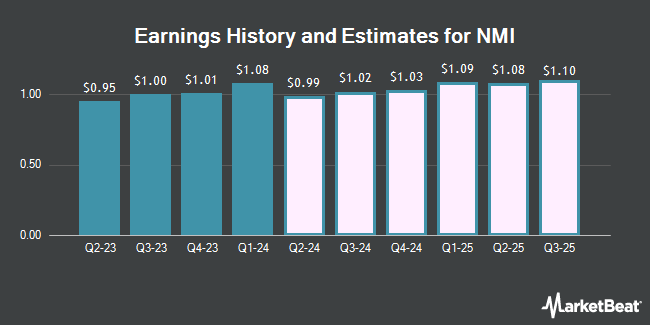

NMI Holdings Inc (NASDAQ:NMIH - Free Report) - Analysts at Zacks Research lifted their Q3 2026 earnings per share estimates for NMI in a report released on Wednesday, July 23rd. Zacks Research analyst R. Department now anticipates that the financial services provider will post earnings per share of $1.26 for the quarter, up from their prior estimate of $1.21. The consensus estimate for NMI's current full-year earnings is $4.62 per share. Zacks Research also issued estimates for NMI's FY2026 earnings at $5.06 EPS, Q2 2027 earnings at $1.35 EPS and FY2027 earnings at $5.38 EPS.

Several other analysts have also issued reports on the company. JPMorgan Chase & Co. increased their target price on NMI from $41.00 to $44.00 and gave the stock an "overweight" rating in a report on Friday, July 11th. Compass Point reissued a "buy" rating and set a $37.00 target price (up from $34.00) on shares of NMI in a report on Friday, May 23rd. Wall Street Zen cut NMI from a "buy" rating to a "hold" rating in a report on Saturday, July 12th. Barclays boosted their price target on NMI from $41.00 to $42.00 and gave the stock an "equal weight" rating in a report on Tuesday, July 8th. Finally, Keefe, Bruyette & Woods cut NMI from an "outperform" rating to a "market perform" rating and boosted their price target for the stock from $42.00 to $43.00 in a report on Monday, July 7th. Four research analysts have rated the stock with a hold rating and four have given a buy rating to the company's stock. According to MarketBeat, the company currently has an average rating of "Moderate Buy" and an average target price of $43.00.

Check Out Our Latest Stock Report on NMI

NMI Stock Performance

NMIH opened at $38.06 on Friday. The firm has a market cap of $2.97 billion, a P/E ratio of 8.22, a price-to-earnings-growth ratio of 1.17 and a beta of 0.55. NMI has a 52-week low of $31.90 and a 52-week high of $43.20. The company has a debt-to-equity ratio of 0.18, a quick ratio of 0.74 and a current ratio of 0.74. The business's fifty day moving average is $39.77 and its 200-day moving average is $37.26.

NMI (NASDAQ:NMIH - Get Free Report) last released its earnings results on Tuesday, April 29th. The financial services provider reported $1.28 earnings per share (EPS) for the quarter, topping the consensus estimate of $1.10 by $0.18. The company had revenue of $173.25 million for the quarter, compared to analyst estimates of $169.04 million. NMI had a return on equity of 17.27% and a net margin of 55.93%. NMI's quarterly revenue was up 10.8% on a year-over-year basis. During the same period in the prior year, the firm posted $1.08 EPS.

Institutional Investors Weigh In On NMI

A number of large investors have recently bought and sold shares of NMIH. Xponance Inc. grew its holdings in NMI by 10.3% in the fourth quarter. Xponance Inc. now owns 5,636 shares of the financial services provider's stock worth $207,000 after purchasing an additional 524 shares during the period. KLP Kapitalforvaltning AS acquired a new position in NMI during the fourth quarter worth $1,092,000. LPL Financial LLC raised its holdings in NMI by 197.6% during the fourth quarter. LPL Financial LLC now owns 49,962 shares of the financial services provider's stock worth $1,837,000 after buying an additional 33,174 shares during the last quarter. Vanguard Group Inc. raised its holdings in NMI by 0.6% during the fourth quarter. Vanguard Group Inc. now owns 7,158,877 shares of the financial services provider's stock worth $263,160,000 after buying an additional 39,503 shares during the last quarter. Finally, Congress Wealth Management LLC DE acquired a new position in NMI during the fourth quarter worth $226,000. 94.12% of the stock is currently owned by institutional investors and hedge funds.

Insider Transactions at NMI

In other NMI news, CEO Adam Pollitzer sold 57,166 shares of the firm's stock in a transaction on Thursday, May 1st. The shares were sold at an average price of $36.54, for a total value of $2,088,845.64. Following the completion of the sale, the chief executive officer directly owned 329,465 shares in the company, valued at approximately $12,038,651.10. This trade represents a 14.79% decrease in their ownership of the stock. The transaction was disclosed in a document filed with the SEC, which can be accessed through this hyperlink. Also, Director Michael Curry Montgomery sold 1,875 shares of the firm's stock in a transaction on Tuesday, May 13th. The stock was sold at an average price of $38.05, for a total transaction of $71,343.75. Following the completion of the sale, the director owned 66,068 shares of the company's stock, valued at $2,513,887.40. The trade was a 2.76% decrease in their ownership of the stock. The disclosure for this sale can be found here. In the last 90 days, insiders sold 113,697 shares of company stock valued at $4,210,337. 3.00% of the stock is owned by insiders.

About NMI

(

Get Free Report)

NMI Holdings, Inc provides private mortgage guaranty insurance services in the United States. The company offers mortgage insurance services, such as primary and pool insurance; and outsourced loan review services to mortgage loan originators. It serves national and regional mortgage banks, money center banks, credit unions, community banks, builder-owned mortgage lenders, internet-sourced lenders, and other non-bank lenders.

Further Reading

This instant news alert was generated by narrative science technology and financial data from MarketBeat in order to provide readers with the fastest and most accurate reporting. This story was reviewed by MarketBeat's editorial team prior to publication. Please send any questions or comments about this story to contact@marketbeat.com.

Before you consider NMI, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and NMI wasn't on the list.

While NMI currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Need to stretch out your 401K or Roth IRA plan? Use these time-tested investing strategies to grow the monthly retirement income that your stock portfolio generates.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.