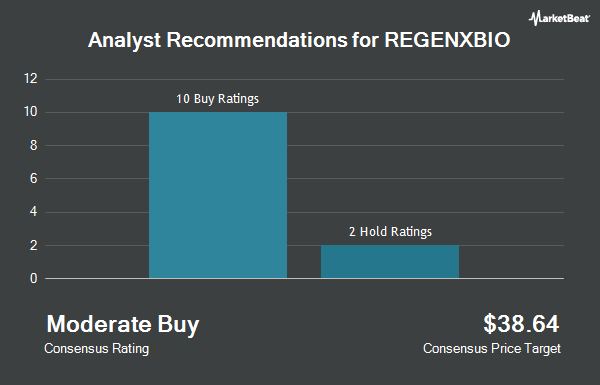

REGENXBIO Inc. (NASDAQ:RGNX - Get Free Report) has been assigned a consensus recommendation of "Moderate Buy" from the six analysts that are presently covering the stock, Marketbeat.com reports. One research analyst has rated the stock with a hold recommendation and five have issued a buy recommendation on the company. The average twelve-month target price among brokers that have updated their coverage on the stock in the last year is $28.3750.

RGNX has been the subject of several analyst reports. Royal Bank Of Canada decreased their target price on shares of REGENXBIO from $21.00 to $17.00 and set an "outperform" rating for the company in a research note on Friday, August 8th. Wall Street Zen cut shares of REGENXBIO from a "hold" rating to a "strong sell" rating in a research report on Saturday, August 9th. Barclays dropped their price objective on shares of REGENXBIO from $50.00 to $37.00 and set an "overweight" rating for the company in a report on Friday, August 8th. Chardan Capital reaffirmed a "buy" rating and set a $52.00 target price on shares of REGENXBIO in a research note on Monday, September 8th. Finally, HC Wainwright reissued a "buy" rating and issued a $34.00 price objective on shares of REGENXBIO in a research note on Monday, September 8th.

Read Our Latest Research Report on REGENXBIO

Insider Activity at REGENXBIO

In other REGENXBIO news, CEO Curran Simpson sold 7,734 shares of the business's stock in a transaction on Wednesday, September 10th. The shares were sold at an average price of $10.02, for a total value of $77,494.68. Following the transaction, the chief executive officer directly owned 244,597 shares of the company's stock, valued at approximately $2,450,861.94. The trade was a 3.07% decrease in their position. The sale was disclosed in a filing with the SEC, which can be accessed through the SEC website. 12.79% of the stock is owned by insiders.

Institutional Investors Weigh In On REGENXBIO

Several institutional investors and hedge funds have recently made changes to their positions in RGNX. Price T Rowe Associates Inc. MD raised its stake in REGENXBIO by 9.0% in the 4th quarter. Price T Rowe Associates Inc. MD now owns 23,910 shares of the biotechnology company's stock valued at $185,000 after purchasing an additional 1,982 shares during the last quarter. Jane Street Group LLC raised its position in shares of REGENXBIO by 325.3% during the 4th quarter. Jane Street Group LLC now owns 164,911 shares of the biotechnology company's stock valued at $1,275,000 after acquiring an additional 126,135 shares in the last quarter. Ameriprise Financial Inc. increased its position in REGENXBIO by 4.7% in the fourth quarter. Ameriprise Financial Inc. now owns 284,521 shares of the biotechnology company's stock worth $2,199,000 after buying an additional 12,883 shares during the period. BNP Paribas Financial Markets increased its holdings in shares of REGENXBIO by 370.1% during the fourth quarter. BNP Paribas Financial Markets now owns 96,093 shares of the biotechnology company's stock valued at $743,000 after purchasing an additional 75,652 shares during the period. Finally, Deutsche Bank AG boosted its stake in REGENXBIO by 8.5% during the fourth quarter. Deutsche Bank AG now owns 200,375 shares of the biotechnology company's stock valued at $1,549,000 after buying an additional 15,722 shares in the last quarter. 88.08% of the stock is currently owned by hedge funds and other institutional investors.

REGENXBIO Price Performance

NASDAQ RGNX traded up $0.33 during trading on Friday, reaching $9.36. 349,929 shares of the company's stock traded hands, compared to its average volume of 483,906. The firm has a market cap of $472.77 million, a price-to-earnings ratio of -2.72 and a beta of 1.17. The company's 50 day simple moving average is $8.78 and its two-hundred day simple moving average is $8.33. REGENXBIO has a 12-month low of $5.03 and a 12-month high of $13.15.

REGENXBIO (NASDAQ:RGNX - Get Free Report) last released its earnings results on Thursday, August 7th. The biotechnology company reported ($1.38) earnings per share for the quarter, missing the consensus estimate of ($1.13) by ($0.25). REGENXBIO had a negative return on equity of 66.95% and a negative net margin of 112.70%.The company had revenue of $21.36 million for the quarter, compared to analysts' expectations of $40.87 million. Research analysts expect that REGENXBIO will post -4.84 earnings per share for the current fiscal year.

REGENXBIO Company Profile

(

Get Free Report)

REGENXBIO Inc, a clinical-stage biotechnology company, provides gene therapies that deliver functional genes to cells with genetic defects in the United States. Its gene therapy product candidates are based on NAV Technology Platform, a proprietary adeno-associated virus gene delivery platform. The company's products in pipeline includes ABBV-RGX-314 for the treatment of wet age-related macular degeneration, diabetic retinopathy, and other chronic retinal diseases; and RGX-202, which is in Phase I/II clinical trial for the treatment of Duchenne muscular dystrophy.

Featured Stories

Before you consider REGENXBIO, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and REGENXBIO wasn't on the list.

While REGENXBIO currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.