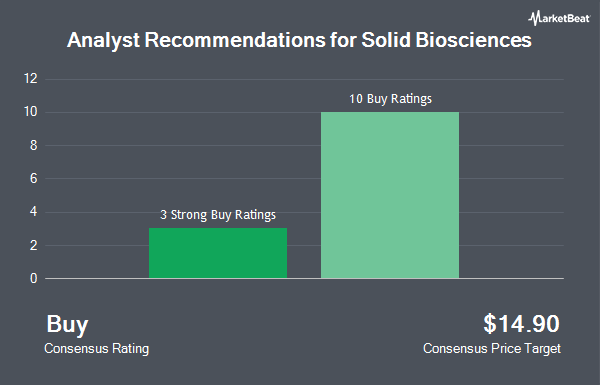

Shares of Solid Biosciences Inc. (NASDAQ:SLDB - Get Free Report) have received an average rating of "Buy" from the twelve analysts that are covering the stock, MarketBeat.com reports. Eight research analysts have rated the stock with a buy rating and four have given a strong buy rating to the company. The average 1-year price objective among brokers that have covered the stock in the last year is $15.67.

Several brokerages have recently commented on SLDB. Truist Financial began coverage on Solid Biosciences in a report on Wednesday, January 8th. They set a "buy" rating and a $16.00 target price on the stock. HC Wainwright increased their price target on shares of Solid Biosciences from $16.00 to $20.00 and gave the company a "buy" rating in a research note on Monday, March 10th. JPMorgan Chase & Co. dropped their price objective on shares of Solid Biosciences from $12.00 to $11.00 and set an "overweight" rating for the company in a research report on Thursday, March 13th. Finally, Chardan Capital reissued a "buy" rating and issued a $16.00 target price on shares of Solid Biosciences in a research note on Friday, March 7th.

View Our Latest Stock Analysis on Solid Biosciences

Hedge Funds Weigh In On Solid Biosciences

Several institutional investors and hedge funds have recently made changes to their positions in SLDB. Allianz Asset Management GmbH acquired a new position in Solid Biosciences in the first quarter valued at about $100,000. CWM LLC increased its stake in Solid Biosciences by 15,188.5% during the 1st quarter. CWM LLC now owns 7,950 shares of the company's stock worth $29,000 after purchasing an additional 7,898 shares in the last quarter. China Universal Asset Management Co. Ltd. increased its stake in Solid Biosciences by 80.7% during the 1st quarter. China Universal Asset Management Co. Ltd. now owns 15,308 shares of the company's stock worth $57,000 after purchasing an additional 6,836 shares in the last quarter. Wellington Management Group LLP raised its holdings in Solid Biosciences by 4.0% during the 4th quarter. Wellington Management Group LLP now owns 124,551 shares of the company's stock worth $498,000 after buying an additional 4,747 shares during the period. Finally, Vestal Point Capital LP lifted its stake in Solid Biosciences by 1.8% in the fourth quarter. Vestal Point Capital LP now owns 2,850,000 shares of the company's stock valued at $11,400,000 after buying an additional 50,000 shares in the last quarter. Institutional investors and hedge funds own 81.46% of the company's stock.

Solid Biosciences Price Performance

Shares of SLDB traded down $0.78 on Friday, hitting $2.59. The company's stock had a trading volume of 2,861,252 shares, compared to its average volume of 979,550. The company has a market capitalization of $200.73 million, a PE ratio of -0.85 and a beta of 2.32. Solid Biosciences has a fifty-two week low of $2.45 and a fifty-two week high of $10.99. The company has a 50 day moving average price of $3.89 and a 200 day moving average price of $4.36.

About Solid Biosciences

(

Get Free ReportSolid Biosciences Inc, a life science company, develops therapies for neuromuscular and cardiac diseases in the United States. The company's lead product candidate is SGT-003, a gene transfer candidate for the treatment of Duchenne muscular dystrophy; and SGT-501 to treat Catecholaminergic polymorphic ventricular tachycardia.

See Also

Before you consider Solid Biosciences, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Solid Biosciences wasn't on the list.

While Solid Biosciences currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.