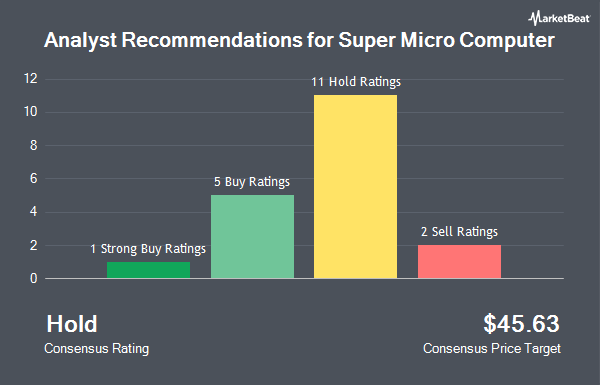

Shares of Super Micro Computer, Inc. (NASDAQ:SMCI - Get Free Report) have earned a consensus recommendation of "Hold" from the seventeen research firms that are currently covering the firm, MarketBeat reports. Two investment analysts have rated the stock with a sell rating, eight have given a hold rating, six have given a buy rating and one has issued a strong buy rating on the company. The average 1-year target price among analysts that have issued ratings on the stock in the last year is $44.75.

Several research analysts recently issued reports on the stock. JPMorgan Chase & Co. cut their target price on shares of Super Micro Computer from $46.00 to $45.00 and set a "neutral" rating for the company in a research report on Wednesday, August 6th. Wedbush restated a "neutral" rating and set a $30.00 price target on shares of Super Micro Computer in a research report on Monday, August 4th. Barclays upped their price target on shares of Super Micro Computer from $29.00 to $45.00 and gave the company an "equal weight" rating in a research report on Thursday, August 7th. Needham & Company LLC upped their price target on shares of Super Micro Computer from $39.00 to $60.00 and gave the company a "buy" rating in a research report on Wednesday, August 6th. Finally, Citigroup reaffirmed a "neutral" rating and set a $52.00 price objective (up from $37.00) on shares of Super Micro Computer in a research note on Friday, July 11th.

View Our Latest Stock Report on SMCI

Super Micro Computer Price Performance

Shares of Super Micro Computer stock traded down $0.58 during trading on Thursday, hitting $45.49. The stock had a trading volume of 22,840,665 shares, compared to its average volume of 43,762,760. The firm has a market cap of $27.15 billion, a price-to-earnings ratio of 27.40, a P/E/G ratio of 1.15 and a beta of 1.46. Super Micro Computer has a 12 month low of $17.25 and a 12 month high of $66.44. The business's 50-day moving average is $48.88 and its 200 day moving average is $41.89. The company has a current ratio of 5.32, a quick ratio of 3.32 and a debt-to-equity ratio of 0.74.

Super Micro Computer (NASDAQ:SMCI - Get Free Report) last released its quarterly earnings results on Tuesday, August 5th. The company reported $0.41 earnings per share for the quarter, missing the consensus estimate of $0.44 by ($0.03). The firm had revenue of $5.76 billion during the quarter, compared to the consensus estimate of $5.88 billion. Super Micro Computer had a return on equity of 17.14% and a net margin of 4.77%. The company's revenue for the quarter was up 8.5% compared to the same quarter last year. During the same period in the previous year, the company posted $6.25 EPS. As a group, sell-side analysts anticipate that Super Micro Computer will post 1.86 earnings per share for the current year.

Insider Buying and Selling

In related news, Director Liang Chiu-Chu Sara Liu sold 200,000 shares of the firm's stock in a transaction that occurred on Monday, July 28th. The shares were sold at an average price of $60.00, for a total value of $12,000,000.00. Following the sale, the director owned 40,426,120 shares in the company, valued at approximately $2,425,567,200. This trade represents a 0.49% decrease in their ownership of the stock. The sale was disclosed in a document filed with the SEC, which can be accessed through the SEC website. Also, CEO Charles Liang sold 200,000 shares of the firm's stock in a transaction that occurred on Monday, July 28th. The stock was sold at an average price of $60.00, for a total transaction of $12,000,000.00. Following the completion of the sale, the chief executive officer owned 40,426,120 shares in the company, valued at $2,425,567,200. This represents a 0.49% decrease in their position. The disclosure for this sale can be found here. Over the last quarter, insiders have sold 1,067,000 shares of company stock worth $53,949,340. 16.30% of the stock is owned by insiders.

Institutional Inflows and Outflows

Several institutional investors and hedge funds have recently modified their holdings of SMCI. Anfield Capital Management LLC bought a new stake in Super Micro Computer in the 2nd quarter valued at $25,000. Twin Peaks Wealth Advisors LLC bought a new stake in Super Micro Computer in the 2nd quarter valued at $25,000. Eastern Bank bought a new stake in Super Micro Computer in the 1st quarter valued at $29,000. Bernard Wealth Management Corp. bought a new stake in Super Micro Computer in the 4th quarter valued at $33,000. Finally, Quarry LP bought a new stake in Super Micro Computer in the 4th quarter valued at $34,000. Hedge funds and other institutional investors own 84.06% of the company's stock.

About Super Micro Computer

(

Get Free Report)

Super Micro Computer, Inc, together with its subsidiaries, develops and manufactures high performance server and storage solutions based on modular and open architecture in the United States, Europe, Asia, and internationally. Its solutions range from complete server, storage systems, modular blade servers, blades, workstations, full racks, networking devices, server sub-systems, server management software, and security software.

Further Reading

Before you consider Super Micro Computer, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Super Micro Computer wasn't on the list.

While Super Micro Computer currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.