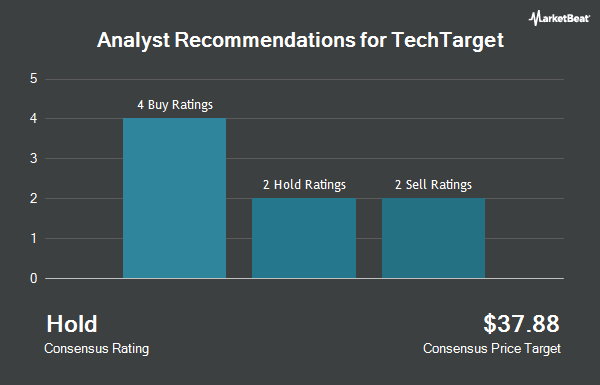

Shares of TechTarget, Inc. (NASDAQ:TTGT - Get Free Report) have received a consensus recommendation of "Moderate Buy" from the six analysts that are covering the firm, MarketBeat reports. One research analyst has rated the stock with a sell rating, one has issued a hold rating and four have given a buy rating to the company. The average 12-month target price among brokers that have issued a report on the stock in the last year is $19.33.

TTGT has been the topic of a number of research analyst reports. Wall Street Zen raised TechTarget from a "sell" rating to a "hold" rating in a report on Saturday, April 26th. Craig Hallum initiated coverage on TechTarget in a report on Monday, June 9th. They issued a "buy" rating and a $12.00 target price on the stock. Lake Street Capital lowered their target price on TechTarget from $12.00 to $10.00 and set a "buy" rating on the stock in a report on Tuesday, June 17th. JPMorgan Chase & Co. lowered TechTarget from a "neutral" rating to an "underweight" rating and decreased their price objective for the stock from $18.00 to $8.00 in a report on Tuesday, June 10th. Finally, Needham & Company LLC reissued a "buy" rating and set a $15.00 price objective on shares of TechTarget in a report on Wednesday, July 2nd.

View Our Latest Stock Report on TTGT

TechTarget Stock Up 3.4%

Shares of TTGT traded up $0.24 during midday trading on Friday, reaching $7.41. 289,895 shares of the stock were exchanged, compared to its average volume of 262,575. The firm has a 50 day simple moving average of $7.51 and a 200-day simple moving average of $11.84. TechTarget has a 12-month low of $6.49 and a 12-month high of $35.11. The company has a market cap of $529.95 million, a price-to-earnings ratio of -17.64 and a beta of 1.02.

TechTarget (NASDAQ:TTGT - Get Free Report) last issued its quarterly earnings data on Monday, July 14th. The information services provider reported ($2.24) earnings per share for the quarter. TechTarget had a negative net margin of 193.29% and a negative return on equity of 125.41%. The company had revenue of $103.89 million during the quarter. Research analysts expect that TechTarget will post -0.46 earnings per share for the current fiscal year.

Institutional Investors Weigh In On TechTarget

A number of institutional investors have recently made changes to their positions in TTGT. GAMMA Investing LLC grew its stake in shares of TechTarget by 4,513.8% during the second quarter. GAMMA Investing LLC now owns 5,029 shares of the information services provider's stock worth $39,000 after purchasing an additional 4,920 shares during the period. KLP Kapitalforvaltning AS acquired a new position in shares of TechTarget during the fourth quarter worth about $103,000. PNC Financial Services Group Inc. raised its holdings in TechTarget by 18.7% during the first quarter. PNC Financial Services Group Inc. now owns 9,768 shares of the information services provider's stock worth $145,000 after acquiring an additional 1,541 shares in the last quarter. Quantbot Technologies LP bought a new stake in TechTarget during the fourth quarter worth about $173,000. Finally, Louisiana State Employees Retirement System bought a new stake in TechTarget in the first quarter valued at approximately $190,000. 93.52% of the stock is owned by institutional investors and hedge funds.

TechTarget Company Profile

(

Get Free ReportTechTarget, Inc, together with its subsidiaries, provides marketing and sales services that deliver business impact for business-to-business technology companies in North America and internationally. The company's service enables technology vendors to identify, reach, and influence corporate information technology (IT) decision-makers actively researching specific IT purchases; and customized marketing programs that integrate demand generation, brand advertising techniques, and content curation and creation.

Featured Stories

Before you consider TechTarget, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TechTarget wasn't on the list.

While TechTarget currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's guide to investing in 5G and which 5G stocks show the most promise.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.