Sagimet Biosciences (NASDAQ:SGMT - Get Free Report) was upgraded by investment analysts at HC Wainwright to a "buy" rating in a research note issued on Thursday, August 7th, MarketBeat Ratings reports. The brokerage currently has a $29.00 target price on the stock. HC Wainwright's target price would suggest a potential upside of 202.71% from the company's current price.

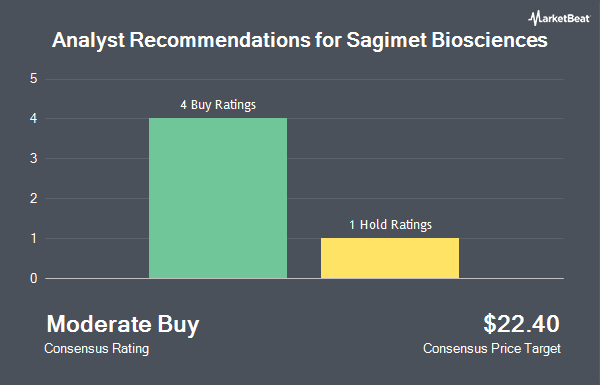

A number of other analysts have also weighed in on SGMT. Jones Trading raised their target price on shares of Sagimet Biosciences from $15.00 to $27.00 and gave the company a "buy" rating in a research report on Friday, June 6th. Canaccord Genuity Group started coverage on shares of Sagimet Biosciences in a research report on Thursday, July 24th. They issued a "buy" rating and a $28.00 target price on the stock. Seven research analysts have rated the stock with a buy rating, According to MarketBeat.com, Sagimet Biosciences presently has a consensus rating of "Buy" and an average target price of $26.57.

Check Out Our Latest Stock Analysis on SGMT

Sagimet Biosciences Trading Up 0.3%

NASDAQ SGMT opened at $9.58 on Thursday. The firm has a market capitalization of $293.82 million, a price-to-earnings ratio of -5.44 and a beta of 3.37. The firm's 50 day simple moving average is $8.52 and its 200 day simple moving average is $5.22. Sagimet Biosciences has a 1 year low of $1.73 and a 1 year high of $11.41.

Sagimet Biosciences (NASDAQ:SGMT - Get Free Report) last posted its quarterly earnings results on Wednesday, August 13th. The company reported ($0.32) earnings per share (EPS) for the quarter, topping the consensus estimate of ($0.52) by $0.20. On average, equities research analysts forecast that Sagimet Biosciences will post -1.6 earnings per share for the current year.

Insider Transactions at Sagimet Biosciences

In related news, insider Eduardo Bruno Martins sold 8,277 shares of Sagimet Biosciences stock in a transaction on Monday, July 21st. The shares were sold at an average price of $9.13, for a total transaction of $75,569.01. Following the completion of the transaction, the insider owned 106,936 shares of the company's stock, valued at $976,325.68. This trade represents a 7.18% decrease in their ownership of the stock. The sale was disclosed in a filing with the Securities & Exchange Commission, which is available at the SEC website. Also, General Counsel Elizabeth Rozek sold 10,780 shares of Sagimet Biosciences stock in a transaction on Monday, July 21st. The stock was sold at an average price of $9.13, for a total transaction of $98,421.40. Following the transaction, the general counsel directly owned 183,726 shares of the company's stock, valued at $1,677,418.38. This represents a 5.54% decrease in their position. The disclosure for this sale can be found here. Over the last 90 days, insiders have sold 84,535 shares of company stock worth $771,805. Company insiders own 14.70% of the company's stock.

Hedge Funds Weigh In On Sagimet Biosciences

Hedge funds have recently bought and sold shares of the company. ANTIPODES PARTNERS Ltd bought a new position in Sagimet Biosciences during the second quarter worth $41,000. Wells Fargo & Company MN acquired a new position in shares of Sagimet Biosciences during the fourth quarter valued at about $31,000. Persistent Asset Partners Ltd acquired a new position in shares of Sagimet Biosciences during the first quarter valued at about $35,000. XTX Topco Ltd purchased a new position in Sagimet Biosciences during the first quarter worth about $35,000. Finally, Summit Financial Wealth Advisors LLC bought a new stake in Sagimet Biosciences in the 4th quarter worth about $61,000. Institutional investors own 87.86% of the company's stock.

About Sagimet Biosciences

(

Get Free Report)

Sagimet Biosciences Inc, a clinical-stage biopharmaceutical company, develops therapeutics called fatty acid synthase (FASN) inhibitors for the treatment of diseases that result from dysfunctional metabolic pathways in the United States. The company's lead drug candidate is Denifanstat, a once-daily pill and selective FASN inhibitor for the treatment of metabolic dysfunction associated steatohepatitis.

Featured Stories

Before you consider Sagimet Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sagimet Biosciences wasn't on the list.

While Sagimet Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Learn the basics of options trading and how to use them to boost returns and manage risk with this free report from MarketBeat. Click the link below to get your free copy.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.