HCA Healthcare (NYSE:HCA - Free Report) had its price target cut by Wells Fargo & Company from $385.00 to $375.00 in a research report sent to investors on Thursday morning,Benzinga reports. They currently have an equal weight rating on the stock.

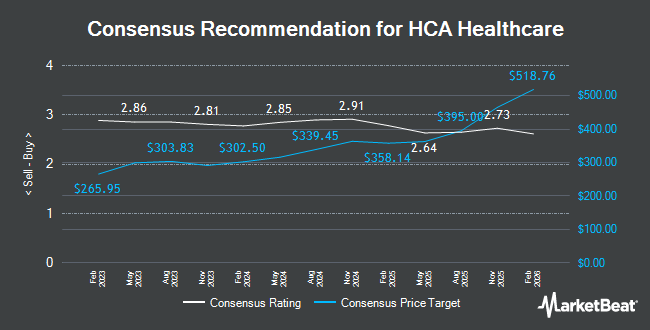

Several other analysts also recently issued reports on the stock. JPMorgan Chase & Co. upped their price objective on shares of HCA Healthcare from $360.00 to $370.00 and gave the stock a "neutral" rating in a report on Monday, August 4th. Barclays reduced their price target on shares of HCA Healthcare from $416.00 to $390.00 and set an "overweight" rating for the company in a report on Monday, July 28th. Royal Bank Of Canada reduced their price target on shares of HCA Healthcare from $404.00 to $401.00 and set an "outperform" rating for the company in a report on Monday, July 28th. Wall Street Zen upgraded shares of HCA Healthcare from a "hold" rating to a "buy" rating in a research note on Saturday, July 5th. Finally, Bank of America cut shares of HCA Healthcare from a "buy" rating to a "neutral" rating and set a $394.00 price objective for the company. in a research note on Wednesday, July 16th. Nine equities research analysts have rated the stock with a hold rating, eight have given a buy rating and one has issued a strong buy rating to the company's stock. According to data from MarketBeat, the stock presently has an average rating of "Moderate Buy" and an average price target of $398.58.

View Our Latest Stock Analysis on HCA Healthcare

HCA Healthcare Stock Up 0.6%

HCA stock traded up $2.18 during trading hours on Thursday, hitting $395.83. The company's stock had a trading volume of 1,251,407 shares, compared to its average volume of 1,541,143. The company has a quick ratio of 0.86, a current ratio of 0.98 and a debt-to-equity ratio of 69.07. The company has a market capitalization of $92.62 billion, a PE ratio of 16.64, a price-to-earnings-growth ratio of 1.24 and a beta of 1.39. HCA Healthcare has a 12 month low of $289.98 and a 12 month high of $417.14. The stock has a 50 day moving average price of $370.53 and a two-hundred day moving average price of $351.63.

HCA Healthcare (NYSE:HCA - Get Free Report) last posted its quarterly earnings data on Friday, July 25th. The company reported $6.84 earnings per share (EPS) for the quarter, topping the consensus estimate of $6.20 by $0.64. The business had revenue of $18.61 billion during the quarter, compared to the consensus estimate of $18.49 billion. HCA Healthcare had a net margin of 8.21% and a negative return on equity of 7,363.11%. HCA Healthcare's quarterly revenue was up 6.4% compared to the same quarter last year. During the same period in the prior year, the firm earned $5.50 EPS. On average, equities research analysts expect that HCA Healthcare will post 24.98 earnings per share for the current year.

HCA Healthcare Announces Dividend

The firm also recently announced a quarterly dividend, which will be paid on Tuesday, September 30th. Stockholders of record on Tuesday, September 16th will be paid a $0.72 dividend. This represents a $2.88 annualized dividend and a dividend yield of 0.7%. The ex-dividend date of this dividend is Tuesday, September 16th. HCA Healthcare's dividend payout ratio (DPR) is 12.11%.

Institutional Inflows and Outflows

Several hedge funds have recently modified their holdings of HCA. Cheviot Value Management LLC bought a new position in HCA Healthcare during the 1st quarter worth approximately $26,000. Saudi Central Bank acquired a new stake in shares of HCA Healthcare in the first quarter valued at approximately $26,000. WPG Advisers LLC acquired a new stake in shares of HCA Healthcare in the first quarter valued at approximately $27,000. Ameriflex Group Inc. acquired a new stake in shares of HCA Healthcare in the second quarter valued at approximately $27,000. Finally, Chung Wu Investment Group LLC acquired a new position in HCA Healthcare during the second quarter worth $27,000. Institutional investors own 62.73% of the company's stock.

HCA Healthcare Company Profile

(

Get Free Report)

HCA Healthcare, Inc, through its subsidiaries, owns and operates hospitals and related healthcare entities in the United States. It operates general and acute care hospitals that offers medical and surgical services, including inpatient care, intensive care, cardiac care, diagnostic, and emergency services; and outpatient services, such as outpatient surgery, laboratory, radiology, respiratory therapy, cardiology, and physical therapy.

Read More

Before you consider HCA Healthcare, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and HCA Healthcare wasn't on the list.

While HCA Healthcare currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Looking to profit from the electric vehicle mega-trend? Enter your email address and we'll send you our list of which EV stocks show the most long-term potential.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.