Chipotle Mexican Grill Today

CMG

Chipotle Mexican Grill

$41.77 -0.33 (-0.79%) As of 10/15/2025 03:59 PM Eastern

This is a fair market value price provided by Polygon.io. Learn more. - 52-Week Range

- $38.30

▼

$66.74 - P/E Ratio

- 37.29

- Price Target

- $57.86

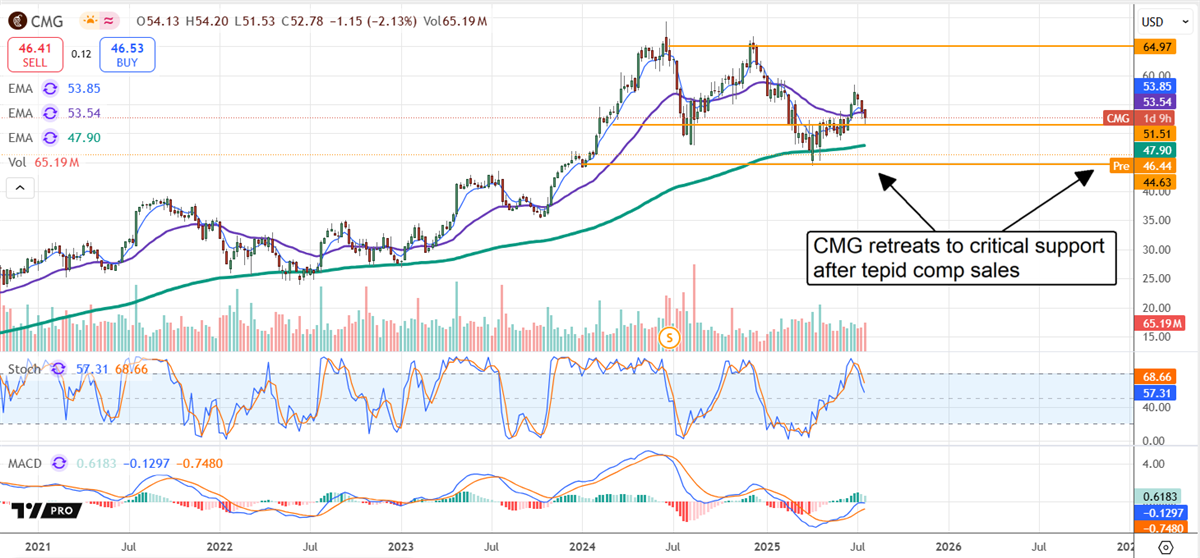

Chipotle Mexican Grill’s NYSE: CMG share price plunged by more than 10% following its fiscal Q2 release, opening what can only be called a smoking hot entry point. The price plunge was sparked by weak comparable store sales, a problem to be sure, but one tied to macroeconomic conditions and a consumer pullback, rather than fundamental operating conditions.

As MarketBeat analyst Chris Markoch likes to put it, weak comps are akin to insider selling; they provide a reason for those who want to sell.

The takeaway is that Chipotle Mexican Grill continues to build business and shareholder leverage, expanding its footprint domestically and abroad, providing a reason to buy for those with Chipotle’s endgame in mind.

Chipotle Has Solid Quarter as Comps Ease and Store Count Grows

Chipotle had a decent quarter despite its relatively tepid results. The company reported $3.06 billion in net revenue for a gain of 3.0% YOY. The market’s sticking point is that growth slowed as comps turned negative, falling by 4% in the quarter, missing MarketBeat’s reported consensus by a narrow margin.

The growth is due entirely to the 8.8% increase in quarter-ending YOY store count, offset by a 4.9% decline in transactions, only partially offset by the increased check average.

Digital, a critical component of Chipotle’s growth and margin strategy, remains vibrant. It accounts for 35.5% of revenue and is expected to continue as a pillar of growth moving forward. The guidance includes an outlook for 330 new stores at the midpoint, with 80% expected to have a Chipotlane.

Chipotlanes are critical because they are accessed only through digital, and the stores that have them outperform those without.

Guidance is another sticking point for the market, particularly regarding the outlook for growth, which is diminished compared to the prior year. The good news is that the company reported improved traction at the end of the quarter, with June comps turning positive as tariff and inflation fears subsided, so outperformance is probable.

Among the key takeaways is that Chipotle is guiding for system-wide growth and sufficient margins to sustain its long-term outlook and capital return.

Chipotle Mexican Grill Builds Leverage: Falls to Low End of Trading Range

Chipotle Mexican Grill’s Q2 balance sheet highlights reflect the strength of its restaurant business model. While equity declined by 3.5% YTD, the loss is primarily due to increased lease liability tied to its store count growth.

Chipotle Mexican Grill Stock Forecast Today

12-Month Stock Price Forecast:$57.8638.54% UpsideModerate BuyBased on 32 Analyst Ratings | Current Price | $41.77 |

|---|

| High Forecast | $73.00 |

|---|

| Average Forecast | $57.86 |

|---|

| Low Forecast | $44.00 |

|---|

Chipotle Mexican Grill Stock Forecast DetailsRevenue and cash flow will improve along with the store count growth, providing ample funds to sustain operations while maintaining a fortress-like position. Other highlights include no significant long-term debt other than lease obligations, and cash and assets are up, with total liabilities of $5.740 billion, roughly 1.3 times the equity.

Chipotle also builds leverage with its capital return. The company isn’t paying dividends but is aggressively repurchasing shares. The Q2 activity reduced the average count by 2.2% YOY and 1.9% YTD, leaving sufficient capital under the current authorization to continue at this pace for about two more quarters.

Based on the balance sheet and cash flow, the board will likely approve an additional authorization by the year's end or early 2026.

The chart action in CMG isn’t fantastic. The market has been under pressure for the last 12 months due to several factors, including a period of tough comparisons, CEO Brian Niccol's exit, and a stock split. However, the market remains above critical support in early premarket trading following the release and may stay there.

The critical support level is near $45, aligning with the low end of the analyst range. A move below this level is unexpected, given the company’s health, outlook, and forward P/E, which suggests a 100% increase in stock price over the next few years. Consolidation and a rebound from this level are expected.

Before you consider Chipotle Mexican Grill, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Chipotle Mexican Grill wasn't on the list.

While Chipotle Mexican Grill currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Enter your email address and we'll send you MarketBeat's list of ten stocks that are set to soar in Fall 2025, despite the threat of tariffs and other economic uncertainty. These ten stocks are incredibly resilient and are likely to thrive in any economic environment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.