AJ Bell (LON:AJB - Get Free Report)'s stock had its "buy" rating reissued by equities research analysts at Shore Capital in a report issued on Thursday, MarketBeat reports. They currently have a GBX 575 price objective on the stock. Shore Capital's target price would indicate a potential upside of 6.38% from the stock's current price.

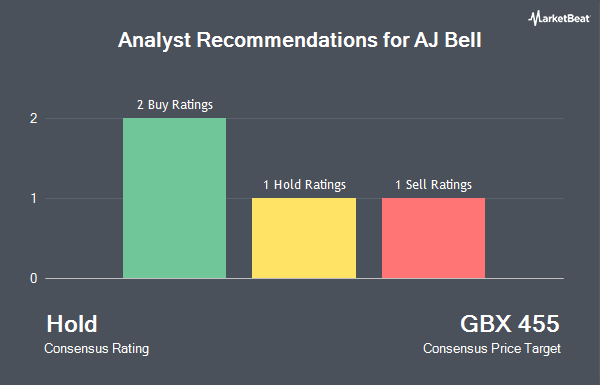

A number of other research firms have also weighed in on AJB. Citigroup upped their target price on shares of AJ Bell from GBX 440 to GBX 475 and gave the stock a "sell" rating in a report on Monday. Jefferies Financial Group upped their price target on shares of AJ Bell from GBX 590 to GBX 625 and gave the stock a "buy" rating in a report on Friday, October 17th. Berenberg Bank upped their target price on AJ Bell from GBX 420 to GBX 490 and gave the stock a "hold" rating in a research note on Monday, July 28th. UBS Group restated a "neutral" rating and issued a GBX 550 price objective on shares of AJ Bell in a research report on Friday, October 17th. Finally, Royal Bank Of Canada upped their price objective on shares of AJ Bell from GBX 440 to GBX 460 and gave the stock a "sector perform" rating in a research report on Friday, July 25th. Three investment analysts have rated the stock with a Buy rating, three have issued a Hold rating and one has given a Sell rating to the company's stock. According to data from MarketBeat.com, AJ Bell presently has a consensus rating of "Hold" and a consensus price target of GBX 542.86.

Read Our Latest Analysis on AJB

AJ Bell Stock Performance

Shares of LON AJB traded down GBX 15 during midday trading on Thursday, hitting GBX 540.50. The company's stock had a trading volume of 1,023,007 shares, compared to its average volume of 1,446,598. The stock has a fifty day moving average price of GBX 520.52 and a 200 day moving average price of GBX 492.13. AJ Bell has a one year low of GBX 355.20 and a one year high of GBX 562. The company has a current ratio of 3.63, a quick ratio of 7.16 and a debt-to-equity ratio of 6.46. The firm has a market capitalization of £2.18 billion, a price-to-earnings ratio of 25.03, a P/E/G ratio of 5.73 and a beta of 0.99.

Insiders Place Their Bets

In other AJ Bell news, insider Michael Thomas Summersgill acquired 85,000 shares of the company's stock in a transaction that occurred on Tuesday, August 19th. The shares were acquired at an average price of GBX 513 per share, with a total value of £436,050. Also, insider Peter Birch sold 37,924 shares of the business's stock in a transaction that occurred on Tuesday, October 14th. The stock was sold at an average price of GBX 543, for a total value of £205,927.32. Insiders own 23.79% of the company's stock.

AJ Bell Company Profile

(

Get Free Report)

Established in 1995, AJ Bell is one of the largest investment platforms in the UK, operating at scale in both the advised and direct-to-consumer markets.

Our purpose is to help people invest by providing them with easy access to Pensions, ISAs and General investment accounts, great customer service and competitive charges.

Our two core platform propositions are AJ Bell in the D2C market and AJ Bell Investcentre in the advised market, which both provide access to a broad investment range including shares and other instruments traded on the major stock exchanges around the world, as well as all mainstream collective investments available in the UK and our own range of AJ Bell funds.

Featured Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider AJ Bell, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and AJ Bell wasn't on the list.

While AJ Bell currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.