemer Group Inc. increased its stake in shares of PROCEPT BioRobotics by 50.7% during the first quarter. Bessemer Group Inc. now owns 10,900 shares of the company's stock valued at $635,000 after buying an additional 3,665 shares during the period. Finally, Diversified Trust Co increased its stake in shares of PROCEPT BioRobotics by 54.6% during the first quarter. Diversified Trust Co now owns 7,187 shares of the company's stock valued at $419,000 after buying an additional 2,538 shares during the period. 89.46% of the stock is owned by hedge funds and other institutional investors.

About PROCEPT BioRobotics

(

Get Free Report)

PROCEPT BioRobotics Corporation, a surgical robotics company, focuses on developing transformative solutions in urology in the United States and internationally. The company develops, manufactures, and sells AquaBeam Robotic System, an image-guided, surgical robotic system for use in minimally invasive urologic surgery with a focus on treating benign prostatic hyperplasia (BPH).

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider PROCEPT BioRobotics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and PROCEPT BioRobotics wasn't on the list.

While PROCEPT BioRobotics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.