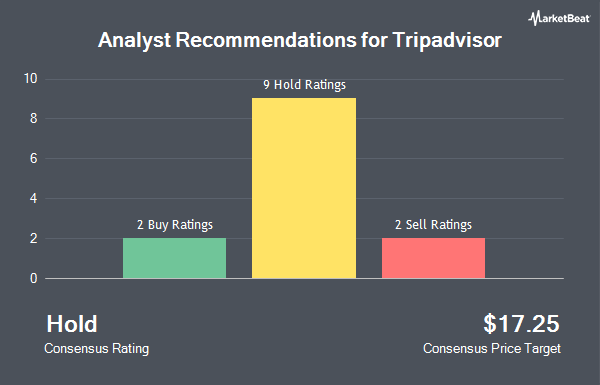

TripAdvisor, Inc. (NASDAQ:TRIP - Get Free Report) has earned a consensus recommendation of "Reduce" from the eleven research firms that are currently covering the stock, Marketbeat reports. Three equities research analysts have rated the stock with a sell recommendation and eight have given a hold recommendation to the company. The average 12 month price target among brokerages that have issued a report on the stock in the last year is $17.0250.

Several research firms recently commented on TRIP. Wall Street Zen raised TripAdvisor from a "buy" rating to a "strong-buy" rating in a report on Saturday, September 13th. B. Riley upped their price objective on TripAdvisor from $17.00 to $21.00 and gave the stock a "neutral" rating in a research report on Monday, August 11th. DA Davidson set a $16.25 target price on TripAdvisor in a research report on Tuesday, July 8th. Weiss Ratings restated a "hold (c)" rating on shares of TripAdvisor in a research note on Saturday, September 27th. Finally, Mizuho assumed coverage on TripAdvisor in a report on Tuesday, September 30th. They issued an "underperform" rating and a $14.00 price target for the company.

Read Our Latest Research Report on TripAdvisor

TripAdvisor Stock Up 0.8%

Shares of TripAdvisor stock opened at $16.00 on Tuesday. The company has a quick ratio of 1.24, a current ratio of 1.24 and a debt-to-equity ratio of 1.37. TripAdvisor has a 52-week low of $10.43 and a 52-week high of $20.16. The company has a market capitalization of $1.86 billion, a P/E ratio of 33.33, a P/E/G ratio of 2.52 and a beta of 1.21. The company has a 50 day moving average of $17.33 and a 200 day moving average of $15.34.

TripAdvisor (NASDAQ:TRIP - Get Free Report) last announced its quarterly earnings data on Thursday, August 7th. The travel company reported $0.46 EPS for the quarter, beating analysts' consensus estimates of $0.43 by $0.03. TripAdvisor had a net margin of 3.53% and a return on equity of 12.40%. The company had revenue of $529.00 million for the quarter, compared to the consensus estimate of $529.91 million. During the same period in the prior year, the firm posted $0.39 EPS. The company's quarterly revenue was up 6.4% compared to the same quarter last year. TripAdvisor has set its Q3 2025 guidance at EPS. FY 2025 guidance at EPS. As a group, research analysts forecast that TripAdvisor will post 0.46 EPS for the current fiscal year.

Insider Activity

In related news, insider Seth J. Kalvert sold 10,880 shares of the stock in a transaction on Friday, September 19th. The shares were sold at an average price of $20.04, for a total value of $218,035.20. Following the transaction, the insider directly owned 136,914 shares of the company's stock, valued at $2,743,756.56. This trade represents a 7.36% decrease in their position. The transaction was disclosed in a filing with the SEC, which is accessible through the SEC website. Insiders own 3.10% of the company's stock.

Hedge Funds Weigh In On TripAdvisor

Several large investors have recently bought and sold shares of TRIP. Penserra Capital Management LLC increased its position in shares of TripAdvisor by 0.3% during the second quarter. Penserra Capital Management LLC now owns 240,847 shares of the travel company's stock worth $3,143,000 after purchasing an additional 745 shares in the last quarter. Brown Miller Wealth Management LLC grew its stake in TripAdvisor by 6.8% during the 2nd quarter. Brown Miller Wealth Management LLC now owns 12,322 shares of the travel company's stock worth $161,000 after buying an additional 781 shares during the last quarter. Teacher Retirement System of Texas grew its stake in TripAdvisor by 4.8% during the 2nd quarter. Teacher Retirement System of Texas now owns 17,386 shares of the travel company's stock worth $227,000 after buying an additional 802 shares during the last quarter. First Hawaiian Bank increased its position in TripAdvisor by 2.9% during the first quarter. First Hawaiian Bank now owns 35,684 shares of the travel company's stock worth $506,000 after buying an additional 1,013 shares during the period. Finally, Smartleaf Asset Management LLC lifted its stake in TripAdvisor by 86.9% in the first quarter. Smartleaf Asset Management LLC now owns 3,055 shares of the travel company's stock valued at $43,000 after buying an additional 1,420 shares during the last quarter. Institutional investors and hedge funds own 98.99% of the company's stock.

TripAdvisor Company Profile

(

Get Free Report)

TripAdvisor, Inc operates as an online travel company, primarily engages in the provision of travel guidance products and services worldwide. The company operates in three segments: Brand Tripadvisor, Viator, and TheFork. The Brand Tripadvisor segment offers travel guidance platforms for travelers to discover, generate, and share authentic user-generated content in the form of ratings and reviews for destinations, points-of-interest, experiences, accommodations, restaurants, and cruises.

Recommended Stories

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider TripAdvisor, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and TripAdvisor wasn't on the list.

While TripAdvisor currently has a Reduce rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.