Microsoft Today

$523.98 -4.59 (-0.87%) As of 04:00 PM Eastern

- 52-Week Range

- $344.79

▼

$555.45 - Dividend Yield

- 0.63%

- P/E Ratio

- 38.75

- Price Target

- $618.47

Many investors expect analysts to change their ratings after a company reports earnings. However, in many cases, investors can get clues about a company’s upcoming earnings from analyst activity before the earnings report is released.

If that’s the case, investors should be bullish about Microsoft Corporation NASDAQ: MSFT. The tech giant will report earnings on July 29, but analysts appear to be making bullish bets in advance. Since the beginning of July, MSFT stock has received one upgrade and three analysts have raised their price targets.

Notably, three of those four analysts are setting a $600 price target for Microsoft. That’s 12% above the current consensus price of $534.14 and 18.9% above the stock’s opening price of $509.61 on July 15.

Microsoft’s Evolution Is the Key to Its Growth

Microsoft’s leadership in AI exemplifies how adaptability, not just scale, drives the company’s long-term bull case. As AI adoption accelerates, many young and nimble companies are popping up. However, Microsoft’s ability to evolve remains a key reason it commands a premium valuation and maintains its place among tech’s elite.

This evolution is seen in its focus on artificial intelligence and cloud infrastructure through its entire product ecosystem. Azure has emerged as a leader in traditional cloud workloads and as a cornerstone of global AI development, powering everything from enterprise applications to advanced language models.

Meanwhile, Microsoft 365 now integrates AI-powered Copilot tools that are redefining productivity, turning its established Windows and Office software into a fresh growth engine.

This evolution is also visible in Microsoft’s push into cybersecurity, an area experiencing double-digit growth as enterprises prioritize digital defenses. The company’s expansion of Game Pass subscriptions and its integration of Activision Blizzard show how gaming has become another diversified revenue stream.

This theme of constant reinvention is shared across the Magnificent Seven stocks. NVIDIA Corp. NASDAQ: NVDA has transformed itself from a GPU manufacturer into the backbone of AI infrastructure.

Alphabet Inc. NASDAQ: GOOGL is embedding its Gemini AI into search and cloud products. Amazon.com Inc. NASDAQ: AMZN is scaling generative AI tools and automation across its logistics network, while Meta Platforms Inc. NASDAQ: META is integrating AI into advertising and content recommendations.

The Next $4 Trillion Company

Microsoft Stock Forecast Today

12-Month Stock Price Forecast:$618.4718.03% UpsideModerate BuyBased on 34 Analyst Ratings | Current Price | $523.98 |

|---|

| High Forecast | $710.00 |

|---|

| Average Forecast | $618.47 |

|---|

| Low Forecast | $475.00 |

|---|

Microsoft Stock Forecast DetailsNVIDIA beat Microsoft and other tech stocks to a $4 trillion market cap. However, Microsoft isn't far behind with a $3.75 trillion market cap. In fact, Dan Ives of Wedbush has forecast that the company will achieve a $5 trillion market cap in the next 18 months.

Anyone paying attention to Microsoft’s growth in the past year knows that this comes down to growth in artificial intelligence (AI) and cloud computing (via the company’s Azure platform).

Strong demand for AI solutions is driving Microsoft’s layoff announcements. The layoffs are part of the company’s push to replace some of its traditional sales force with solutions engineers. This is being done in response to customers who are demanding technical answers earlier in the sales process.

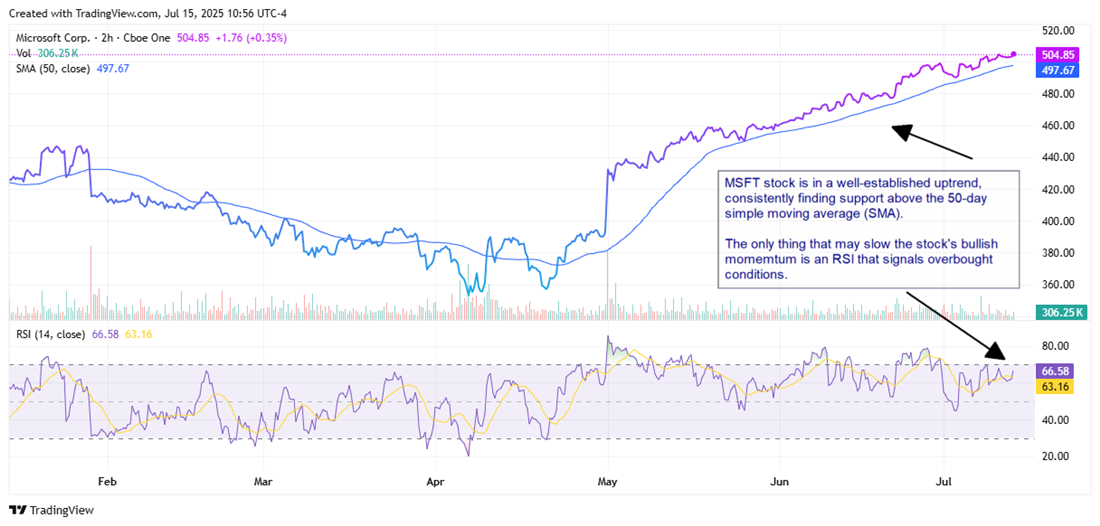

A Goldilocks Chart With 1 Small Area of Concern

MSFT stock has been trending higher in a well-established uptrend, consistently finding support above the 50-day simple moving average (SMA). This technical strength, combined with positive (albeit relatively flat) momentum from the MACD indicator, suggests continued bullish sentiment in the near term.

If you’re a long-term investor, this chart gives you no reason to be concerned about heading into earnings. Analyst sentiment suggests that the company is likely to beat on the top and bottom lines, which would be bullish for the stock.

One area of concern for those considering a new position might be the relative strength indicator (RSI), which is showing oversold conditions. This might inspire some profit-taking around the earnings report. However, if the stock breaks below its 50-day SMA, that would likely be a potential buying opportunity.

Before you consider Microsoft, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Microsoft wasn't on the list.

While Microsoft currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Discover the next wave of investment opportunities with our report, 7 Stocks That Will Be Magnificent in 2025. Explore companies poised to replicate the growth, innovation, and value creation of the tech giants dominating today's markets.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.