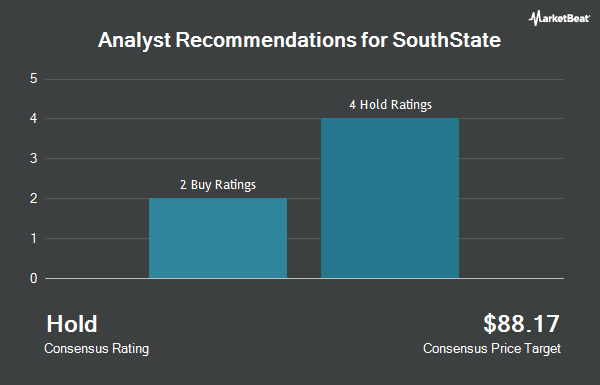

Shares of SouthState Co. (NASDAQ:SSB - Get Free Report) have received a consensus rating of "Buy" from the eleven research firms that are currently covering the stock, MarketBeat reports. One investment analyst has rated the stock with a hold recommendation, eight have assigned a buy recommendation and two have assigned a strong buy recommendation to the company. The average 1-year price objective among brokerages that have updated their coverage on the stock in the last year is $116.45.

A number of research analysts have issued reports on SSB shares. Raymond James Financial set a $110.00 price target on SouthState in a report on Monday, April 28th. Barclays increased their price objective on SouthState from $115.00 to $117.00 and gave the company an "overweight" rating in a research note on Tuesday, July 8th. Jefferies Financial Group started coverage on SouthState in a report on Wednesday, May 21st. They issued a "buy" rating and a $110.00 target price for the company. DA Davidson dropped their target price on SouthState from $125.00 to $115.00 and set a "buy" rating for the company in a report on Monday, April 28th. Finally, Stephens restated an "overweight" rating and issued a $119.00 target price on shares of SouthState in a report on Monday, April 28th.

Get Our Latest Stock Analysis on SouthState

SouthState Price Performance

Shares of SSB stock traded up $0.12 on Wednesday, reaching $97.71. The company's stock had a trading volume of 538,885 shares, compared to its average volume of 748,926. The stock's fifty day simple moving average is $91.11 and its 200-day simple moving average is $93.34. SouthState has a 1 year low of $77.74 and a 1 year high of $114.27. The company has a current ratio of 0.91, a quick ratio of 0.91 and a debt-to-equity ratio of 0.07. The company has a market capitalization of $9.92 billion, a price-to-earnings ratio of 14.04 and a beta of 0.77.

SouthState Announces Dividend

The company also recently declared a quarterly dividend, which was paid on Friday, May 16th. Investors of record on Friday, May 9th were paid a dividend of $0.54 per share. The ex-dividend date of this dividend was Friday, May 9th. This represents a $2.16 dividend on an annualized basis and a yield of 2.21%. SouthState's dividend payout ratio is presently 34.12%.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of SSB. Raymond James Financial Inc. acquired a new stake in shares of SouthState in the 4th quarter valued at approximately $5,682,000. HighTower Advisors LLC lifted its holdings in shares of SouthState by 33.4% in the 4th quarter. HighTower Advisors LLC now owns 14,877 shares of the bank's stock valued at $1,480,000 after buying an additional 3,724 shares during the period. Swiss National Bank raised its holdings in SouthState by 0.7% during the fourth quarter. Swiss National Bank now owns 149,937 shares of the bank's stock worth $14,916,000 after purchasing an additional 1,100 shares during the last quarter. Skandinaviska Enskilda Banken AB publ acquired a new position in SouthState during the fourth quarter worth $699,000. Finally, Commonwealth Equity Services LLC raised its holdings in SouthState by 1.2% during the fourth quarter. Commonwealth Equity Services LLC now owns 9,537 shares of the bank's stock worth $949,000 after purchasing an additional 112 shares during the last quarter. 89.76% of the stock is currently owned by hedge funds and other institutional investors.

About SouthState

(

Get Free ReportSouthState Corporation operates as the bank holding company for SouthState Bank, National Association that provides a range of banking services and products to individuals and companies. It offers checking accounts, savings deposits, interest-bearing transaction accounts, certificates of deposits, money market accounts, and other time deposits, as well as bond accounting, asset/liability consulting related activities, and other clearing and corporate checking account services.

Recommended Stories

Before you consider SouthState, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and SouthState wasn't on the list.

While SouthState currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.