Synchrony Financial (NYSE:SYF - Get Free Report) had its target price hoisted by Evercore ISI from $83.00 to $84.00 in a research report issued on Tuesday,Benzinga reports. The brokerage presently has an "outperform" rating on the financial services provider's stock. Evercore ISI's price target points to a potential upside of 20.43% from the company's current price.

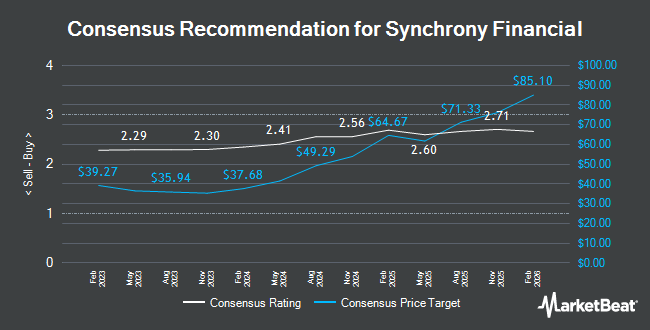

Several other equities research analysts also recently weighed in on SYF. JMP Securities increased their price target on Synchrony Financial from $77.00 to $88.00 and gave the stock a "market outperform" rating in a report on Thursday, September 25th. Barclays dropped their price objective on Synchrony Financial from $81.00 to $80.00 and set an "overweight" rating for the company in a report on Wednesday, July 23rd. JPMorgan Chase & Co. boosted their price objective on Synchrony Financial from $52.00 to $80.00 and gave the company an "overweight" rating in a report on Friday, July 11th. Bank of America boosted their price objective on Synchrony Financial from $75.00 to $80.00 and gave the company a "buy" rating in a report on Thursday, September 11th. Finally, Truist Financial boosted their price objective on Synchrony Financial from $68.00 to $76.00 and gave the company a "hold" rating in a report on Thursday, July 24th. Twelve equities research analysts have rated the stock with a Buy rating and eight have assigned a Hold rating to the company's stock. According to data from MarketBeat, Synchrony Financial currently has a consensus rating of "Moderate Buy" and an average price target of $76.47.

Get Our Latest Analysis on SYF

Synchrony Financial Price Performance

NYSE:SYF traded down $3.57 during trading hours on Tuesday, reaching $69.75. The stock had a trading volume of 2,616,166 shares, compared to its average volume of 3,907,600. The stock has a market capitalization of $25.95 billion, a PE ratio of 8.46, a PEG ratio of 0.75 and a beta of 1.48. Synchrony Financial has a 52 week low of $40.54 and a 52 week high of $77.41. The company has a 50 day moving average price of $73.31 and a two-hundred day moving average price of $63.19. The company has a debt-to-equity ratio of 1.02, a quick ratio of 1.24 and a current ratio of 1.24.

Synchrony Financial (NYSE:SYF - Get Free Report) last issued its quarterly earnings data on Tuesday, July 22nd. The financial services provider reported $2.50 EPS for the quarter, topping analysts' consensus estimates of $1.72 by $0.78. The business had revenue of $3.65 billion during the quarter, compared to analysts' expectations of $3.71 billion. Synchrony Financial had a net margin of 14.43% and a return on equity of 21.34%. The business's revenue was down 1.8% on a year-over-year basis. During the same period last year, the company posted $1.55 EPS. Synchrony Financial has set its FY 2025 guidance at EPS. As a group, sell-side analysts anticipate that Synchrony Financial will post 7.67 earnings per share for the current fiscal year.

Insider Buying and Selling at Synchrony Financial

In other news, insider Darrell Owens sold 600 shares of the business's stock in a transaction dated Monday, August 4th. The stock was sold at an average price of $67.95, for a total transaction of $40,770.00. Following the sale, the insider owned 21,372 shares in the company, valued at approximately $1,452,227.40. The trade was a 2.73% decrease in their ownership of the stock. The sale was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, insider Brian J. Sr. Wenzel sold 8,514 shares of the stock in a transaction that occurred on Tuesday, August 5th. The shares were sold at an average price of $70.00, for a total transaction of $595,980.00. Following the completion of the transaction, the insider directly owned 68,588 shares of the company's stock, valued at $4,801,160. The trade was a 11.04% decrease in their ownership of the stock. The disclosure for this sale can be found here. 0.33% of the stock is owned by insiders.

Institutional Inflows and Outflows

A number of hedge funds and other institutional investors have recently made changes to their positions in the stock. Allspring Global Investments Holdings LLC raised its stake in shares of Synchrony Financial by 30.4% in the first quarter. Allspring Global Investments Holdings LLC now owns 73,136 shares of the financial services provider's stock worth $3,895,000 after purchasing an additional 17,061 shares during the last quarter. U.S. Capital Wealth Advisors LLC acquired a new stake in Synchrony Financial during the 1st quarter valued at approximately $11,506,000. AQR Capital Management LLC increased its stake in shares of Synchrony Financial by 1.3% in the first quarter. AQR Capital Management LLC now owns 4,020,839 shares of the financial services provider's stock worth $206,711,000 after acquiring an additional 50,162 shares during the period. Merit Financial Group LLC lifted its position in Synchrony Financial by 70.2% during the first quarter. Merit Financial Group LLC now owns 10,657 shares of the financial services provider's stock valued at $564,000 after purchasing an additional 4,397 shares during the period. Finally, Envestnet Asset Management Inc. raised its stake in shares of Synchrony Financial by 2.5% during the 1st quarter. Envestnet Asset Management Inc. now owns 236,967 shares of the financial services provider's stock valued at $12,545,000 after buying an additional 5,765 shares during the last quarter. Hedge funds and other institutional investors own 96.48% of the company's stock.

About Synchrony Financial

(

Get Free Report)

Synchrony Financial, together with its subsidiaries, operates as a consumer financial services company in the United States. It provides credit products, such as credit cards, commercial credit products, and consumer installment loans. The company also offers private label credit cards, dual co-brand and general purpose credit cards, short- and long-term installment loans, and consumer banking products; and deposit products, including certificates of deposit, individual retirement accounts, money market accounts, and savings accounts, and sweep and affinity deposits, as well as accepts deposits through third-party securities brokerage firms.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Synchrony Financial, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Synchrony Financial wasn't on the list.

While Synchrony Financial currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the 10 Best High-Yield Dividend Stocks for 2025 and secure reliable income in uncertain markets. Download the report now to identify top dividend payers and avoid common yield traps.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.