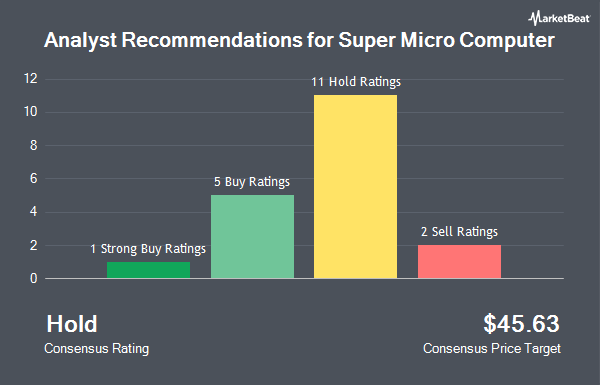

Shares of Super Micro Computer, Inc. (NASDAQ:SMCI - Get Free Report) have received an average recommendation of "Hold" from the nineteen ratings firms that are currently covering the stock, Marketbeat Ratings reports. Two investment analysts have rated the stock with a sell recommendation, eleven have issued a hold recommendation, five have issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1 year price target among brokerages that have issued a report on the stock in the last year is $45.53.

A number of equities research analysts have recently issued reports on the company. Citigroup began coverage on Super Micro Computer in a research report on Tuesday. They issued a "neutral" rating and a $39.00 price target for the company. StockNews.com upgraded Super Micro Computer to a "sell" rating in a report on Thursday. Mizuho set a $34.00 price target on Super Micro Computer in a report on Tuesday. The Goldman Sachs Group lowered shares of Super Micro Computer from a "neutral" rating to a "sell" rating and dropped their price objective for the company from $40.00 to $32.00 in a report on Monday, March 24th. Finally, Barclays reaffirmed an "equal weight" rating and set a $34.00 target price on shares of Super Micro Computer in a research note on Tuesday.

View Our Latest Analysis on Super Micro Computer

Super Micro Computer Price Performance

Shares of Super Micro Computer stock traded down $0.69 during mid-day trading on Tuesday, reaching $31.42. 21,155,137 shares of the stock traded hands, compared to its average volume of 71,572,345. The company has a quick ratio of 1.93, a current ratio of 3.77 and a debt-to-equity ratio of 0.32. The business has a 50-day moving average of $35.51 and a 200 day moving average of $35.34. The stock has a market capitalization of $18.75 billion, a PE ratio of 15.77 and a beta of 1.36. Super Micro Computer has a fifty-two week low of $17.25 and a fifty-two week high of $101.40.

Super Micro Computer (NASDAQ:SMCI - Get Free Report) last announced its earnings results on Tuesday, May 6th. The company reported $0.31 earnings per share (EPS) for the quarter, topping the consensus estimate of $0.30 by $0.01. The company had revenue of $4.60 billion for the quarter, compared to analysts' expectations of $5.40 billion. Super Micro Computer had a net margin of 8.09% and a return on equity of 30.57%. The firm's quarterly revenue was up 19.5% on a year-over-year basis. During the same quarter in the previous year, the company posted $0.66 EPS. On average, analysts predict that Super Micro Computer will post 1.86 EPS for the current year.

Insiders Place Their Bets

In other Super Micro Computer news, Director Robert L. Blair sold 19,460 shares of the company's stock in a transaction dated Friday, February 28th. The stock was sold at an average price of $42.58, for a total transaction of $828,606.80. The sale was disclosed in a filing with the SEC, which is available at the SEC website. Also, CEO Charles Liang sold 46,293 shares of the business's stock in a transaction dated Wednesday, February 26th. The stock was sold at an average price of $50.17, for a total value of $2,322,519.81. Following the transaction, the chief executive officer now directly owns 67,403,640 shares of the company's stock, valued at approximately $3,381,640,618.80. This represents a 0.07 % decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders sold a total of 137,473 shares of company stock worth $6,771,552 over the last 90 days. Corporate insiders own 17.60% of the company's stock.

Institutional Investors Weigh In On Super Micro Computer

Several institutional investors have recently modified their holdings of the company. Vanguard Group Inc. lifted its position in shares of Super Micro Computer by 908.4% during the 4th quarter. Vanguard Group Inc. now owns 61,992,493 shares of the company's stock worth $1,889,531,000 after buying an additional 55,845,073 shares during the last quarter. Geode Capital Management LLC boosted its stake in Super Micro Computer by 914.7% in the fourth quarter. Geode Capital Management LLC now owns 12,846,717 shares of the company's stock valued at $390,572,000 after acquiring an additional 11,580,677 shares in the last quarter. FMR LLC purchased a new position in shares of Super Micro Computer during the fourth quarter worth about $292,869,000. Invesco Ltd. increased its position in shares of Super Micro Computer by 929.5% during the fourth quarter. Invesco Ltd. now owns 7,542,742 shares of the company's stock worth $229,903,000 after purchasing an additional 6,810,082 shares in the last quarter. Finally, Northern Trust Corp lifted its holdings in shares of Super Micro Computer by 1,573.8% in the 4th quarter. Northern Trust Corp now owns 4,897,876 shares of the company's stock valued at $149,287,000 after purchasing an additional 4,605,260 shares during the last quarter. 84.06% of the stock is owned by hedge funds and other institutional investors.

About Super Micro Computer

(

Get Free ReportSuper Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Featured Articles

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.