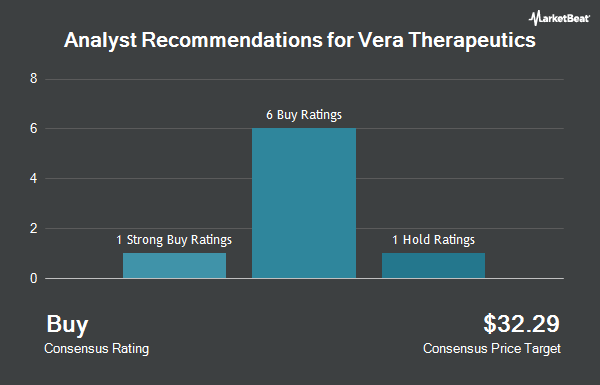

Vera Therapeutics, Inc. (NASDAQ:VERA - Get Free Report) has earned a consensus recommendation of "Buy" from the ten research firms that are presently covering the company, MarketBeat reports. One equities research analyst has rated the stock with a hold recommendation, seven have given a buy recommendation and two have assigned a strong buy recommendation to the company. The average 1 year target price among brokers that have issued a report on the stock in the last year is $65.00.

A number of research firms have recently weighed in on VERA. Wedbush dropped their price target on shares of Vera Therapeutics from $34.00 to $26.00 and set a "neutral" rating on the stock in a research note on Wednesday, May 7th. Guggenheim reissued a "buy" rating on shares of Vera Therapeutics in a research report on Tuesday, June 3rd. Cantor Fitzgerald lowered their target price on shares of Vera Therapeutics from $107.00 to $100.00 and set an "overweight" rating on the stock in a research report on Wednesday, May 7th. HC Wainwright reissued a "buy" rating and set a $85.00 target price (up from $75.00) on shares of Vera Therapeutics in a research report on Monday, June 2nd. Finally, Scotiabank reissued an "outperform" rating on shares of Vera Therapeutics in a research report on Tuesday, June 3rd.

Read Our Latest Stock Analysis on VERA

Vera Therapeutics Stock Down 1.1%

Shares of NASDAQ VERA traded down $0.25 during mid-day trading on Tuesday, reaching $23.51. The company had a trading volume of 312,736 shares, compared to its average volume of 995,413. Vera Therapeutics has a twelve month low of $18.53 and a twelve month high of $51.61. The company has a debt-to-equity ratio of 0.10, a quick ratio of 27.68 and a current ratio of 27.68. The stock has a market capitalization of $1.50 billion, a PE ratio of -7.82 and a beta of 1.19. The stock's 50 day moving average is $22.75 and its 200-day moving average is $27.03.

Vera Therapeutics (NASDAQ:VERA - Get Free Report) last posted its quarterly earnings results on Thursday, May 8th. The company reported ($0.81) earnings per share for the quarter, missing analysts' consensus estimates of ($0.75) by ($0.06). During the same period last year, the business earned ($0.56) EPS. As a group, equities analysts anticipate that Vera Therapeutics will post -2.89 earnings per share for the current fiscal year.

Insider Buying and Selling at Vera Therapeutics

In other news, Director Patrick G. Enright acquired 40,607 shares of the company's stock in a transaction dated Tuesday, June 24th. The stock was bought at an average price of $22.35 per share, with a total value of $907,566.45. Following the completion of the acquisition, the director owned 3,596,593 shares in the company, valued at approximately $80,383,853.55. This represents a 1.14% increase in their position. The acquisition was disclosed in a document filed with the SEC, which is available through this hyperlink. Insiders own 16.30% of the company's stock.

Institutional Trading of Vera Therapeutics

A number of hedge funds and other institutional investors have recently modified their holdings of the stock. GC Wealth Management RIA LLC acquired a new stake in shares of Vera Therapeutics in the second quarter valued at approximately $320,000. Perigon Wealth Management LLC acquired a new stake in shares of Vera Therapeutics in the second quarter valued at approximately $245,000. Fifth Third Bancorp acquired a new stake in shares of Vera Therapeutics in the second quarter valued at approximately $102,000. Rhumbline Advisers increased its holdings in shares of Vera Therapeutics by 7.9% in the first quarter. Rhumbline Advisers now owns 63,189 shares of the company's stock valued at $1,518,000 after purchasing an additional 4,600 shares in the last quarter. Finally, Jane Street Group LLC increased its holdings in shares of Vera Therapeutics by 297.1% in the first quarter. Jane Street Group LLC now owns 41,578 shares of the company's stock valued at $999,000 after purchasing an additional 62,678 shares in the last quarter. Institutional investors and hedge funds own 99.21% of the company's stock.

Vera Therapeutics Company Profile

(

Get Free ReportVera Therapeutics, Inc, a clinical stage biotechnology company, focuses on developing and commercializing treatments for patients with serious immunological diseases. Its lead product candidate is atacicept, a fusion protein self-administered as a subcutaneous injection that is in Phase III clinical trial for patients with immunoglobulin A nephropathy; and for treatment of lupus nephritis that is in Phase II clinical trial.

Recommended Stories

Before you consider Vera Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vera Therapeutics wasn't on the list.

While Vera Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Unlock the timeless value of gold with our exclusive 2025 Gold Forecasting Report. Explore why gold remains the ultimate investment for safeguarding wealth against inflation, economic shifts, and global uncertainties. Whether you're planning for future generations or seeking a reliable asset in turbulent times, this report is your essential guide to making informed decisions.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.