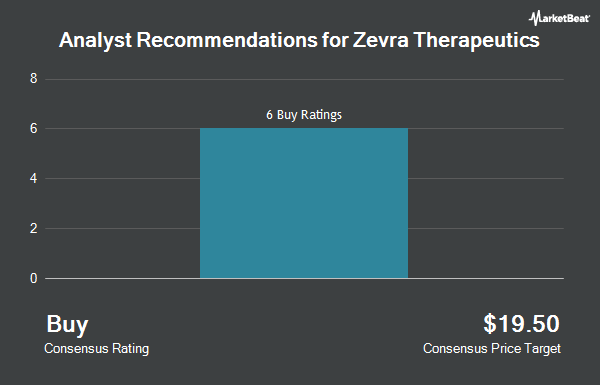

Shares of Zevra Therapeutics, Inc. (NASDAQ:ZVRA - Get Free Report) have been given a consensus rating of "Moderate Buy" by the nine ratings firms that are currently covering the firm, Marketbeat reports. One research analyst has rated the stock with a hold recommendation and eight have assigned a buy recommendation to the company. The average 1 year target price among analysts that have covered the stock in the last year is $23.7143.

ZVRA has been the topic of several research analyst reports. Wall Street Zen lowered Zevra Therapeutics from a "strong-buy" rating to a "buy" rating in a research note on Sunday, July 20th. HC Wainwright initiated coverage on Zevra Therapeutics in a research note on Wednesday, July 2nd. They issued a "buy" rating and a $26.00 price objective on the stock. Citigroup reaffirmed an "outperform" rating on shares of Zevra Therapeutics in a research note on Wednesday, August 13th. Zacks Research lowered Zevra Therapeutics from a "strong-buy" rating to a "hold" rating in a research note on Monday, August 18th. Finally, JMP Securities reduced their price objective on Zevra Therapeutics from $19.00 to $18.00 and set a "market outperform" rating on the stock in a research note on Wednesday, August 13th.

Check Out Our Latest Research Report on Zevra Therapeutics

Insider Buying and Selling

In related news, Director John B. Bode purchased 5,000 shares of Zevra Therapeutics stock in a transaction that occurred on Tuesday, August 19th. The shares were purchased at an average cost of $9.16 per share, with a total value of $45,800.00. Following the transaction, the director owned 45,000 shares of the company's stock, valued at approximately $412,200. The trade was a 12.50% increase in their position. The purchase was disclosed in a filing with the SEC, which can be accessed through this link. Company insiders own 2.40% of the company's stock.

Hedge Funds Weigh In On Zevra Therapeutics

Several hedge funds and other institutional investors have recently bought and sold shares of the stock. Ameritas Investment Partners Inc. lifted its position in Zevra Therapeutics by 30.0% during the 2nd quarter. Ameritas Investment Partners Inc. now owns 5,541 shares of the company's stock worth $49,000 after acquiring an additional 1,280 shares in the last quarter. The Manufacturers Life Insurance Company lifted its position in Zevra Therapeutics by 9.4% during the 2nd quarter. The Manufacturers Life Insurance Company now owns 20,294 shares of the company's stock worth $179,000 after acquiring an additional 1,750 shares in the last quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. raised its position in shares of Zevra Therapeutics by 6.1% in the 1st quarter. MIRAE ASSET GLOBAL ETFS HOLDINGS Ltd. now owns 31,761 shares of the company's stock valued at $238,000 after purchasing an additional 1,812 shares in the last quarter. Carret Asset Management LLC raised its position in shares of Zevra Therapeutics by 9.7% in the 2nd quarter. Carret Asset Management LLC now owns 39,640 shares of the company's stock valued at $349,000 after purchasing an additional 3,500 shares in the last quarter. Finally, Charles Schwab Investment Management Inc. raised its position in shares of Zevra Therapeutics by 2.6% in the 1st quarter. Charles Schwab Investment Management Inc. now owns 153,331 shares of the company's stock valued at $1,148,000 after purchasing an additional 3,827 shares in the last quarter. 35.03% of the stock is owned by institutional investors and hedge funds.

Zevra Therapeutics Trading Up 0.2%

ZVRA traded up $0.02 during midday trading on Wednesday, hitting $8.95. The company's stock had a trading volume of 765,544 shares, compared to its average volume of 1,643,669. The company has a current ratio of 7.85, a quick ratio of 7.81 and a debt-to-equity ratio of 0.52. The firm has a market cap of $502.36 million, a P/E ratio of -42.62 and a beta of 1.56. The firm has a 50-day moving average price of $10.57 and a two-hundred day moving average price of $8.91. Zevra Therapeutics has a 52-week low of $6.19 and a 52-week high of $13.16.

About Zevra Therapeutics

(

Get Free Report)

Zevra Therapeutics, Inc discovers and develops various proprietary prodrugs to treat serious medical conditions in the United States. The company develops its products through Ligand Activated Therapy platform. Its lead product candidate is KP1077, consisting of KP1077IH, which is under Phase 2 clinical trial for the treatment of idiopathic hypersomnia, and KP1077N, which is under Phase ½ clinical trial to treat narcolepsy.

Read More

Before you consider Zevra Therapeutics, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Zevra Therapeutics wasn't on the list.

While Zevra Therapeutics currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Just getting into the stock market? These 10 simple stocks can help beginning investors build long-term wealth without knowing options, technicals, or other advanced strategies.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.