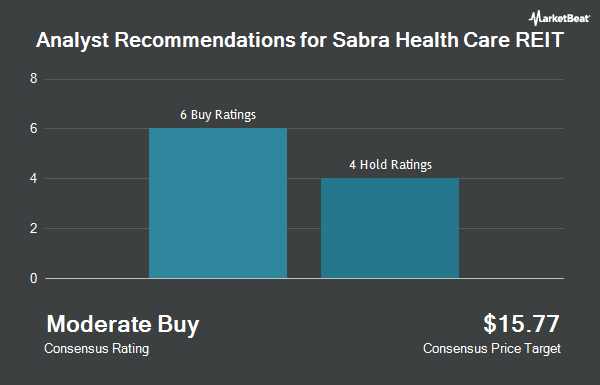

Sabra Healthcare REIT, Inc. (NASDAQ:SBRA - Get Free Report) has been assigned a consensus rating of "Moderate Buy" from the seven ratings firms that are presently covering the firm, MarketBeat.com reports. Four analysts have rated the stock with a hold recommendation, two have given a buy recommendation and one has assigned a strong buy recommendation to the company. The average 12-month price objective among brokerages that have updated their coverage on the stock in the last year is $20.8333.

Several equities analysts have recently weighed in on the company. Scotiabank raised their price target on Sabra Healthcare REIT from $19.00 to $20.00 and gave the company a "sector perform" rating in a report on Monday, June 23rd. Truist Financial lifted their price objective on Sabra Healthcare REIT from $18.00 to $20.00 and gave the stock a "hold" rating in a report on Tuesday, September 2nd. JMP Securities lifted their price objective on Sabra Healthcare REIT from $20.00 to $22.00 and gave the stock a "market outperform" rating in a report on Wednesday, August 6th. Wells Fargo & Company lifted their price objective on Sabra Healthcare REIT from $20.00 to $21.00 and gave the stock an "overweight" rating in a report on Wednesday, August 27th. Finally, BMO Capital Markets lifted their price objective on Sabra Healthcare REIT from $19.00 to $22.00 and gave the stock a "market perform" rating in a report on Monday, August 25th.

View Our Latest Analysis on Sabra Healthcare REIT

Hedge Funds Weigh In On Sabra Healthcare REIT

Several large investors have recently modified their holdings of the stock. SVB Wealth LLC bought a new position in shares of Sabra Healthcare REIT during the 1st quarter worth $34,000. UMB Bank n.a. raised its stake in Sabra Healthcare REIT by 379.6% in the first quarter. UMB Bank n.a. now owns 2,048 shares of the real estate investment trust's stock valued at $36,000 after buying an additional 1,621 shares during the last quarter. Wealth Preservation Advisors LLC purchased a new stake in Sabra Healthcare REIT in the first quarter valued at about $38,000. EverSource Wealth Advisors LLC raised its stake in Sabra Healthcare REIT by 150.7% in the second quarter. EverSource Wealth Advisors LLC now owns 2,555 shares of the real estate investment trust's stock valued at $47,000 after buying an additional 1,536 shares during the last quarter. Finally, Northwestern Mutual Wealth Management Co. raised its stake in Sabra Healthcare REIT by 61.2% in the first quarter. Northwestern Mutual Wealth Management Co. now owns 2,806 shares of the real estate investment trust's stock valued at $49,000 after buying an additional 1,065 shares during the last quarter. Institutional investors own 99.40% of the company's stock.

Sabra Healthcare REIT Trading Down 0.8%

Shares of SBRA traded down $0.15 during mid-day trading on Monday, reaching $18.71. The company's stock had a trading volume of 3,923,838 shares, compared to its average volume of 2,041,152. The stock has a market cap of $4.49 billion, a PE ratio of 24.62, a P/E/G ratio of 1.50 and a beta of 0.88. The company has a current ratio of 4.80, a quick ratio of 4.80 and a debt-to-equity ratio of 0.91. Sabra Healthcare REIT has a 52 week low of $15.60 and a 52 week high of $20.03. The company's fifty day moving average price is $18.73 and its two-hundred day moving average price is $18.05.

Sabra Healthcare REIT (NASDAQ:SBRA - Get Free Report) last released its quarterly earnings data on Monday, August 4th. The real estate investment trust reported $0.38 earnings per share for the quarter, beating analysts' consensus estimates of $0.36 by $0.02. Sabra Healthcare REIT had a return on equity of 6.69% and a net margin of 24.87%.The firm had revenue of $189.15 million during the quarter, compared to analyst estimates of $185.64 million. During the same quarter in the prior year, the firm posted $0.36 earnings per share. The business's quarterly revenue was up 7.4% compared to the same quarter last year. Sabra Healthcare REIT has set its FY 2025 guidance at 1.450-1.470 EPS. On average, analysts predict that Sabra Healthcare REIT will post 1.45 earnings per share for the current fiscal year.

Sabra Healthcare REIT Dividend Announcement

The business also recently disclosed a quarterly dividend, which was paid on Friday, August 29th. Stockholders of record on Friday, August 15th were given a dividend of $0.30 per share. This represents a $1.20 dividend on an annualized basis and a dividend yield of 6.4%. The ex-dividend date of this dividend was Friday, August 15th. Sabra Healthcare REIT's payout ratio is presently 157.89%.

Sabra Healthcare REIT Company Profile

(

Get Free Report)

Sabra Health Care REIT, Inc engages in the business of acquiring, financing, and owning real estate property. The company was founded on May 10, 2010 and is headquartered in Tustin, CA.

See Also

Before you consider Sabra Healthcare REIT, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sabra Healthcare REIT wasn't on the list.

While Sabra Healthcare REIT currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.