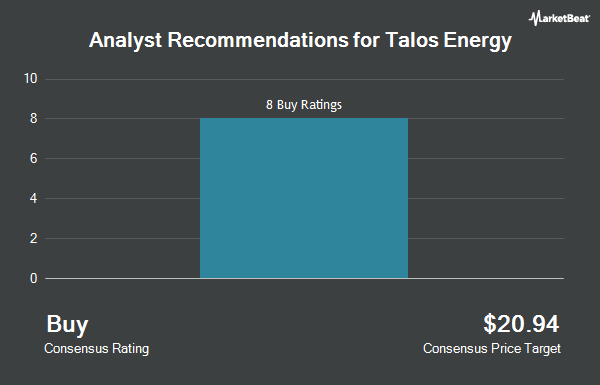

Shares of Talos Energy Inc. (NYSE:TALO - Get Free Report) have received a consensus rating of "Moderate Buy" from the eight research firms that are covering the company, Marketbeat reports. One equities research analyst has rated the stock with a sell rating, two have given a hold rating and five have given a buy rating to the company. The average twelve-month price objective among brokerages that have covered the stock in the last year is $14.4286.

Several equities research analysts have recently weighed in on the stock. Mizuho reaffirmed a "neutral" rating and issued a $11.00 price target on shares of Talos Energy in a research report on Monday, September 15th. Wall Street Zen lowered shares of Talos Energy from a "hold" rating to a "sell" rating in a research note on Saturday, August 9th. Weiss Ratings reiterated a "sell (e+)" rating on shares of Talos Energy in a research note on Saturday, September 27th. Finally, Capital One Financial started coverage on shares of Talos Energy in a research note on Monday, June 16th. They set an "overweight" rating and a $14.00 price objective for the company.

Get Our Latest Analysis on TALO

Talos Energy Price Performance

Shares of TALO opened at $10.08 on Wednesday. The company has a 50 day moving average price of $9.18 and a 200-day moving average price of $8.57. Talos Energy has a fifty-two week low of $6.23 and a fifty-two week high of $12.71. The stock has a market capitalization of $1.76 billion, a PE ratio of -10.39 and a beta of 0.74. The company has a debt-to-equity ratio of 0.49, a quick ratio of 1.22 and a current ratio of 1.22.

Talos Energy (NYSE:TALO - Get Free Report) last announced its quarterly earnings results on Wednesday, August 6th. The company reported ($0.27) earnings per share for the quarter, topping the consensus estimate of ($0.33) by $0.06. Talos Energy had a negative net margin of 8.91% and a negative return on equity of 2.34%. The firm had revenue of $424.72 million during the quarter, compared to analysts' expectations of $443.53 million. During the same quarter in the prior year, the company earned $0.03 EPS. The company's revenue was down 22.7% compared to the same quarter last year. Equities analysts predict that Talos Energy will post -0.44 earnings per share for the current fiscal year.

Insider Activity at Talos Energy

In related news, Director Paula R. Glover sold 6,159 shares of the business's stock in a transaction that occurred on Wednesday, September 3rd. The shares were sold at an average price of $9.69, for a total transaction of $59,680.71. The transaction was disclosed in a document filed with the Securities & Exchange Commission, which is accessible through the SEC website. 0.36% of the stock is currently owned by company insiders.

Institutional Inflows and Outflows

Hedge funds have recently bought and sold shares of the stock. Virtus Fixed Income Advisers LLC acquired a new position in Talos Energy during the 2nd quarter valued at approximately $25,000. GAMMA Investing LLC increased its stake in Talos Energy by 360.9% during the 1st quarter. GAMMA Investing LLC now owns 3,194 shares of the company's stock valued at $31,000 after purchasing an additional 2,501 shares in the last quarter. Smartleaf Asset Management LLC increased its stake in Talos Energy by 134.4% during the 2nd quarter. Smartleaf Asset Management LLC now owns 3,703 shares of the company's stock valued at $32,000 after purchasing an additional 2,123 shares in the last quarter. CWM LLC increased its stake in shares of Talos Energy by 186.3% in the second quarter. CWM LLC now owns 6,027 shares of the company's stock worth $51,000 after acquiring an additional 3,922 shares during the period. Finally, Signaturefd LLC increased its stake in shares of Talos Energy by 571.3% in the first quarter. Signaturefd LLC now owns 5,612 shares of the company's stock worth $55,000 after acquiring an additional 4,776 shares during the period. Institutional investors and hedge funds own 89.35% of the company's stock.

About Talos Energy

(

Get Free Report)

Talos Energy Inc, through its subsidiaries, engages in the exploration and production of oil, natural gas, and natural gas liquids in the United States and Mexico. It also engages in the development of carbon capture and sequestration. Talos Energy Inc was founded in 2011 and is headquartered in Houston, Texas.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Talos Energy, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Talos Energy wasn't on the list.

While Talos Energy currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.