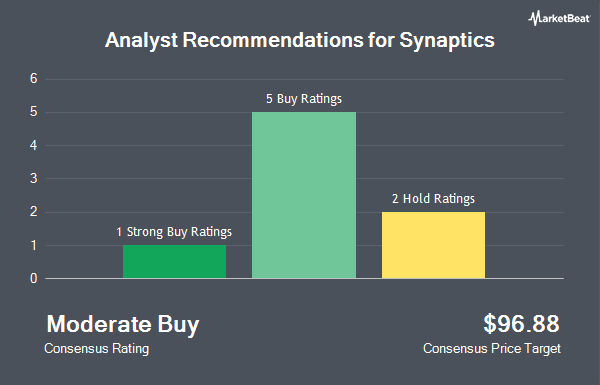

Shares of Synaptics Incorporated (NASDAQ:SYNA - Get Free Report) have earned a consensus rating of "Moderate Buy" from the nine ratings firms that are currently covering the firm, MarketBeat Ratings reports. One analyst has rated the stock with a sell recommendation, one has issued a hold recommendation, six have given a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1-year price target among analysts that have issued a report on the stock in the last year is $91.3333.

Several equities research analysts have commented on SYNA shares. Zacks Research lowered shares of Synaptics from a "hold" rating to a "strong sell" rating in a report on Friday, August 15th. Barclays started coverage on shares of Synaptics in a report on Monday, August 18th. They issued an "overweight" rating and a $78.00 price target on the stock. Finally, Wall Street Zen lowered shares of Synaptics from a "buy" rating to a "hold" rating in a report on Friday, August 22nd.

Read Our Latest Research Report on Synaptics

Synaptics Price Performance

NASDAQ:SYNA opened at $69.92 on Wednesday. Synaptics has a one year low of $41.80 and a one year high of $89.81. The company has a debt-to-equity ratio of 0.60, a quick ratio of 2.26 and a current ratio of 2.78. The firm has a market cap of $2.70 billion, a price-to-earnings ratio of -57.78 and a beta of 1.63. The firm's fifty day moving average is $67.23 and its two-hundred day moving average is $62.68.

Synaptics (NASDAQ:SYNA - Get Free Report) last posted its quarterly earnings results on Thursday, August 7th. The software maker reported $1.01 EPS for the quarter, beating the consensus estimate of $1.00 by $0.01. Synaptics had a negative net margin of 4.45% and a positive return on equity of 4.32%. The company had revenue of $282.80 million for the quarter, compared to analyst estimates of $280.12 million. During the same period in the prior year, the company earned $0.64 earnings per share. The firm's revenue was up 14.3% on a year-over-year basis. Synaptics has set its Q1 2026 guidance at 1.490-1.690 EPS. Research analysts expect that Synaptics will post 0.96 EPS for the current year.

Synaptics announced that its board has approved a stock buyback plan on Thursday, August 7th that permits the company to buyback $150.00 million in outstanding shares. This buyback authorization permits the software maker to buy up to 6.5% of its stock through open market purchases. Stock buyback plans are typically an indication that the company's board believes its shares are undervalued.

Institutional Trading of Synaptics

Several hedge funds and other institutional investors have recently added to or reduced their stakes in the company. Johnson Investment Counsel Inc. grew its stake in Synaptics by 6.1% in the 2nd quarter. Johnson Investment Counsel Inc. now owns 3,601 shares of the software maker's stock valued at $233,000 after acquiring an additional 206 shares during the last quarter. California State Teachers Retirement System grew its stake in Synaptics by 0.6% in the 2nd quarter. California State Teachers Retirement System now owns 36,853 shares of the software maker's stock valued at $2,389,000 after acquiring an additional 209 shares during the last quarter. Nisa Investment Advisors LLC grew its stake in Synaptics by 50.3% in the 2nd quarter. Nisa Investment Advisors LLC now owns 708 shares of the software maker's stock valued at $46,000 after acquiring an additional 237 shares during the last quarter. PNC Financial Services Group Inc. grew its stake in Synaptics by 32.5% in the 1st quarter. PNC Financial Services Group Inc. now owns 1,016 shares of the software maker's stock valued at $65,000 after acquiring an additional 249 shares during the last quarter. Finally, Parallel Advisors LLC grew its stake in Synaptics by 151.1% in the 1st quarter. Parallel Advisors LLC now owns 447 shares of the software maker's stock valued at $28,000 after acquiring an additional 269 shares during the last quarter. Institutional investors and hedge funds own 99.43% of the company's stock.

Synaptics Company Profile

(

Get Free Report)

Synaptics Incorporated develops, markets, and sells semiconductor products worldwide. The company offers AudioSmart for voice and audio processing; ConnectSmart for high-speed video/audio/data connectivity; DisplayLink for transmitting compressed video frames across low bandwidth connections; VideoSmart that enables set-top boxes, over-the-top, streaming devices, soundbars, surveillance cameras, and smart displays; and ImagingSmart solutions.

Featured Articles

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Synaptics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synaptics wasn't on the list.

While Synaptics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.