Ascendis Pharma A/S (NASDAQ:ASND - Get Free Report) had its price target raised by analysts at Stifel Nicolaus from $212.00 to $254.00 in a research note issued to investors on Friday,Benzinga reports. The brokerage currently has a "buy" rating on the biotechnology company's stock. Stifel Nicolaus' price objective suggests a potential upside of 30.64% from the stock's previous close.

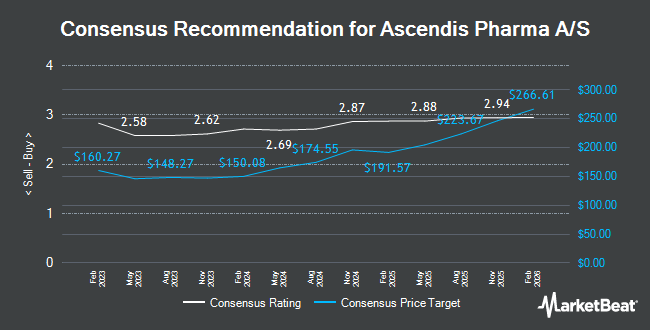

Several other brokerages also recently issued reports on ASND. Morgan Stanley assumed coverage on Ascendis Pharma A/S in a research report on Thursday, July 3rd. They set an "overweight" rating and a $250.00 price objective for the company. Oppenheimer restated an "outperform" rating and issued a $224.00 target price (up from $215.00) on shares of Ascendis Pharma A/S in a research report on Friday, June 13th. Bank of America upped their target price on Ascendis Pharma A/S from $201.00 to $216.00 and gave the stock a "buy" rating in a research report on Monday, June 9th. Wells Fargo & Company restated an "overweight" rating and issued a $295.00 target price (up from $289.00) on shares of Ascendis Pharma A/S in a research report on Friday. Finally, Evercore ISI upped their target price on Ascendis Pharma A/S from $260.00 to $280.00 and gave the stock an "outperform" rating in a research report on Friday, May 2nd. Seventeen analysts have rated the stock with a buy rating, Based on data from MarketBeat, the stock has a consensus rating of "Buy" and an average price target of $239.80.

View Our Latest Analysis on Ascendis Pharma A/S

Ascendis Pharma A/S Trading Down 0.8%

Ascendis Pharma A/S stock traded down $1.55 during midday trading on Friday, hitting $194.42. The stock had a trading volume of 541,885 shares, compared to its average volume of 494,629. The stock has a market cap of $11.89 billion, a P/E ratio of -37.77 and a beta of 0.41. Ascendis Pharma A/S has a 12 month low of $111.09 and a 12 month high of $199.99. The business has a fifty day moving average price of $174.44 and a 200 day moving average price of $159.76.

Ascendis Pharma A/S (NASDAQ:ASND - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The biotechnology company reported ($0.93) earnings per share for the quarter, beating the consensus estimate of ($1.42) by $0.49. The firm had revenue of $216.28 million during the quarter, compared to the consensus estimate of $163.17 million. On average, equities analysts anticipate that Ascendis Pharma A/S will post -4.34 EPS for the current fiscal year.

Institutional Investors Weigh In On Ascendis Pharma A/S

Large investors have recently bought and sold shares of the business. RA Capital Management L.P. boosted its holdings in Ascendis Pharma A/S by 1.7% during the first quarter. RA Capital Management L.P. now owns 10,281,496 shares of the biotechnology company's stock valued at $1,602,474,000 after acquiring an additional 168,752 shares during the period. Avoro Capital Advisors LLC lifted its stake in shares of Ascendis Pharma A/S by 2.3% in the fourth quarter. Avoro Capital Advisors LLC now owns 5,103,055 shares of the biotechnology company's stock valued at $702,538,000 after buying an additional 114,167 shares during the period. Janus Henderson Group PLC lifted its stake in shares of Ascendis Pharma A/S by 4.6% in the fourth quarter. Janus Henderson Group PLC now owns 4,380,382 shares of the biotechnology company's stock valued at $602,910,000 after buying an additional 193,688 shares during the period. T. Rowe Price Investment Management Inc. lifted its stake in shares of Ascendis Pharma A/S by 12.0% in the first quarter. T. Rowe Price Investment Management Inc. now owns 3,053,824 shares of the biotechnology company's stock valued at $475,970,000 after buying an additional 328,278 shares during the period. Finally, Capital International Investors lifted its stake in shares of Ascendis Pharma A/S by 35.7% in the fourth quarter. Capital International Investors now owns 2,863,249 shares of the biotechnology company's stock valued at $394,183,000 after buying an additional 753,859 shares during the period.

Ascendis Pharma A/S Company Profile

(

Get Free Report)

Ascendis Pharma A/S, a biopharmaceutical company, focuses on developing therapies for unmet medical needs. It offers SKYTROFA for treating patients with growth hormone deficiency (GHD). The company is also developing a pipeline of three independent endocrinology rare disease product candidates in clinical development, as well as focuses on advancing oncology therapeutic candidates.

See Also

Before you consider Ascendis Pharma A/S, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Ascendis Pharma A/S wasn't on the list.

While Ascendis Pharma A/S currently has a Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking for the next FAANG stock before everyone has heard about it? Enter your email address to see which stocks MarketBeat analysts think might become the next trillion dollar tech company.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.