Softcat (LON:SCT - Get Free Report) had its price objective raised by investment analysts at Jefferies Financial Group from GBX 1,400 to GBX 1,450 in a note issued to investors on Thursday, MarketBeat reports. The firm presently has an "underperform" rating on the stock. Jefferies Financial Group's price target points to a potential downside of 10.88% from the company's previous close.

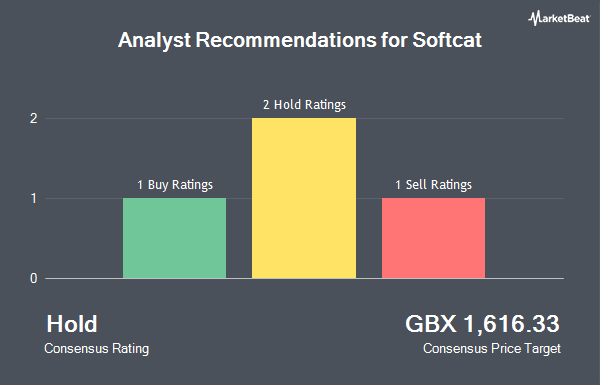

Other equities research analysts have also recently issued reports about the company. Citigroup reduced their price target on Softcat from GBX 2,000 to GBX 1,960 and set a "buy" rating on the stock in a research note on Tuesday, August 19th. UBS Group reaffirmed a "sell" rating and issued a GBX 1,400 target price on shares of Softcat in a research report on Friday, October 17th. Liberum Capital raised shares of Softcat to a "buy" rating and set a GBX 1,800 target price on the stock in a research report on Thursday, July 24th. JPMorgan Chase & Co. reissued a "neutral" rating on shares of Softcat in a research report on Thursday, September 11th. Finally, Shore Capital restated a "buy" rating and issued a GBX 1,925 price objective on shares of Softcat in a report on Wednesday. Four equities research analysts have rated the stock with a Buy rating, two have assigned a Hold rating and two have assigned a Sell rating to the company's stock. Based on data from MarketBeat, Softcat currently has an average rating of "Hold" and an average target price of GBX 1,724.25.

Read Our Latest Research Report on SCT

Softcat Trading Down 0.8%

LON:SCT traded down GBX 13 during mid-day trading on Thursday, reaching GBX 1,627. 4,497,126 shares of the company's stock traded hands, compared to its average volume of 752,298. Softcat has a 12-month low of GBX 1,427 and a 12-month high of GBX 1,960. The firm has a market capitalization of £3.24 billion, a price-to-earnings ratio of 26.03, a PEG ratio of 11.51 and a beta of 0.71. The company has a debt-to-equity ratio of 3.48, a current ratio of 1.60 and a quick ratio of 1.38. The company has a 50 day moving average price of GBX 1,578.85 and a 200-day moving average price of GBX 1,652.09.

Softcat (LON:SCT - Get Free Report) last announced its quarterly earnings results on Wednesday, October 22nd. The company reported GBX 69.50 earnings per share (EPS) for the quarter. Softcat had a return on equity of 43.79% and a net margin of 12.37%. On average, sell-side analysts predict that Softcat will post 60.72 earnings per share for the current year.

Softcat Company Profile

(

Get Free Report)

Softcat plc operates as a value-added IT reseller and IT infrastructure solutions provider in the United Kingdom. The company advices, procures, designs, implements, and manages technology, such as software licensing, workplace technology, networking, security, and cloud and datacenter for businesses and public sector organizations.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Softcat, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Softcat wasn't on the list.

While Softcat currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.