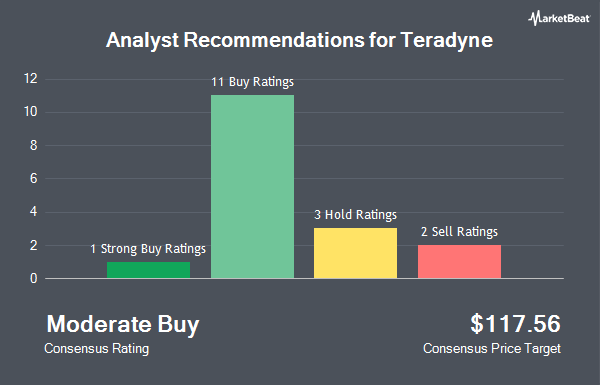

Shares of Teradyne, Inc. (NASDAQ:TER - Get Free Report) have been assigned an average recommendation of "Hold" from the seventeen brokerages that are presently covering the firm, MarketBeat.com reports. Three equities research analysts have rated the stock with a sell rating, four have given a hold rating, nine have assigned a buy rating and one has given a strong buy rating to the company. The average twelve-month target price among brokerages that have updated their coverage on the stock in the last year is $112.50.

A number of brokerages have recently issued reports on TER. JPMorgan Chase & Co. reiterated a "neutral" rating and issued a $102.00 price target (up from $88.00) on shares of Teradyne in a report on Thursday, July 17th. The Goldman Sachs Group started coverage on Teradyne in a report on Thursday, July 10th. They issued a "sell" rating and a $80.00 price target on the stock. UBS Group raised their price objective on Teradyne from $110.00 to $120.00 and gave the stock a "buy" rating in a research report on Monday, July 21st. Susquehanna lowered their price objective on Teradyne from $155.00 to $133.00 and set a "positive" rating for the company in a research report on Wednesday, April 30th. Finally, Morgan Stanley raised their price objective on Teradyne from $68.00 to $74.00 and gave the stock an "underweight" rating in a research report on Wednesday, July 9th.

Read Our Latest Report on Teradyne

Hedge Funds Weigh In On Teradyne

Institutional investors and hedge funds have recently modified their holdings of the stock. DAVENPORT & Co LLC lifted its holdings in shares of Teradyne by 29.8% in the 1st quarter. DAVENPORT & Co LLC now owns 5,094 shares of the company's stock valued at $421,000 after buying an additional 1,170 shares during the period. Park Avenue Securities LLC lifted its holdings in shares of Teradyne by 56.0% in the 1st quarter. Park Avenue Securities LLC now owns 3,045 shares of the company's stock valued at $252,000 after buying an additional 1,093 shares during the period. Crossmark Global Holdings Inc. lifted its holdings in shares of Teradyne by 6.4% in the 1st quarter. Crossmark Global Holdings Inc. now owns 4,328 shares of the company's stock valued at $357,000 after buying an additional 261 shares during the period. California Public Employees Retirement System increased its stake in shares of Teradyne by 87.5% in the 4th quarter. California Public Employees Retirement System now owns 498,614 shares of the company's stock valued at $62,785,000 after purchasing an additional 232,730 shares in the last quarter. Finally, Asset Management One Co. Ltd. increased its stake in shares of Teradyne by 5.5% in the 1st quarter. Asset Management One Co. Ltd. now owns 68,612 shares of the company's stock valued at $5,667,000 after purchasing an additional 3,589 shares in the last quarter. Institutional investors and hedge funds own 99.77% of the company's stock.

Teradyne Trading Down 1.3%

Shares of NASDAQ:TER opened at $90.15 on Friday. Teradyne has a 12-month low of $65.77 and a 12-month high of $144.16. The business's fifty day simple moving average is $87.63 and its 200-day simple moving average is $94.00. The company has a market capitalization of $14.46 billion, a PE ratio of 25.47, a P/E/G ratio of 3.99 and a beta of 1.70.

Teradyne (NASDAQ:TER - Get Free Report) last announced its quarterly earnings results on Monday, April 28th. The company reported $0.75 earnings per share (EPS) for the quarter, beating analysts' consensus estimates of $0.61 by $0.14. Teradyne had a return on equity of 20.06% and a net margin of 19.86%. The business had revenue of $685.70 million for the quarter, compared to the consensus estimate of $680.54 million. During the same period last year, the business posted $0.51 EPS. The business's revenue was up 14.3% compared to the same quarter last year. Research analysts predict that Teradyne will post 3.88 EPS for the current year.

Teradyne announced that its Board of Directors has approved a share buyback program on Monday, April 28th that permits the company to buyback $1.00 billion in shares. This buyback authorization permits the company to reacquire up to 8.1% of its shares through open market purchases. Shares buyback programs are often an indication that the company's board believes its stock is undervalued.

Teradyne Dividend Announcement

The company also recently declared a quarterly dividend, which was paid on Friday, June 13th. Shareholders of record on Thursday, May 22nd were given a dividend of $0.12 per share. The ex-dividend date was Thursday, May 22nd. This represents a $0.48 dividend on an annualized basis and a yield of 0.53%. Teradyne's dividend payout ratio is currently 13.56%.

About Teradyne

(

Get Free ReportTeradyne, Inc designs, develops, manufactures, and sells automated test systems and robotics products worldwide. It operates through four segments; Semiconductor Test, System Test, Robotics, and Wireless Test. The Semiconductor Test segment offers products and services for wafer level and device package testing of semiconductor devices in automotive, industrial, communications, consumer, smartphones, cloud, computer and electronic game, and other applications.

See Also

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Teradyne, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Teradyne wasn't on the list.

While Teradyne currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the top 7 AI stocks to invest in right now. This exclusive report highlights the companies leading the AI revolution and shaping the future of technology in 2025.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.