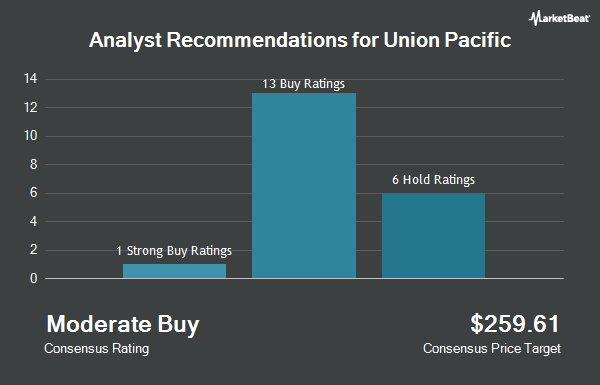

Union Pacific Corporation (NYSE:UNP - Get Free Report) has earned an average rating of "Moderate Buy" from the twenty-eight analysts that are currently covering the company, Marketbeat reports. Eleven equities research analysts have rated the stock with a hold rating, sixteen have issued a buy rating and one has given a strong buy rating to the company. The average 12-month price target among analysts that have updated their coverage on the stock in the last year is $261.6250.

Several research analysts have commented on the stock. TD Cowen dropped their price objective on shares of Union Pacific from $258.00 to $257.00 and set a "buy" rating for the company in a report on Friday. Wells Fargo & Company increased their price objective on shares of Union Pacific from $250.00 to $260.00 and gave the company an "overweight" rating in a report on Friday, July 25th. Jefferies Financial Group upgraded shares of Union Pacific from a "hold" rating to a "buy" rating and upped their target price for the company from $250.00 to $285.00 in a research report on Friday, July 25th. JPMorgan Chase & Co. upped their target price on shares of Union Pacific from $265.00 to $267.00 and gave the company a "neutral" rating in a research report on Friday. Finally, Barclays cut shares of Union Pacific from an "overweight" rating to an "equal weight" rating in a research report on Wednesday, July 30th.

Read Our Latest Stock Analysis on UNP

Institutional Trading of Union Pacific

Hedge funds have recently made changes to their positions in the business. Envestnet Portfolio Solutions Inc. raised its position in shares of Union Pacific by 10.6% during the 2nd quarter. Envestnet Portfolio Solutions Inc. now owns 93,337 shares of the railroad operator's stock valued at $21,475,000 after buying an additional 8,925 shares in the last quarter. LGT Group Foundation raised its position in Union Pacific by 9.7% in the 1st quarter. LGT Group Foundation now owns 5,398 shares of the railroad operator's stock worth $1,275,000 after purchasing an additional 477 shares during the period. Nuveen LLC purchased a new stake in Union Pacific in the 1st quarter worth about $988,822,000. SlateStone Wealth LLC raised its position in Union Pacific by 6.2% in the 1st quarter. SlateStone Wealth LLC now owns 13,264 shares of the railroad operator's stock worth $3,133,000 after purchasing an additional 772 shares during the period. Finally, Meadow Creek Wealth Advisors LLC raised its position in Union Pacific by 10.9% in the 1st quarter. Meadow Creek Wealth Advisors LLC now owns 3,666 shares of the railroad operator's stock worth $866,000 after purchasing an additional 359 shares during the period. 80.38% of the stock is currently owned by hedge funds and other institutional investors.

Union Pacific Stock Down 1.6%

UNP opened at $216.56 on Friday. The firm has a 50-day simple moving average of $224.95 and a two-hundred day simple moving average of $224.28. Union Pacific has a 52 week low of $204.66 and a 52 week high of $256.84. The company has a market capitalization of $128.44 billion, a PE ratio of 18.40, a price-to-earnings-growth ratio of 2.29 and a beta of 1.07. The company has a quick ratio of 0.53, a current ratio of 0.75 and a debt-to-equity ratio of 1.75.

Union Pacific (NYSE:UNP - Get Free Report) last released its quarterly earnings data on Thursday, October 23rd. The railroad operator reported $3.08 EPS for the quarter, beating the consensus estimate of $2.99 by $0.09. Union Pacific had a net margin of 28.73% and a return on equity of 42.23%. The business had revenue of $6.24 billion during the quarter, compared to the consensus estimate of $6.24 billion. During the same quarter in the prior year, the firm earned $2.75 EPS. The business's revenue was up 2.5% on a year-over-year basis. Analysts forecast that Union Pacific will post 11.99 earnings per share for the current fiscal year.

Union Pacific Company Profile

(

Get Free Report)

Union Pacific Corporation, through its subsidiary, Union Pacific Railroad Company, operates in the railroad business in the United States. The company offers transportation services for grain and grain products, fertilizers, food and refrigerated products, and coal and renewables to grain processors, animal feeders, ethanol producers, renewable biofuel producers, and other agricultural users; and construction products, industrial chemicals, plastics, forest products, specialized products, metals and ores, petroleum, liquid petroleum gases, soda ash, and sand, as well as finished automobiles, automotive parts, and merchandise in intermodal containers.

Read More

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider Union Pacific, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Union Pacific wasn't on the list.

While Union Pacific currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.