Wingstop (NASDAQ:WING - Get Free Report) had its price objective hoisted by equities researchers at Stephens from $400.00 to $425.00 in a research report issued on Thursday, MarketBeat.com reports. The brokerage presently has an "overweight" rating on the restaurant operator's stock. Stephens' price target would indicate a potential upside of 17.26% from the stock's previous close.

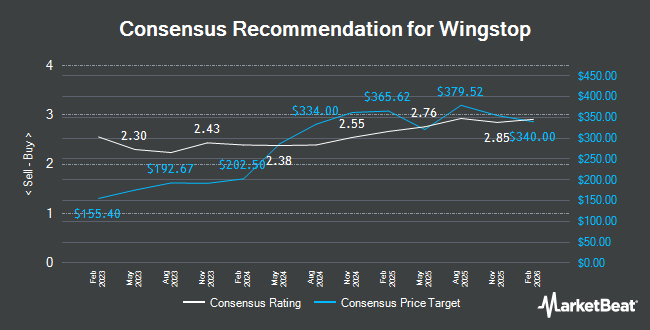

Other analysts also recently issued reports about the company. TD Securities reissued a "buy" rating and set a $440.00 price objective on shares of Wingstop in a research report on Tuesday, June 17th. Cowen reissued a "buy" rating on shares of Wingstop in a research report on Thursday, May 1st. Bank of America cut their price objective on Wingstop from $430.00 to $420.00 and set a "buy" rating for the company in a research report on Friday, July 18th. Gordon Haskett raised Wingstop to a "strong-buy" rating in a research report on Wednesday, April 30th. Finally, Robert W. Baird raised their price objective on Wingstop from $350.00 to $400.00 and gave the stock an "outperform" rating in a research report on Friday, May 23rd. One analyst has rated the stock with a sell rating, five have given a hold rating, twenty-one have given a buy rating and three have given a strong buy rating to the stock. According to data from MarketBeat.com, the company has an average rating of "Moderate Buy" and an average price target of $379.52.

Check Out Our Latest Report on WING

Wingstop Stock Performance

Shares of NASDAQ WING traded down $14.89 during trading on Thursday, hitting $362.45. 1,199,950 shares of the company were exchanged, compared to its average volume of 770,947. Wingstop has a 12-month low of $204.00 and a 12-month high of $433.86. The company has a fifty day moving average price of $340.50 and a 200-day moving average price of $285.90. The firm has a market capitalization of $10.11 billion, a PE ratio of 60.41, a P/E/G ratio of 5.05 and a beta of 1.84.

Wingstop (NASDAQ:WING - Get Free Report) last posted its quarterly earnings results on Wednesday, July 30th. The restaurant operator reported $1.00 EPS for the quarter, topping the consensus estimate of $0.88 by $0.12. Wingstop had a negative return on equity of 17.07% and a net margin of 25.61%. The business had revenue of $174.33 million for the quarter, compared to analyst estimates of $172.60 million. During the same quarter in the previous year, the firm earned $0.93 EPS. The company's quarterly revenue was up 12.0% compared to the same quarter last year. Research analysts anticipate that Wingstop will post 4.18 earnings per share for the current fiscal year.

Insiders Place Their Bets

In related news, SVP Marisa Carona sold 11,938 shares of the business's stock in a transaction that occurred on Friday, August 1st. The stock was sold at an average price of $370.34, for a total transaction of $4,421,118.92. The transaction was disclosed in a legal filing with the Securities & Exchange Commission, which is accessible through this hyperlink. Also, SVP Raj Kapoor sold 637 shares of the business's stock in a transaction that occurred on Monday, May 5th. The shares were sold at an average price of $273.07, for a total value of $173,945.59. Following the completion of the sale, the senior vice president owned 517 shares of the company's stock, valued at approximately $141,177.19. This represents a 55.20% decrease in their position. The disclosure for this sale can be found here. Insiders have sold 32,475 shares of company stock worth $11,665,881 in the last three months. 0.72% of the stock is owned by company insiders.

Institutional Investors Weigh In On Wingstop

A number of institutional investors and hedge funds have recently added to or reduced their stakes in WING. Price T Rowe Associates Inc. MD increased its holdings in shares of Wingstop by 43.2% in the first quarter. Price T Rowe Associates Inc. MD now owns 1,646,934 shares of the restaurant operator's stock valued at $371,517,000 after purchasing an additional 496,717 shares during the period. American Century Companies Inc. increased its holdings in shares of Wingstop by 4.7% in the first quarter. American Century Companies Inc. now owns 1,262,597 shares of the restaurant operator's stock valued at $284,817,000 after purchasing an additional 56,535 shares during the period. T. Rowe Price Investment Management Inc. acquired a new position in shares of Wingstop in the first quarter valued at approximately $212,672,000. Massachusetts Financial Services Co. MA increased its holdings in shares of Wingstop by 23.8% in the fourth quarter. Massachusetts Financial Services Co. MA now owns 801,732 shares of the restaurant operator's stock valued at $227,852,000 after purchasing an additional 154,055 shares during the period. Finally, Alyeska Investment Group L.P. increased its holdings in shares of Wingstop by 29.8% in the first quarter. Alyeska Investment Group L.P. now owns 693,115 shares of the restaurant operator's stock valued at $156,353,000 after purchasing an additional 158,977 shares during the period.

About Wingstop

(

Get Free Report)

Wingstop Inc, together with its subsidiaries, franchises and operates restaurants under the Wingstop brand. Its restaurants offer classic wings, boneless wings, tenders, and hand-sauced-and-tossed in various flavors, as well as chicken sandwiches with fries and hand-cut carrots and celery that are cooked-to-order.

See Also

Before you consider Wingstop, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Wingstop wasn't on the list.

While Wingstop currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.