It Pays To Be A Bargain Hunter

It Pays To Be A Bargain Hunter

Bargain hunting. The act of buying stocks when they’re cheap with the hopes of selling them later at a profit. But what makes a bargain? A stock in a downtrend is certainly less expensive today than it was in the past but that doesn’t make it a buy.

The stocks I want to highlight today have been in multi-year downtrends and offer deep discounts to their peers. What makes them different from trash stocks, the factor that makes them buyable, is that they are well-established dividend-paying blue-chip favorites who’ve been correcting past wrongs. While each story is different they all share a common theme: restructuring and/or turnaround efforts are about to start paying off.

Kraft-Heinz Trims More Fat, Strengthens The Balance Sheet

The Kraft-Heinz (NASDAQ:KHC) turnaround took a new tone a few weeks ago when the company announced the sale of its natural cheese business. You may think whoa, what is Kraft without cheese but don’t fret. The deal is more like a sale-leaseback of infrastructure property. The U.S. arm of Groupe Lactalis is buying the business for $3.2 billion and licensing the Kraft cheese brands for perpetuity. What this means for Kraft is an initial 3% to 5% hit to revenue along with another $3.2 billion to put toward paying down debt and pursuing growth opportunities. What this means for investors is Kraft’s balance sheet is coming closer to the long-term goal.

Shares of Kraft are yielding nearly 5.0% with the stock trading near $32. The payout ratio is about 60% of earnings but not to worry, the company is projecting a return to sequential growth as soon as the 2nd quarter following the sale and YOY growth in the 2nd year. Until then, the balance sheet is in even better shape than it was before. Don’t forget, Kraft cut its dividend payment about two years ago in order to pay down its debt. The company was well on its way to reaching the target debt ratio of 3X earnings. On a technical basis, the stock has been bottoming for two years and appears to be putting in a bullish Head & Shoulders reversal. For this stock, reclaiming lost glory means a 200% to 300% upside from recent price action.

Wells Fargo Is Ready To Rebound

Wells Fargo (NYSE:WFC) has been dealing with one issue after another for years, it seems like, but may have finally hit rock bottom. The stock is trading just above a decade-low level where I think the bulls are waiting to buy. The company’s 3Q earnings report left a lot to be desired but one thing is clear; the bank is sitting on a lot of cash and is prepared to weather whatever storm the pandemic has left to bring.

The headlines may have seemed shocking, “Capital Reserves Fall To $769 million from $9.5 billion” but you have to read between the lines. What they mean is the amount of new capital put into reserves shrank from $9.5 billion to $769 million, the total capital reserves grew to $20.5 billion, are up more than 100% from last year, and put the company’s capital reserve ratio well above the FOMC’s target.

What this means for the dividend is that a distribution increase is coming and probably within the next 12 months. On a technical basis, the $22 level is very important. If the stock falls below here it could fall all the way to $10 but I don’t think that will happen. Wells Fargo is expected to have a major earnings rebound next year and that should help lift prices.

The Analysts Are Warming Up To General Electric

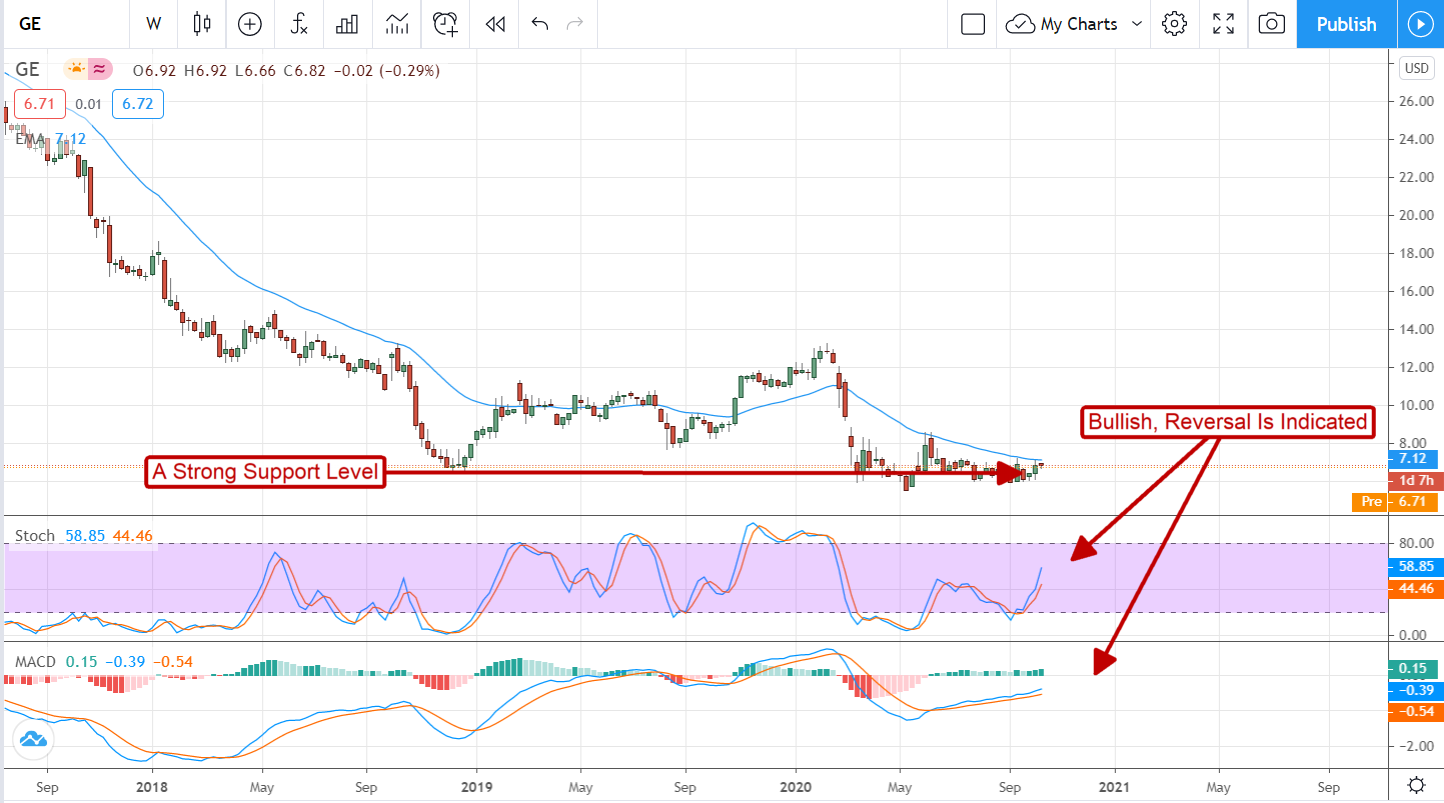

General Electric (NYSE:GE) just got a nod from the analyst’s community that highlights its turnaround story. CEO Larry Culp has been working hard for the last two years trimming fat, streamlining operations, and refocusing the company on growth and those efforts are about to pay off. According to Joe Ritchie of Goldman Sachs, General Electric is a “leaner, more productive company with better capital discipline” and will emerge from the pandemic stronger than before. Regarding the earnings, EPS will likely come in negative to flat this year but growth is expected next.

The dividend looks a little shaky this year but is covered by the company’s cash position. Next year the payout ratio falls to a ridiculously low 2.9%. Methinks there is a distribution increase in the cards for GE and that could help (would help) lift share prices. Technically, the stock is bottoming at a long-term low and looks like it could easily move higher. The indicators suggest a strong buy is warranted, the only thing missing from this signal for me is a strong move above the EMA.

Before you consider GE Aerospace, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and GE Aerospace wasn't on the list.

While GE Aerospace currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for July 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.