Snap (NYSE:SNAP - Free Report) had its price objective decreased by UBS Group from $10.00 to $9.00 in a research report sent to investors on Wednesday morning,Benzinga reports. UBS Group currently has a neutral rating on the stock.

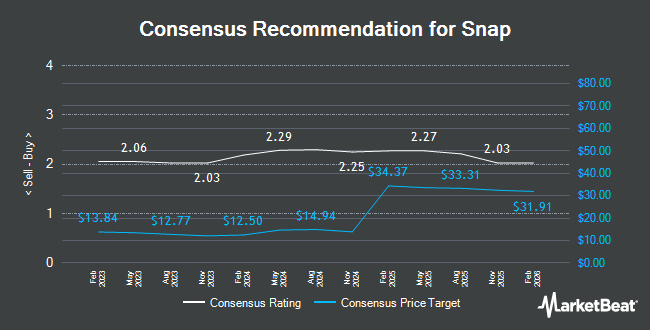

Several other research analysts have also recently weighed in on SNAP. B. Riley decreased their price objective on shares of Snap from $12.00 to $10.00 and set a "neutral" rating for the company in a report on Wednesday, April 30th. Citizens Jmp reaffirmed a "market perform" rating on shares of Snap in a research report on Wednesday. JMP Securities reissued a "market perform" rating on shares of Snap in a report on Wednesday. Loop Capital dropped their price target on Snap from $16.00 to $12.00 and set a "buy" rating for the company in a research note on Friday, May 16th. Finally, Morgan Stanley increased their price target on Snap from $6.50 to $8.50 and gave the company an "equal weight" rating in a research note on Monday, July 21st. Two research analysts have rated the stock with a sell rating, twenty-three have issued a hold rating and five have issued a buy rating to the company. According to MarketBeat.com, the company presently has a consensus rating of "Hold" and a consensus target price of $34.16.

Check Out Our Latest Report on SNAP

Snap Stock Down 1.4%

NYSE:SNAP traded down $0.11 during trading hours on Wednesday, reaching $7.44. 26,571,573 shares of the company traded hands, compared to its average volume of 36,170,441. The company has a current ratio of 4.30, a quick ratio of 4.30 and a debt-to-equity ratio of 1.55. The business's 50-day moving average price is $8.91 and its two-hundred day moving average price is $9.13. Snap has a 1 year low of $7.08 and a 1 year high of $13.28. The stock has a market capitalization of $12.43 billion, a P/E ratio of -23.20 and a beta of 0.62.

Snap (NYSE:SNAP - Get Free Report) last issued its earnings results on Tuesday, August 5th. The company reported ($0.16) earnings per share (EPS) for the quarter, hitting the consensus estimate of ($0.16). Snap had a negative net margin of 9.69% and a negative return on equity of 22.68%. The business had revenue of $1.34 billion during the quarter, compared to analysts' expectations of $1.34 billion. During the same period in the previous year, the company earned ($0.15) earnings per share. The business's revenue for the quarter was up 8.7% compared to the same quarter last year. Analysts predict that Snap will post -0.3 earnings per share for the current year.

Insiders Place Their Bets

In other news, SVP Eric Young sold 117,592 shares of the company's stock in a transaction dated Friday, May 16th. The stock was sold at an average price of $8.59, for a total transaction of $1,010,115.28. Following the completion of the transaction, the senior vice president directly owned 3,348,290 shares of the company's stock, valued at approximately $28,761,811.10. This represents a 3.39% decrease in their position. The transaction was disclosed in a legal filing with the SEC, which can be accessed through this link. Also, General Counsel Michael J. O'sullivan sold 24,000 shares of the company's stock in a transaction that occurred on Thursday, July 31st. The shares were sold at an average price of $9.57, for a total value of $229,680.00. Following the completion of the transaction, the general counsel directly owned 486,984 shares of the company's stock, valued at $4,660,436.88. This trade represents a 4.70% decrease in their ownership of the stock. The disclosure for this sale can be found here. Insiders have sold 667,802 shares of company stock valued at $5,813,801 in the last three months. Corporate insiders own 22.68% of the company's stock.

Institutional Trading of Snap

Several institutional investors and hedge funds have recently bought and sold shares of the business. Vanguard Group Inc. increased its stake in shares of Snap by 6.7% during the first quarter. Vanguard Group Inc. now owns 109,483,491 shares of the company's stock worth $953,601,000 after acquiring an additional 6,921,841 shares during the period. Capital World Investors increased its position in Snap by 38.9% during the 4th quarter. Capital World Investors now owns 84,137,317 shares of the company's stock worth $906,161,000 after purchasing an additional 23,569,522 shares during the period. SRS Investment Management LLC lifted its holdings in shares of Snap by 1.4% in the 4th quarter. SRS Investment Management LLC now owns 73,723,115 shares of the company's stock valued at $793,998,000 after buying an additional 1,001,632 shares during the period. Capital International Investors purchased a new stake in shares of Snap in the fourth quarter valued at approximately $422,049,000. Finally, Geode Capital Management LLC grew its holdings in Snap by 1.1% during the fourth quarter. Geode Capital Management LLC now owns 11,831,472 shares of the company's stock worth $127,078,000 after acquiring an additional 134,017 shares during the period. Hedge funds and other institutional investors own 47.52% of the company's stock.

About Snap

(

Get Free Report)

Snap Inc operates as a technology company in North America, Europe, and internationally. The company offers Snapchat, a visual messaging application with various tabs, such as camera, visual messaging, snap map, stories, and spotlight that enable people to communicate visually through short videos and images.

Read More

Before you consider Snap, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Snap wasn't on the list.

While Snap currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.