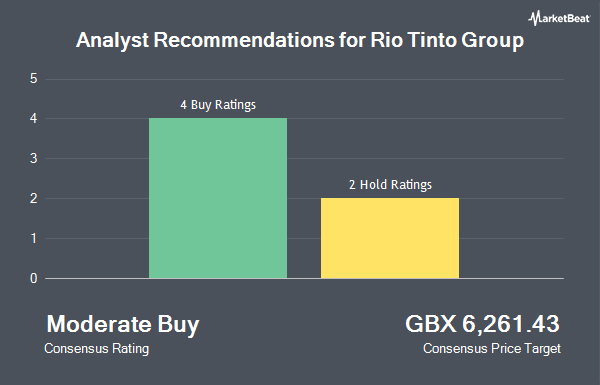

Rio Tinto Group (LON:RIO - Get Free Report) has earned an average rating of "Hold" from the six research firms that are covering the company, MarketBeat reports. Four analysts have rated the stock with a hold recommendation and two have issued a buy recommendation on the company. The average 12 month price objective among brokers that have issued a report on the stock in the last year is GBX 5,325.

A number of brokerages recently weighed in on RIO. Deutsche Bank Aktiengesellschaft downgraded shares of Rio Tinto Group to a "hold" rating and lowered their price objective for the company from GBX 5,300 to GBX 5,100 in a research report on Wednesday, July 30th. Berenberg Bank reaffirmed a "hold" rating and set a GBX 4,700 price objective on shares of Rio Tinto Group in a research report on Friday, August 1st. JPMorgan Chase & Co. lowered their price objective on shares of Rio Tinto Group from GBX 5,570 to GBX 5,450 and set an "overweight" rating for the company in a research report on Thursday, July 31st. Finally, Royal Bank Of Canada boosted their price objective on shares of Rio Tinto Group from GBX 4,700 to GBX 4,900 and gave the company a "sector perform" rating in a research report on Wednesday, July 30th.

Get Our Latest Research Report on Rio Tinto Group

Rio Tinto Group Price Performance

Shares of LON:RIO opened at GBX 4,991 on Tuesday. The company has a quick ratio of 1.34, a current ratio of 1.70 and a debt-to-equity ratio of 25.28. Rio Tinto Group has a fifty-two week low of GBX 4,024.50 and a fifty-two week high of GBX 5,321. The firm has a 50-day simple moving average of GBX 4,637.61 and a 200 day simple moving average of GBX 4,514.05. The company has a market cap of £81.09 billion, a PE ratio of 794.87, a P/E/G ratio of -0.64 and a beta of 0.59.

About Rio Tinto Group

(

Get Free Report)

We operate in 35 countries where our 60,000 employees are working to find better ways to provide the materials the world needs. Our portfolio includes iron ore, copper, aluminium and a range of other minerals and materials needed for people, communities and nations to grow and prosper, and for the world to cut carbon emissions to net zero.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Rio Tinto Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Rio Tinto Group wasn't on the list.

While Rio Tinto Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.