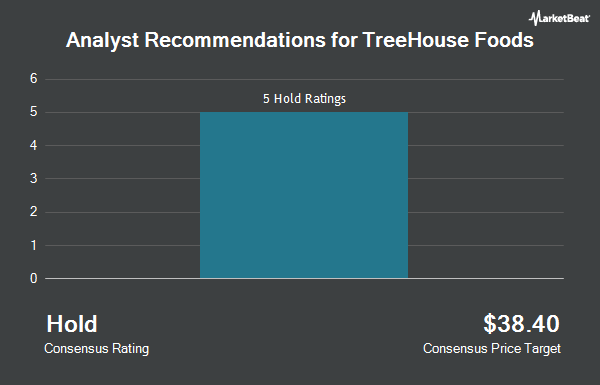

TreeHouse Foods, Inc. (NYSE:THS - Get Free Report) has earned a consensus rating of "Hold" from the seven ratings firms that are currently covering the stock, MarketBeat.com reports. Seven investment analysts have rated the stock with a hold recommendation. The average 12-month target price among analysts that have issued ratings on the stock in the last year is $24.00.

Several research firms recently weighed in on THS. Mizuho dropped their price objective on TreeHouse Foods from $24.00 to $22.00 and set a "neutral" rating for the company in a research note on Monday, July 28th. Stifel Nicolaus dropped their price objective on TreeHouse Foods from $24.00 to $23.00 and set a "hold" rating for the company in a research note on Tuesday, July 29th. Finally, Barclays dropped their price objective on TreeHouse Foods from $25.00 to $21.00 and set an "equal weight" rating for the company in a research note on Tuesday, July 15th.

Check Out Our Latest Stock Analysis on TreeHouse Foods

Institutional Investors Weigh In On TreeHouse Foods

Several hedge funds have recently made changes to their positions in THS. Illinois Municipal Retirement Fund increased its stake in shares of TreeHouse Foods by 2.3% in the first quarter. Illinois Municipal Retirement Fund now owns 25,462 shares of the company's stock worth $690,000 after acquiring an additional 562 shares during the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. increased its stake in shares of TreeHouse Foods by 2.7% in the fourth quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 26,838 shares of the company's stock worth $943,000 after acquiring an additional 696 shares during the last quarter. Hsbc Holdings PLC increased its stake in shares of TreeHouse Foods by 8.8% in the first quarter. Hsbc Holdings PLC now owns 9,814 shares of the company's stock worth $268,000 after acquiring an additional 790 shares during the last quarter. Commonwealth of Pennsylvania Public School Empls Retrmt SYS increased its stake in shares of TreeHouse Foods by 7.9% in the second quarter. Commonwealth of Pennsylvania Public School Empls Retrmt SYS now owns 11,669 shares of the company's stock worth $227,000 after acquiring an additional 857 shares during the last quarter. Finally, HighTower Advisors LLC increased its stake in shares of TreeHouse Foods by 8.9% in the first quarter. HighTower Advisors LLC now owns 10,520 shares of the company's stock worth $285,000 after acquiring an additional 861 shares during the last quarter. Institutional investors and hedge funds own 99.81% of the company's stock.

TreeHouse Foods Stock Performance

Shares of THS stock traded up $0.07 during trading hours on Wednesday, reaching $17.38. 1,210,057 shares of the company's stock were exchanged, compared to its average volume of 668,264. The company has a market cap of $877.69 million, a P/E ratio of 44.57 and a beta of 0.26. The company's 50 day moving average is $18.86 and its two-hundred day moving average is $21.82. TreeHouse Foods has a 1 year low of $17.05 and a 1 year high of $42.55. The company has a debt-to-equity ratio of 0.98, a current ratio of 1.26 and a quick ratio of 0.38.

TreeHouse Foods (NYSE:THS - Get Free Report) last issued its earnings results on Thursday, July 31st. The company reported $0.17 earnings per share (EPS) for the quarter, topping analysts' consensus estimates of $0.10 by $0.07. The business had revenue of $801.40 million during the quarter, compared to the consensus estimate of $788.84 million. TreeHouse Foods had a return on equity of 6.35% and a net margin of 0.62%.The company's revenue for the quarter was up 1.2% on a year-over-year basis. During the same period in the prior year, the business posted $0.29 EPS. TreeHouse Foods has set its Q3 2025 guidance at EPS. FY 2025 guidance at EPS. Equities research analysts anticipate that TreeHouse Foods will post 1.94 EPS for the current fiscal year.

About TreeHouse Foods

(

Get Free Report)

TreeHouse Foods, Inc manufactures and distributes private brands snacks and beverages in the United States and internationally. The company provides snacking products, such as crackers, pretzels, in-store bakery items, frozen griddle items, cookies, and candies; and beverage and drink mixes, including non-dairy creamer, coffee, broths/stocks, powdered beverages and other blends, tea, and ready-to-drink-beverages.

See Also

Before you consider TreeHouse Foods, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TreeHouse Foods wasn't on the list.

While TreeHouse Foods currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of seven best retirement stocks and why they should be in your portfolio.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.