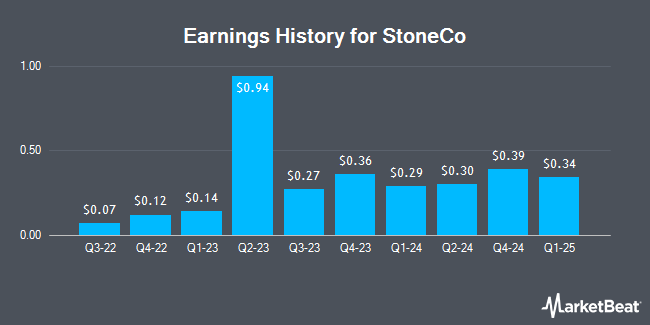

StoneCo (NASDAQ:STNE - Get Free Report) is expected to be releasing its Q1 2025 earnings data after the market closes on Thursday, May 8th. Analysts expect StoneCo to post earnings of $0.29 per share and revenue of $3.68 billion for the quarter.

StoneCo (NASDAQ:STNE - Get Free Report) last issued its quarterly earnings data on Tuesday, March 18th. The company reported $0.39 earnings per share for the quarter, beating the consensus estimate of $0.32 by $0.07. The firm had revenue of $582.20 million for the quarter, compared to analyst estimates of $3.59 billion. StoneCo had a net margin of 16.02% and a return on equity of 13.92%. On average, analysts expect StoneCo to post $1 EPS for the current fiscal year and $1 EPS for the next fiscal year.

StoneCo Stock Down 0.4 %

Shares of NASDAQ STNE traded down $0.06 during mid-day trading on Tuesday, reaching $13.29. 930,608 shares of the company traded hands, compared to its average volume of 5,700,541. The company's fifty day moving average is $11.22 and its two-hundred day moving average is $10.07. StoneCo has a fifty-two week low of $7.72 and a fifty-two week high of $17.09. The company has a debt-to-equity ratio of 0.47, a quick ratio of 1.42 and a current ratio of 1.42. The stock has a market cap of $3.80 billion, a PE ratio of 10.40, a price-to-earnings-growth ratio of 0.41 and a beta of 2.01.

Analyst Upgrades and Downgrades

A number of equities research analysts have issued reports on STNE shares. Citigroup upgraded shares of StoneCo from a "neutral" rating to a "buy" rating and upped their price target for the company from $9.00 to $15.00 in a report on Tuesday, April 22nd. Morgan Stanley increased their target price on StoneCo from $5.70 to $6.00 and gave the stock an "underweight" rating in a report on Friday, March 21st. Barclays lifted their price target on shares of StoneCo from $12.00 to $13.00 and gave the company an "equal weight" rating in a report on Wednesday, April 23rd. The Goldman Sachs Group reduced their price objective on StoneCo from $16.00 to $14.00 and set a "buy" rating on the stock in a research note on Thursday, February 6th. Finally, Wells Fargo & Company upgraded shares of StoneCo from an "equal weight" rating to an "overweight" rating in a research report on Wednesday, March 19th. One investment analyst has rated the stock with a sell rating, one has issued a hold rating, seven have assigned a buy rating and one has given a strong buy rating to the company's stock. According to MarketBeat.com, the stock presently has an average rating of "Moderate Buy" and an average target price of $15.38.

Check Out Our Latest Research Report on StoneCo

StoneCo Company Profile

(

Get Free Report)

StoneCo Ltd. provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil. It distributes its solutions, principally through proprietary Stone Hubs, which offer hyper-local sales and services; and sells solutions to brick-and-mortar and digital merchants through sales team.

Further Reading

Before you consider StoneCo, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and StoneCo wasn't on the list.

While StoneCo currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Which stocks are hedge funds and endowments buying in today's market? Enter your email address and we'll send you MarketBeat's list of thirteen stocks that institutional investors are buying now.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.