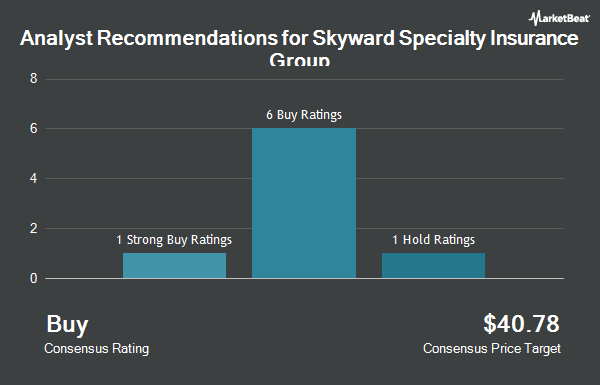

Shares of Skyward Specialty Insurance Group, Inc. (NASDAQ:SKWD - Get Free Report) have received a consensus rating of "Moderate Buy" from the eleven brokerages that are presently covering the stock, MarketBeat reports. Four research analysts have rated the stock with a hold recommendation, six have issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1-year price target among brokerages that have issued ratings on the stock in the last year is $60.7778.

A number of research analysts recently commented on the company. JMP Securities upped their target price on Skyward Specialty Insurance Group from $65.00 to $70.00 and gave the company a "market outperform" rating in a research note on Thursday. Piper Sandler cut their target price on Skyward Specialty Insurance Group from $69.00 to $59.00 and set an "overweight" rating for the company in a research note on Friday, August 1st. Citigroup restated an "outperform" rating on shares of Skyward Specialty Insurance Group in a research note on Thursday. Keefe, Bruyette & Woods upped their target price on Skyward Specialty Insurance Group from $67.00 to $72.00 and gave the company an "outperform" rating in a research note on Thursday, May 29th. Finally, Wall Street Zen cut Skyward Specialty Insurance Group from a "buy" rating to a "hold" rating in a research report on Saturday, August 2nd.

Read Our Latest Analysis on Skyward Specialty Insurance Group

Skyward Specialty Insurance Group Stock Up 0.0%

Shares of SKWD stock traded up $0.02 during trading hours on Thursday, reaching $50.25. 29,552 shares of the company's stock were exchanged, compared to its average volume of 420,847. The business has a fifty day moving average price of $51.18 and a 200-day moving average price of $53.99. The stock has a market capitalization of $2.03 billion, a P/E ratio of 15.86 and a beta of 0.62. Skyward Specialty Insurance Group has a fifty-two week low of $37.79 and a fifty-two week high of $65.05.

Skyward Specialty Insurance Group (NASDAQ:SKWD - Get Free Report) last issued its earnings results on Wednesday, July 30th. The company reported $0.89 EPS for the quarter, beating analysts' consensus estimates of $0.86 by $0.03. The business had revenue of $319.90 million during the quarter, compared to analyst estimates of $324.64 million. Skyward Specialty Insurance Group had a return on equity of 16.40% and a net margin of 10.53%.During the same period in the prior year, the company posted $0.80 earnings per share. As a group, research analysts expect that Skyward Specialty Insurance Group will post 3.05 EPS for the current fiscal year.

Insiders Place Their Bets

In other Skyward Specialty Insurance Group news, CFO Mark W. Haushill sold 52,748 shares of the company's stock in a transaction on Friday, June 13th. The stock was sold at an average price of $58.76, for a total value of $3,099,472.48. Following the sale, the chief financial officer directly owned 133,629 shares in the company, valued at $7,852,040.04. This represents a 28.30% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the SEC, which is available at this hyperlink. 7.86% of the stock is owned by company insiders.

Institutional Trading of Skyward Specialty Insurance Group

Several large investors have recently made changes to their positions in the business. Osaic Holdings Inc. grew its holdings in shares of Skyward Specialty Insurance Group by 140.9% during the second quarter. Osaic Holdings Inc. now owns 1,462 shares of the company's stock worth $84,000 after purchasing an additional 855 shares during the last quarter. Squarepoint Ops LLC grew its holdings in shares of Skyward Specialty Insurance Group by 116.6% during the second quarter. Squarepoint Ops LLC now owns 89,436 shares of the company's stock worth $5,169,000 after purchasing an additional 48,148 shares during the last quarter. Cim LLC grew its holdings in shares of Skyward Specialty Insurance Group by 56.2% during the second quarter. Cim LLC now owns 9,586 shares of the company's stock worth $554,000 after purchasing an additional 3,448 shares during the last quarter. Tower Research Capital LLC TRC grew its holdings in shares of Skyward Specialty Insurance Group by 725.3% during the second quarter. Tower Research Capital LLC TRC now owns 7,807 shares of the company's stock worth $451,000 after purchasing an additional 6,861 shares during the last quarter. Finally, Man Group plc bought a new stake in shares of Skyward Specialty Insurance Group during the second quarter worth $315,000. Institutional investors own 94.83% of the company's stock.

About Skyward Specialty Insurance Group

(

Get Free Report)

Skyward Specialty Insurance Group, Inc, an insurance holding company, underwrites commercial property and casualty insurance products in the United States. It offers general liability, excess liability, professional liability, commercial auto, group accident and health, property, surety, and workers' compensation insurance products.

See Also

Before you consider Skyward Specialty Insurance Group, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Skyward Specialty Insurance Group wasn't on the list.

While Skyward Specialty Insurance Group currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Market downturns give many investors pause, and for good reason. Wondering how to offset this risk? Enter your email address to learn more about using beta to protect your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.