Sarepta Therapeutics (NASDAQ:SRPT - Get Free Report) is anticipated to announce its Q2 2025 earnings results after the market closes on Wednesday, August 6th. Analysts expect the company to announce earnings of $0.89 per share and revenue of $530.66 million for the quarter.

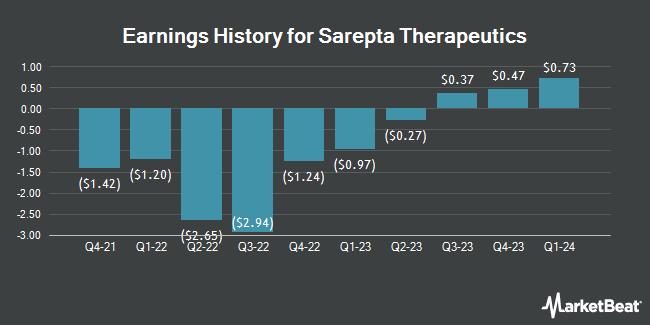

Sarepta Therapeutics (NASDAQ:SRPT - Get Free Report) last announced its quarterly earnings data on Tuesday, May 6th. The biotechnology company reported ($3.42) earnings per share for the quarter, missing analysts' consensus estimates of $2.20 by ($5.62). The firm had revenue of $744.86 million for the quarter, compared to analysts' expectations of $685.75 million. Sarepta Therapeutics had a negative net margin of 11.12% and a negative return on equity of 14.88%. The business's quarterly revenue was up 80.2% on a year-over-year basis. During the same period in the prior year, the business posted $0.73 earnings per share. On average, analysts expect Sarepta Therapeutics to post $3 EPS for the current fiscal year and $11 EPS for the next fiscal year.

Sarepta Therapeutics Price Performance

Shares of NASDAQ SRPT traded down $0.51 during trading hours on Friday, reaching $15.91. 9,339,167 shares of the stock traded hands, compared to its average volume of 20,245,834. The company has a market capitalization of $1.56 billion, a P/E ratio of -5.91 and a beta of 0.46. The company has a quick ratio of 2.46, a current ratio of 4.02 and a debt-to-equity ratio of 1.00. Sarepta Therapeutics has a 52-week low of $10.41 and a 52-week high of $145.00. The company's 50-day simple moving average is $23.80 and its two-hundred day simple moving average is $60.79.

Institutional Inflows and Outflows

An institutional investor recently bought a new position in Sarepta Therapeutics stock. Great Lakes Advisors LLC acquired a new position in Sarepta Therapeutics, Inc. (NASDAQ:SRPT - Free Report) during the 1st quarter, according to the company in its most recent disclosure with the Securities & Exchange Commission. The firm acquired 3,506 shares of the biotechnology company's stock, valued at approximately $224,000. Institutional investors own 86.68% of the company's stock.

Wall Street Analyst Weigh In

A number of equities analysts have commented on the company. Bank of America reaffirmed an "underperform" rating on shares of Sarepta Therapeutics in a research note on Wednesday, July 23rd. Citigroup started coverage on Sarepta Therapeutics in a research report on Tuesday, July 22nd. They set a "sell" rating on the stock. Wells Fargo & Company dropped their target price on Sarepta Therapeutics from $65.00 to $48.00 and set an "overweight" rating on the stock in a report on Thursday, July 24th. Robert W. Baird boosted their target price on Sarepta Therapeutics from $30.00 to $35.00 and gave the stock an "outperform" rating in a report on Thursday, July 17th. Finally, Evercore ISI downgraded Sarepta Therapeutics from an "outperform" rating to an "inline" rating and set a $50.00 target price on the stock. in a report on Thursday, May 8th. Six research analysts have rated the stock with a sell rating, sixteen have issued a hold rating and eight have issued a buy rating to the company. According to MarketBeat, the stock presently has a consensus rating of "Hold" and a consensus target price of $49.12.

Get Our Latest Stock Report on SRPT

Sarepta Therapeutics Company Profile

(

Get Free Report)

Sarepta Therapeutics, Inc, a commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases. It offers EXONDYS 51 injection to treat duchenne muscular dystrophy (duchenne) in patients with confirmed mutation of the dystrophin gene that is amenable to exon 51 skipping; VYONDYS 53 for the treatment of duchenne in patients with confirmed mutation of the dystrophin gene that is amenable to exon 53 skipping; AMONDYS 45 for the treatment of duchenne in patients with confirmed mutation of the dystrophin gene; and ELEVIDYS, an adeno-associated virus based gene therapy for the treatment of ambulatory pediatric patients aged 4 through 5 years with duchenne with a confirmed mutation in the duchenne gene.

See Also

Before you consider Sarepta Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Sarepta Therapeutics wasn't on the list.

While Sarepta Therapeutics currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven stocks and why their long-term outlooks are very promising.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.