Apple Today

$262.24 +9.95 (+3.94%) As of 04:00 PM Eastern

- 52-Week Range

- $169.21

▼

$264.38 - Dividend Yield

- 0.40%

- P/E Ratio

- 39.79

- Price Target

- $248.29

In the past three months, Apple Inc. NASDAQ: AAPL stock has jumped over 26% and become one of the better-performing stocks in the tech sector. The stock is still “only” up about 11% in the last 12 months, but recent analyst sentiment suggests that there’s still more upside to the stock’s recent rally heading into the holiday season. For many reasons, it’s still about the iPhone.

Since its Sept. 19 launch, Apple has been reporting stronger-than-expected sales for its latest iPhone model, the iPhone 17. Apple didn’t increase its price on the base model, which is helping drive sales. Plus, many iPhone users are ready for upgrades, particularly those who have an iPhone 15 or earlier model.

On the other hand, skeptics are pointing out that the initial surge seems to be slowing, particularly in the United States. They rationalize that consumers front-loaded their upgrades to the iPhone 16 to avoid the impact of tariffs.

Apple’s AI Story May Surprise Critics

Apple detractors will also note that the company has lagged behind companies like Microsoft, Alphabet, and Meta Platforms when it comes to an artificial intelligence (AI) strategy. All three of those companies have announced billions of dollars in capital expenditure to fund their AI ambitions, which are currently taking place in the cloud.

The current launch may not remove every concern, but the new iPhone does include several AI features, such as enhanced Siri, real-time translation, and advanced image/video editing.

Early sales suggest these features may be enough to spur sales during the coming holiday season. Those purchases also increase the likelihood that consumers will sign up for other parts of Apple’s high-margin Services ecosystem, such as iCloud, Apple Music, or even AppleTV+.

Is Apple’s Walled Garden the Key to AI Success?

Apple MarketRank™ Stock Analysis

- Overall MarketRank™

- 95th Percentile

- Analyst Rating

- Moderate Buy

- Upside/Downside

- 4.1% Downside

- Short Interest Level

- Healthy

- Dividend Strength

- Strong

- Environmental Score

- -1.97

- News Sentiment

- 1.04

- Insider Trading

- Selling Shares

- Proj. Earnings Growth

- 12.64%

See Full AnalysisAnother reason for consumers to consider upgrading to the iPhone 17 may come from Apple’s privacy-first approach to AI. Apple has never been one to take the lead in areas like AI, but they tend to win with a well-executed strategy that pays off over time.

This appears to be true for AI that operates on devices (or at the edge) rather than in the cloud. Bloomberg Intelligence predicts that this market could reach $143 billion by 2034.

On-device AI allows Apple to leverage its custom silicon A-series and M-series chips to run AI models directly on its hardware. Plus, Apple is keeping those AI workloads local within its iOS ecosystem (i.e., its walled garden). This appeals to regulators and consumers who are wary of data collection and scrutinize cloud-based platforms.

Momentum Favors Further Stock Gains

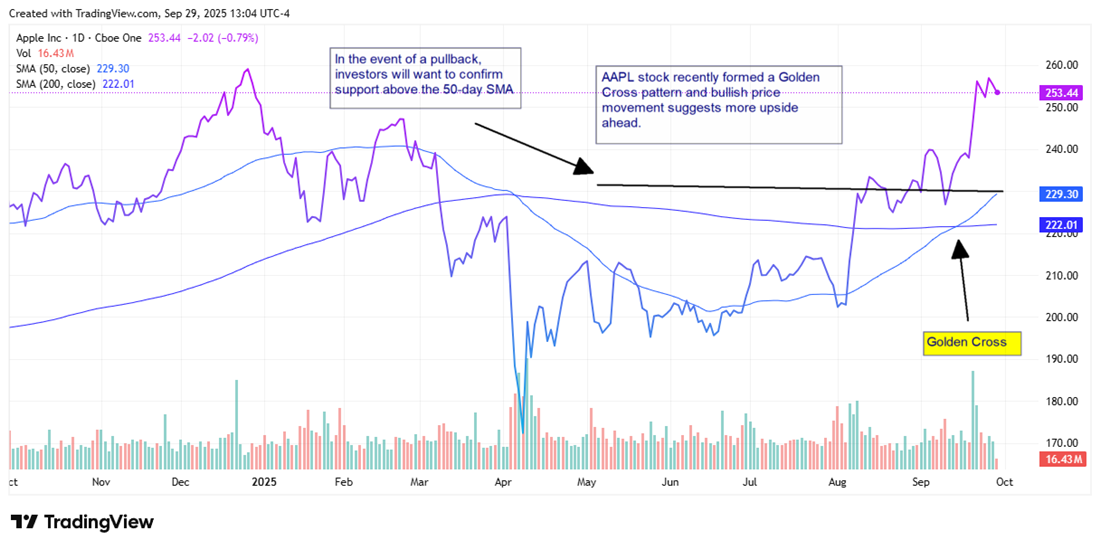

AAPL stock recently formed a Golden Cross pattern with its 50-day simple moving average crossing above its 200-day SMA. The stock closed at $253.44 on Sept. 26, which showed that the bullish signal is being confirmed by price action. However, an RSI of around 68 indicates near-term overbought conditions, with potential resistance of around $260. That could bring some consolidation or profit-taking ahead of the company’s next earnings report on October 30.

If the stock pulls back, an area around the 50-day SMA (i.e., $229) would be a level of support to watch. Holding above that level would confirm a breakout, which could send the stock above its 52-week high of around $260.

That would match the bullish sentiment of many analysts who are raising their price targets for AAPL stock. Dan Ives of Wedbush is the most bullish, giving the stock a price target of $310, up from $270.

Before you consider Apple, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Apple wasn't on the list.

While Apple currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Wondering where to start (or end) with AI stocks? These 10 simple stocks can help investors build long-term wealth as artificial intelligence continues to grow into the future.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.