The consumer staples sector, known for its stability and essential role in daily life, represents companies producing household goods like food, beverages, and personal care products.

The industry is characterized by its resilience, stability, and inelastic demand. In times of economic uncertainty and market turbulence, consumer staples companies tend to maintain a steady demand for their products, making them a reliable investment option for those seeking safety and consistent returns.

The Consumer Staples Select Sector SPDR ETF NYSE: XLP is a gateway to this sector, offering diversification and stability. Recently, XLP rapidly approached a fundamental support level, hinting at a potential turning point after a fast selloff, resulting in a 9.47% YTD decline.

Consumer Staples Trade into Critical Support

The ETF's rapid descent into a key level of support indicates a crucial juncture where the sector ETF is now closely aligning with a historical support level. This support level has proven significant over an extended period, suggesting that it might serve as a sturdy foundation for the ETF's valuation and a potential springboard for a move higher.

The current scenario presents investors with an intriguing opportunity to consider entering the market, as the ETF's price may have reached a level where it could rebound after selling off rapidly in a short period.

Investors need to consider the top-weighted names within the ETF, as these companies often significantly influence its performance.

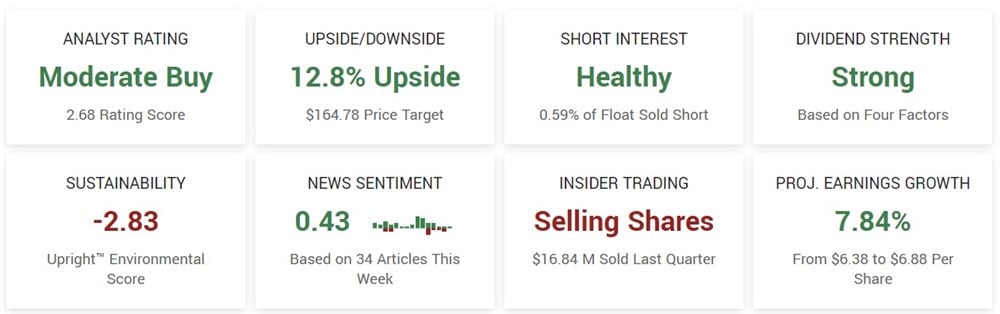

PG is the top-weighted name in the ETF with a 14.64% weighting. The multinational consumer goods corporation is having a year to forget, down almost 4%. However, investors will look closely at the company's upcoming earnings release on October 18 to see if the company can beat estimates. The company is expected to report earnings of $1.71 per share, representing growth of 8.92% year-over-year.

Analysts currently have the stock as a Moderate Buy, but that might change post-earnings. Analysts are bullish on PG with their rating and price target of $164.78, which sees over 13% upside.

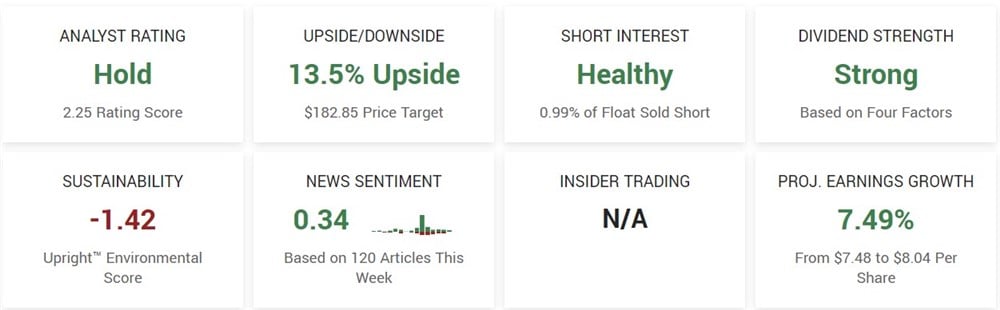

The second top holding of XLP is PEP, weighing 10.23%. Like PG, shares of PEP have so far underperformed the sector and overall market, down almost 11% year-to-date.

The dividend aristocrat trades in a key area of higher time frame support, around $160.Going forward, whether the stock can maintain this level or not will be key not only for its shareholders but also for the XLP.

The company recently reported earnings on October 10. They beat expectations with earnings of $2.25 per share (surpassing estimates by $0.10) and revenue of $23.45 billion (slightly higher than expected). Their quarterly revenue increased by 6.7% year-over-year. Over the past year, PepsiCo generated $6.00 in earnings per share and has a price-to-earnings ratio of 28.0. Earnings are projected to grow by 7.49% in the coming year, from $7.48 to $8.04 per share.

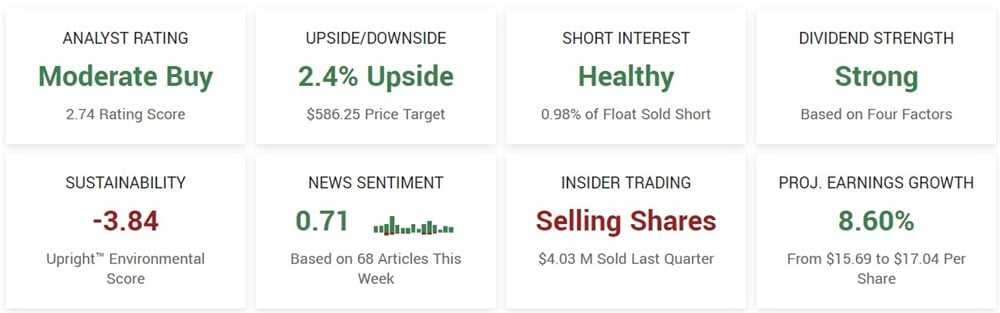

In third place is COST, with a weighting of 9.79% in the consumer staples ETF. Unlike the above two stocks, shares of COST have vastly outperformed its sector and the overall market during the year. Year-to-date, the stock is up almost over 25%, and that outperformance might continue as the stock looks likely to break above critical resistance near $580.

In its latest earnings report on September 26, 2023, Costco Wholesale exceeded expectations, reporting earnings of $4.86 per share for the quarter (surpassing estimates by $0.07) and revenue of $78.94 billion (beating forecasts by 9.5%). Their earnings per share over the past year was $14.16, and future earnings are expected to grow by 8.60%. The next earnings release is estimated to be on December 14, 2023.

COST is one of the most upgraded stocks with a Moderate Buy rating. However, analysts aren't calling for significant upside as the consensus analyst price target is just 2.07% higher than its previous close.

Before you consider Procter & Gamble, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis. MarketBeat has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and Procter & Gamble wasn't on the list.

While Procter & Gamble currently has a Moderate Buy rating among analysts, top-rated analysts believe these five stocks are better buys.

View The Five Stocks Here

Thinking about investing in Meta, Roblox, or Unity? Enter your email to learn what streetwise investors need to know about the metaverse and public markets before making an investment.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.