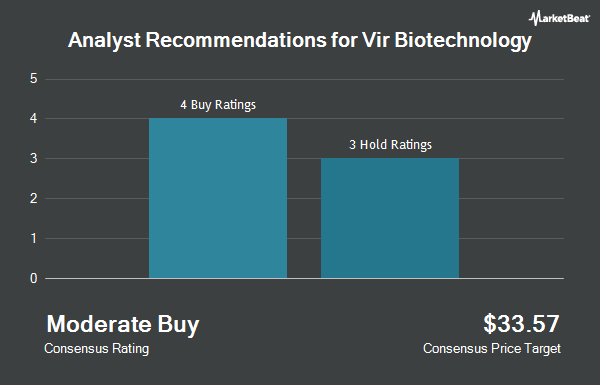

Vir Biotechnology, Inc. (NASDAQ:VIR - Get Free Report) has earned a consensus recommendation of "Moderate Buy" from the nine research firms that are covering the stock, MarketBeat Ratings reports. One investment analyst has rated the stock with a hold rating and eight have assigned a buy rating to the company. The average 1-year target price among brokerages that have covered the stock in the last year is $28.4444.

A number of research analysts recently commented on VIR shares. Needham & Company LLC reissued a "buy" rating and issued a $14.00 price target on shares of Vir Biotechnology in a report on Thursday, May 22nd. Raymond James Financial started coverage on Vir Biotechnology in a report on Friday, July 11th. They issued an "outperform" rating for the company. Finally, Bank of America raised Vir Biotechnology from a "neutral" rating to a "buy" rating and increased their price target for the company from $12.00 to $14.00 in a report on Wednesday.

Get Our Latest Report on Vir Biotechnology

Insider Activity at Vir Biotechnology

In other Vir Biotechnology news, Director Vicki L. Sato sold 22,000 shares of the company's stock in a transaction that occurred on Friday, August 1st. The stock was sold at an average price of $4.99, for a total transaction of $109,780.00. Following the sale, the director owned 1,276,391 shares in the company, valued at $6,369,191.09. This represents a 1.69% decrease in their ownership of the stock. The sale was disclosed in a filing with the SEC, which is available through this link. Also, EVP Mark Eisner sold 6,796 shares of the company's stock in a transaction that occurred on Tuesday, July 15th. The shares were sold at an average price of $5.47, for a total value of $37,174.12. Following the sale, the executive vice president owned 108,204 shares in the company, valued at $591,875.88. The trade was a 5.91% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 57,582 shares of company stock worth $294,930 in the last 90 days. 16.00% of the stock is currently owned by insiders.

Institutional Trading of Vir Biotechnology

Several institutional investors and hedge funds have recently bought and sold shares of VIR. Invesco Ltd. raised its stake in Vir Biotechnology by 0.6% during the fourth quarter. Invesco Ltd. now owns 398,772 shares of the company's stock valued at $2,927,000 after buying an additional 2,574 shares in the last quarter. XTX Topco Ltd acquired a new stake in Vir Biotechnology during the fourth quarter valued at approximately $177,000. Marshall Wace LLP acquired a new stake in Vir Biotechnology during the fourth quarter valued at approximately $173,000. First Trust Advisors LP acquired a new stake in Vir Biotechnology during the fourth quarter valued at approximately $93,000. Finally, Dimensional Fund Advisors LP raised its stake in Vir Biotechnology by 58.0% during the fourth quarter. Dimensional Fund Advisors LP now owns 1,915,465 shares of the company's stock valued at $14,059,000 after buying an additional 703,360 shares in the last quarter. Institutional investors and hedge funds own 65.32% of the company's stock.

Vir Biotechnology Price Performance

VIR traded down $0.10 on Tuesday, reaching $4.94. The company's stock had a trading volume of 1,676,623 shares, compared to its average volume of 1,541,118. The stock has a market cap of $686.26 million, a price-to-earnings ratio of -1.24 and a beta of 1.28. Vir Biotechnology has a 1 year low of $4.16 and a 1 year high of $14.45. The business's 50 day moving average is $5.09 and its 200 day moving average is $5.85.

Vir Biotechnology (NASDAQ:VIR - Get Free Report) last issued its quarterly earnings results on Wednesday, August 6th. The company reported ($0.80) EPS for the quarter, missing analysts' consensus estimates of ($0.72) by ($0.08). The business had revenue of $1.21 million during the quarter, compared to analysts' expectations of $2.38 million. Vir Biotechnology had a negative net margin of 2,895.94% and a negative return on equity of 50.22%. The company's revenue for the quarter was down 60.5% on a year-over-year basis. During the same period in the prior year, the company posted ($1.02) EPS. As a group, research analysts forecast that Vir Biotechnology will post -3.92 earnings per share for the current fiscal year.

About Vir Biotechnology

(

Get Free Report)

Vir Biotechnology, Inc, an immunology company, develops therapeutic products to treat and prevent serious infectious diseases. Its clinical development pipeline consists of product candidates targeting hepatitis delta virus (HDV), hepatitis B virus (HBV), and human immunodeficiency virus (HIV). The company's preclinical candidates include those targeting influenza A and B, coronavirus disease 2019, respiratory syncytial virus (RSV) and human metapneumovirus (MPV), and human papillomavirus (HPV).

See Also

Before you consider Vir Biotechnology, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Vir Biotechnology wasn't on the list.

While Vir Biotechnology currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.