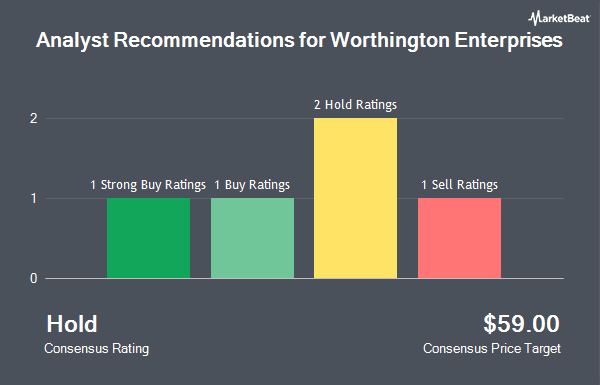

Shares of Worthington Enterprises, Inc. (NYSE:WOR - Get Free Report) have been assigned an average rating of "Hold" from the five research firms that are currently covering the stock, Marketbeat.com reports. One equities research analyst has rated the stock with a sell recommendation, two have assigned a hold recommendation, one has issued a buy recommendation and one has assigned a strong buy recommendation to the company. The average 1-year target price among analysts that have issued a report on the stock in the last year is $59.00.

Several brokerages have recently commented on WOR. Wall Street Zen raised Worthington Enterprises from a "buy" rating to a "strong-buy" rating in a report on Sunday, August 24th. The Goldman Sachs Group boosted their price objective on Worthington Enterprises from $44.00 to $50.00 and gave the stock a "sell" rating in a report on Thursday, June 26th. Zacks Research lowered Worthington Enterprises from a "strong-buy" rating to a "hold" rating in a report on Monday, August 25th. Finally, Canaccord Genuity Group boosted their price objective on Worthington Enterprises from $69.00 to $81.00 and gave the stock a "buy" rating in a report on Thursday, June 26th.

Get Our Latest Research Report on WOR

Worthington Enterprises Price Performance

WOR stock traded down $0.34 during mid-day trading on Friday, reaching $61.13. 257,739 shares of the company traded hands, compared to its average volume of 182,781. The company has a debt-to-equity ratio of 0.32, a current ratio of 3.48 and a quick ratio of 2.62. The company has a market capitalization of $3.04 billion, a P/E ratio of 32.00 and a beta of 1.20. Worthington Enterprises has a 52-week low of $37.88 and a 52-week high of $70.91. The company has a fifty day moving average price of $63.89 and a 200-day moving average price of $56.81.

Worthington Enterprises (NYSE:WOR - Get Free Report) last posted its earnings results on Tuesday, June 24th. The industrial products company reported $1.06 earnings per share for the quarter, beating analysts' consensus estimates of $0.84 by $0.22. The business had revenue of $317.88 million during the quarter, compared to analyst estimates of $300.96 million. Worthington Enterprises had a return on equity of 16.66% and a net margin of 8.33%.The company's quarterly revenue was down .3% compared to the same quarter last year. During the same quarter in the previous year, the firm earned $0.74 EPS. As a group, analysts anticipate that Worthington Enterprises will post 2.67 earnings per share for the current year.

Worthington Enterprises Increases Dividend

The firm also recently disclosed a quarterly dividend, which will be paid on Monday, September 29th. Stockholders of record on Monday, September 15th will be issued a dividend of $0.19 per share. The ex-dividend date of this dividend is Monday, September 15th. This is a positive change from Worthington Enterprises's previous quarterly dividend of $0.17. This represents a $0.76 annualized dividend and a dividend yield of 1.2%. Worthington Enterprises's payout ratio is presently 39.79%.

Institutional Inflows and Outflows

Several hedge funds and other institutional investors have recently modified their holdings of WOR. EverSource Wealth Advisors LLC boosted its stake in Worthington Enterprises by 693.6% in the second quarter. EverSource Wealth Advisors LLC now owns 619 shares of the industrial products company's stock worth $39,000 after buying an additional 541 shares in the last quarter. ORG Partners LLC boosted its stake in Worthington Enterprises by 61.0% in the second quarter. ORG Partners LLC now owns 660 shares of the industrial products company's stock worth $43,000 after buying an additional 250 shares in the last quarter. Ameritas Advisory Services LLC purchased a new stake in Worthington Enterprises in the second quarter worth approximately $46,000. Quarry LP purchased a new stake in Worthington Enterprises in the first quarter worth approximately $49,000. Finally, State of Wyoming purchased a new stake in Worthington Enterprises in the fourth quarter worth approximately $51,000. Hedge funds and other institutional investors own 51.59% of the company's stock.

Worthington Enterprises Company Profile

(

Get Free Report)

Worthington Enterprises, Inc operates as an industrial manufacturing company. It operates through three segments: Building Products, Consumer Products, and Sustainable Energy Solutions. The Building Products segment sells refrigerant and LPG cylinders, well water and expansion tanks, fire suppression tanks, chemical tanks, and foam and adhesive tanks for gas producers, and distributors.

Recommended Stories

Before you consider Worthington Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Worthington Enterprises wasn't on the list.

While Worthington Enterprises currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Nuclear energy stocks are roaring. It's the hottest energy sector of the year. Cameco Corp, Paladin Energy, and BWX Technologies were all up more than 40% in 2024. The biggest market moves could still be ahead of us, and there are seven nuclear energy stocks that could rise much higher in the next several months. To unlock these tickers, enter your email address below.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.