Rigel Pharmaceuticals (NASDAQ:RIGL - Get Free Report) is expected to issue its Q2 2025 quarterly earnings data after the market closes on Tuesday, August 5th. Analysts expect Rigel Pharmaceuticals to post earnings of $1.42 per share and revenue of $64.58 million for the quarter. Rigel Pharmaceuticals has set its FY 2025 guidance at EPS.

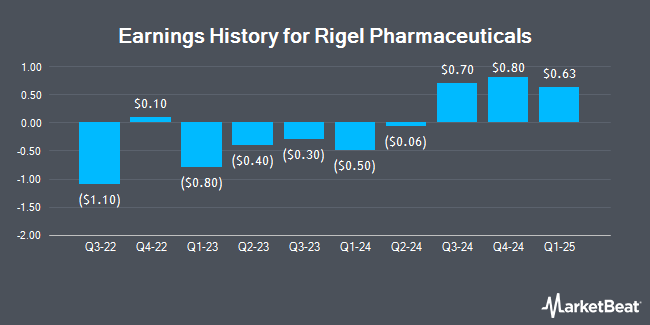

Rigel Pharmaceuticals (NASDAQ:RIGL - Get Free Report) last issued its quarterly earnings data on Tuesday, May 6th. The biotechnology company reported $0.63 earnings per share for the quarter, beating the consensus estimate of $0.14 by $0.49. The firm had revenue of $53.33 million for the quarter, compared to analyst estimates of $43.87 million. Rigel Pharmaceuticals had a net margin of 18.31% and a negative return on equity of 655.26%. During the same quarter last year, the firm earned ($0.50) earnings per share. On average, analysts expect Rigel Pharmaceuticals to post $0 EPS for the current fiscal year and $1 EPS for the next fiscal year.

Rigel Pharmaceuticals Stock Up 5.6%

Shares of Rigel Pharmaceuticals stock traded up $1.11 during midday trading on Wednesday, reaching $21.01. 255,865 shares of the company's stock traded hands, compared to its average volume of 173,762. The company has a market cap of $375.45 million, a price-to-earnings ratio of 10.15 and a beta of 1.26. Rigel Pharmaceuticals has a 52 week low of $8.61 and a 52 week high of $29.82. The company's 50 day simple moving average is $19.66 and its 200 day simple moving average is $19.66. The company has a debt-to-equity ratio of 2.42, a quick ratio of 2.13 and a current ratio of 2.20.

Institutional Inflows and Outflows

An institutional investor recently raised its position in Rigel Pharmaceuticals stock. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its position in shares of Rigel Pharmaceuticals, Inc. (NASDAQ:RIGL - Free Report) by 14.8% in the first quarter, according to its most recent 13F filing with the Securities & Exchange Commission. The institutional investor owned 11,366 shares of the biotechnology company's stock after purchasing an additional 1,464 shares during the quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. owned approximately 0.06% of Rigel Pharmaceuticals worth $204,000 at the end of the most recent quarter. Institutional investors and hedge funds own 66.23% of the company's stock.

Analysts Set New Price Targets

Separately, Cantor Fitzgerald raised their price target on Rigel Pharmaceuticals from $20.00 to $23.00 and gave the company a "neutral" rating in a research report on Wednesday, May 7th. Three research analysts have rated the stock with a hold rating and three have assigned a buy rating to the company. Based on data from MarketBeat.com, the stock currently has an average rating of "Moderate Buy" and a consensus price target of $36.40.

Read Our Latest Research Report on Rigel Pharmaceuticals

About Rigel Pharmaceuticals

(

Get Free Report)

Rigel Pharmaceuticals, Inc, a biotechnology company, engages in discovering, developing, and providing therapies that enhance the lives of patients with hematologic disorders and cancer. The company's commercialized products include Tavalisse, an oral spleen tyrosine kinase inhibitor for the treatment of adult patients with chronic immune thrombocytopenia; Rezlidhia, a non-intensive monotherapy for the treatment of adult patients with relapsed or refractory (R/R) acute myeloid leukemia (AML) with a susceptible isocitrate dehydrogenase-1 (IDH1) mutation as detected by an FDA-approved test; and GAVRETO, a once daily, small molecule, oral, kinase inhibitor for the treatment of adult patients with metastatic rearranged during transfection (RET) fusion-positive non-small cell lung cancer, as well as for the treatment of adult and pediatric patients 12 years of age and older with advanced or metastatic RET fusion-positive thyroid cancer.

Featured Articles

Before you consider Rigel Pharmaceuticals, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rigel Pharmaceuticals wasn't on the list.

While Rigel Pharmaceuticals currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.