Qorvo (NASDAQ:QRVO - Get Free Report) had its target price increased by research analysts at Piper Sandler from $110.00 to $125.00 in a research note issued to investors on Wednesday, July 30th, MarketBeat reports. The brokerage currently has an "overweight" rating on the semiconductor company's stock. Piper Sandler's price objective indicates a potential upside of 47.15% from the company's previous close.

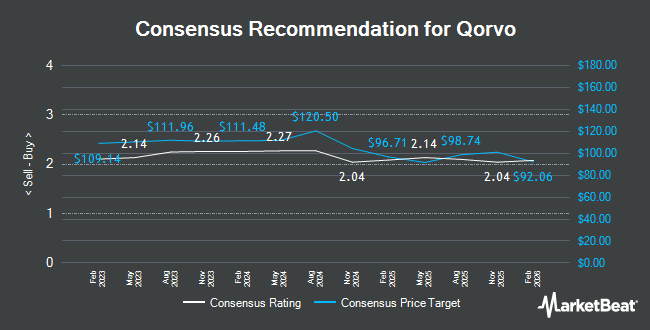

Several other equities analysts also recently issued reports on QRVO. The Goldman Sachs Group started coverage on shares of Qorvo in a report on Thursday, July 10th. They set a "neutral" rating and a $90.00 price objective on the stock. TD Cowen raised their price target on shares of Qorvo from $80.00 to $95.00 and gave the stock a "hold" rating in a research note on Wednesday, July 30th. Citigroup restated a "sell" rating on shares of Qorvo in a research report on Tuesday, June 10th. Stifel Nicolaus set a $88.00 price objective on shares of Qorvo and gave the stock a "hold" rating in a research report on Wednesday, July 30th. Finally, UBS Group raised their price objective on shares of Qorvo from $75.00 to $95.00 and gave the stock a "neutral" rating in a research report on Monday, July 21st. Three analysts have rated the stock with a sell rating, ten have issued a hold rating, five have assigned a buy rating and one has assigned a strong buy rating to the company's stock. According to data from MarketBeat.com, the company currently has an average rating of "Hold" and a consensus target price of $95.35.

Get Our Latest Stock Report on QRVO

Qorvo Trading Down 0.3%

Shares of Qorvo stock opened at $84.95 on Wednesday. The company has a current ratio of 2.81, a quick ratio of 2.01 and a debt-to-equity ratio of 0.45. Qorvo has a 12-month low of $49.46 and a 12-month high of $117.90. The firm has a market capitalization of $7.87 billion, a price-to-earnings ratio of 99.94, a PEG ratio of 1.66 and a beta of 1.35. The firm's 50 day simple moving average is $83.61 and its two-hundred day simple moving average is $76.24.

Qorvo (NASDAQ:QRVO - Get Free Report) last released its quarterly earnings data on Tuesday, July 29th. The semiconductor company reported $0.92 earnings per share for the quarter, topping analysts' consensus estimates of $0.62 by $0.30. The firm had revenue of $818.80 million for the quarter, compared to analyst estimates of $775.61 million. Qorvo had a net margin of 2.21% and a return on equity of 12.63%. The business's quarterly revenue was down 7.7% compared to the same quarter last year. During the same quarter in the prior year, the business earned $0.87 earnings per share. Analysts predict that Qorvo will post 4.09 EPS for the current year.

Institutional Inflows and Outflows

A number of institutional investors have recently made changes to their positions in the business. Ameriprise Financial Inc. grew its holdings in shares of Qorvo by 102.0% in the fourth quarter. Ameriprise Financial Inc. now owns 3,597,546 shares of the semiconductor company's stock valued at $251,577,000 after purchasing an additional 1,816,811 shares in the last quarter. FIL Ltd grew its holdings in shares of Qorvo by 5.3% in the fourth quarter. FIL Ltd now owns 3,324,241 shares of the semiconductor company's stock valued at $232,464,000 after purchasing an additional 166,461 shares in the last quarter. Vulcan Value Partners LLC lifted its stake in Qorvo by 53.7% in the fourth quarter. Vulcan Value Partners LLC now owns 2,581,296 shares of the semiconductor company's stock worth $180,487,000 after acquiring an additional 902,353 shares during the last quarter. Jericho Capital Asset Management L.P. purchased a new position in Qorvo in the first quarter worth approximately $168,980,000. Finally, Contour Asset Management LLC purchased a new position in Qorvo in the first quarter worth approximately $151,698,000. Institutional investors and hedge funds own 88.57% of the company's stock.

About Qorvo

(

Get Free Report)

Qorvo, Inc engages in development and commercialization of technologies and products for wireless, wired, and power markets. It operates through three segments: High Performance Analog (HPA), Connectivity and Sensors Group (CSG), and Advanced Cellular Group (ACG). The HPA segment supplies radio frequency and power management solutions for automotive, defense and aerospace, cellular infrastructure, broadband, and other markets.

Featured Stories

Before you consider Qorvo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Qorvo wasn't on the list.

While Qorvo currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.