Value Is Where You Find It, Right?

Value Is Where You Find It, Right?

There is a saying that value is where you find it and it is right, to a degree. Two stocks with all else in common can be said to be equally valued if both trade at the same value relative to the fundamentals. A stock that trades for $1,000 might be cheap compared to a stock that trades for $100 or even $10 or a $1 if the numbers are right. It all depends on the number of shares, earnings, etc. The problem, for smaller investors more than others, is that finding value where “you find it” doesn’t mean that all stocks are affordable.

Smaller investors may be attracted to the value of Amazon (NASDAQ: AMZN), Shopify (NYSE: SHOP), or Chipotle Mexican Grill (NYSE: CMG) but find the $1,000 price tag is far too high. At that price point investing in a single stock can leave far too few options when it comes to diversification and exposure. And that’s where penny stocks can come into play. Penny stocks, or stocks that trade for under $1.00, are a great way for smaller investors to get into the market, especially budding markets like the Cannabis industry.

Two Vertically Integrated Cannabis Penny Stocks

By far the best investments in the cannabis space are the vertically integrated operators like The Green Organic Dutchman (OTCMKTS:TGODF) and Medmen Enterprises (OTCMKTS:MMNFF). Vertically integrated companies control the entire operation from seed to sale including the facilities and distribution system for both. The Green Organic Dutchman is a smaller operator located in Canada’s most populous province of Ontario. The company is well-positioned as a growing boutique brand with sales supported by both the expansion of Ontario’s cannabis sales infrastructure and growth in Canada’s other cannabis markets. In terms of sales, sales have begun to grow on an exponential basis setting the company up for profitability sometime in calendar 2020.

If there was ever a penny stock worth investing in it is Medmen. Medmen is one of the U.S.’s largest multistate operators with 24 locations in 6 states. Not only does the company have more licenses than are currently in use (a path for growth) the company is well-positioned for U.S. Federal legalization. Once legalization is nationwide the company is expected to begin aggressively expanding the number of stores, licenses, and states in which it operates.

Two CBD Plays For Penny Stock Investors

The U.S. cannabis market isn’t all about pot, in many cases, it’s about hemp. Hemp is the source of CBD, a multi-billion dollar industry on its own, and is also an in-road for both U.S. and Canadian operators into as-yet unregulated cannabis markets. CBD Unlimited, formerly known as Endexx, manufactures and markets a line of consumable CBD products including oils, delayed-release capsules, beverages, topicals, and pet products.

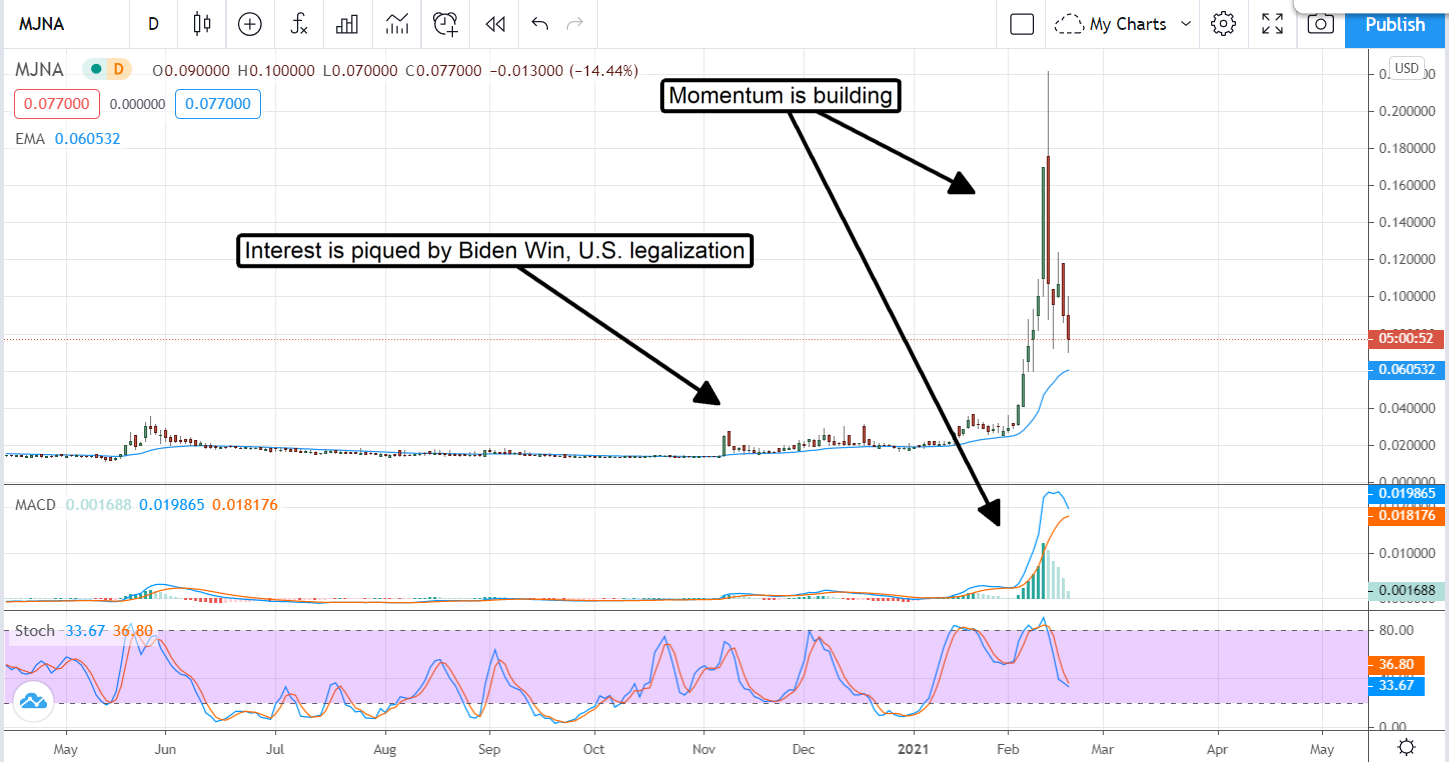

Another growing concern in the CBD space is Medical Marijuana, Inc (OTCMKTS:MJNA). This company also makes a line of CBD-infused products with a twist. This company focuses on the nutraceutical effects of cannabidiol oils and their applications as health treatments. Products include oils, chewing gum, topicals, and consumables.

Cannabis Infrastructure Penny Stocks Should Not Be Overlooked

Even with the robust outlook for cannabis, there is no way, not for sure, to know which brands will reign supreme. In that light, it is sometimes a good idea to invest in the infrastructure of a thing rather than the thing itself. In this case, it’s two company’s that sell and/or set up and service cannabis production. Two businesses that are assured of sales if not of who those sales will come from.

GreenGro Technologies (OTCMKTS:GRNH) manufactures and markets vertical grow systems and components for both industrial and home use. The company recently inked a deal with Arkansas-based Organa, an organic CBD producer, that should catapult both companies to the forefront of the green-CBD market. Agritek Holdings, Inc (OTCMKTS:AGTK) is a Florida-based company operating under in several segments within the cannabis industry. The company is vertically integrated with brands of its own currently on the market but the business is focused more on setting up and/or leasing operational space for other businesses. Yet again, this is a company in a great position for U.S. legalization.

Before you consider MedMen Enterprises, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and MedMen Enterprises wasn't on the list.

While MedMen Enterprises currently has a Hold rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

MarketBeat's analysts have just released their top five short plays for October 2025. Learn which stocks have the most short interest and how to trade them. Enter your email address to see which companies made the list.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.