Data search and analytics platform

Elastic NYSE: ESTC stock has taken a tumble towards 2021 lows but is primed for a snapback rally. The leading provider of enterprise data search

solutions is still showing impressive double-digit top-line growth. Shares sold-off on fiscal Q2 2022 resulted in fears of a slowdown in growth as mixed guidance spooked investors to overreact. The Company has strong strategic partnerships with both

Google NASDAQ: GOOG and

Microsoft NASDAQ: MSFT. The Company is a leader in data observability and is moving to bolster its security offerings. The growth is fueled by its Elastic Cloud adoption with

enterprise search, security, and observability services. The fundamental growth in massive

data volumes continues to fuel the demand for Elastic solutions. Prudent investors looking for a cheap entry into a leading

enterprise search provider at a discount can watch for opportunistic pullbacks in shares of Elastic.

Fiscal Q2 2022 Earnings Release

On Dec. 1, 2021, Elastic released its fiscal second-quarter 2022 results for the quarter ended Oct. 2021. The Company reported an earnings-per-share (EPS) loss of (-$0.09) versus (-$0.16) consensus analyst estimates, an $0.07 beat. Revenues grew 42.1% year-over-year (YoY) to $206 million, beating analyst estimates for $194.57 million. Elastic cloud revenues grew 84% YoY to $69 million. Total customers with annual contract values (ACV) over $100,000 was 830 and total subscription customers grew to $17,000, up from $16,000 in same period year ago. Elastic CEO Shay Banon commented, ““Our strong second-quarter results were fueled by the rapid adoption of Elastic Cloud, the increased strategic relevance of our solutions, and continued expansion across our customer base. Customers are increasingly choosing Elastic Cloud to reduce complexity, automate operations, and make faster, data-driven decisions. Given the ongoing momentum, we expect Elastic Cloud revenue to exceed 50% of our total revenue in the next three years.”

Mixed Fiscal 2022 Guidance

Elastic provided Q3 fiscal 2022 EPS estimates to (-$0.24) to (-$0.20) versus (-$0.22) consensus analyst estimates on revenues between $207 to $209 million compared to $202.35 million analyst estimates. The Company provided full-year fiscal 2022 EPS to come in between (-$0.61) to ($0.51) versus analyst estimates for ($0.60) with raised revenues expected between $826 million to $832 million versus $813.52 analyst expectations.

Conference Call Takeaways

CEO Banon set the tone, “The strong performance was fueled by continued adoption of our differentiated solutions, reflecting our increased strategic relevance across our customer base. Organizations across the world continue to accelerate their digital transformation plan, creating a massive volume of data. IDC estimates that by 2025, we will be generating 480 exabytes of data per day. And as much as 90% of that data is unstructured. And with endless data comes endless possibilities.

At Elastic, we use the power of search to help people and organizations turn these possibilities into results. With our leading platform for search-powered solutions, we help everyone organizations, their employees and their customers accelerate the results that matter. Our solutions for enterprise search, observability and security help people find what they need faster, keep mission critical applications running smoothly, and protect against cyber threats. As I get that to spending time in person with customers, something I'm hearing again and again, is that for many organizations, their business strategy heavily relies on their cloud strategy. As organizations embrace the cloud to drive business agility and flexibility, IT systems also become more distributed and heterogeneous. This is because as new workloads are deployed on the cloud, many times across clouds, existing workloads might still run on-premises. And with data having gravity to it, deploying search powered solutions next to it while working seamlessly across it is critical. Our investments in Elastic Cloud are geared to address exactly these needs. And it is resonating with our customers. And we continue to invest in Elastic Cloud, which we expect will exceed 50% of our revenue in the next three years. We are expanding our strategic partnerships with the cloud hyperscalers. And we are seeing significant traction in the cloud marketplaces. This is happening thanks to our investments with each cloud provider in product, marketing, and the field.” He concluded, “Elastic is at the epicenter of all of these digital transformation trends, the possibilities for us are endless. That's why we're making significant investments in our business in all functions. And particularly in the field. We're expanding coverage in all geographies, and also expanding our global cloud inside sales, which supports our scalable programmatic approach to revenue generation, which focused on Elastic Cloud. And we continue to invest in our partnerships, Azure and Google Cloud were marquee sponsors of our Elastic on Global User Conference.”

ESTC Opportunistic Pullback Levels

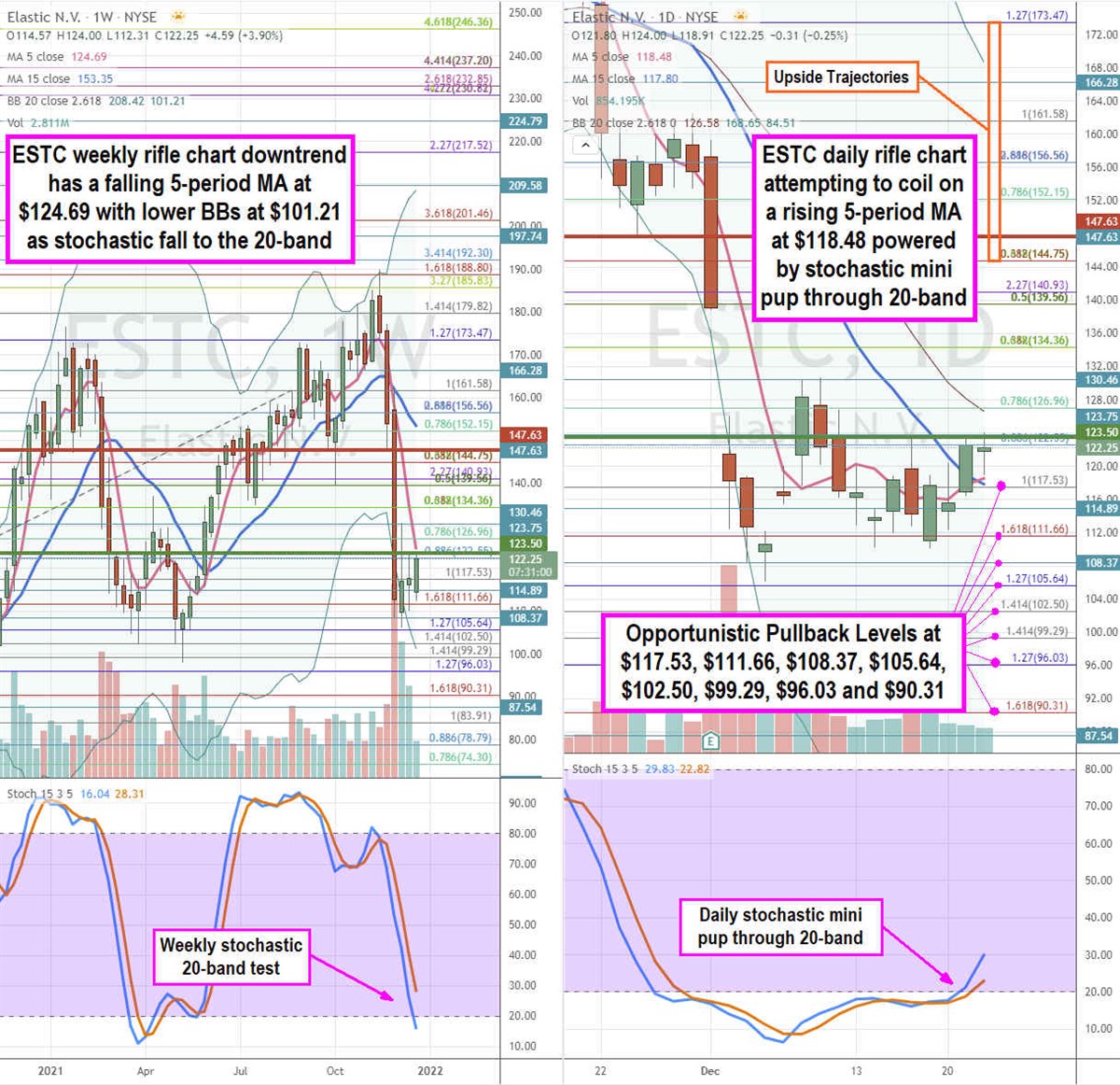

Using the rifle charts on the weekly and daily time frames provides a precision view of the landscape for ESTC stock. The weekly rifle chart peaked near the $188.80 Fibonacci (fib) level before triggering the market structure high (MSH) sell signal on the $147.63 breakdown. Shares collapsed on earnings on thw weekly stochastic mini inverse pup to the 20-band. The weekly 5-period moving average (MA) resistance is falling at $124.69, followed by the 15-period MA at $153.35. The weekly market structure low (MSL) buy triggers above $123.50. The daily stochastic is attempting to breakout as the 5-period MA at $118.48 crosses up through the 15-period MA at $117.80. The daily stochastic has a strong stochastic mini pup that bounced through the 20-band. Prudent investors can watch for opportunistic pullback levels at the $117.53 fib, $111.66 fib, $108.37, $105.64 fib, $102.50 fib, $99.29 fib, $96.03 fib, and the $90.31 fib level. Upside trajectories range from the $144.75 fib level up towards the $173.47 fib level.

Before you make your next trade, you'll want to hear this.

MarketBeat keeps track of Wall Street's top-rated and best performing research analysts and the stocks they recommend to their clients on a daily basis.

Our team has identified the five stocks that top analysts are quietly whispering to their clients to buy now before the broader market catches on... and none of the big name stocks were on the list.

They believe these five stocks are the five best companies for investors to buy now...

See The Five Stocks Here

Explore Elon Musk’s boldest ventures yet—from AI and autonomy to space colonization—and find out how investors can ride the next wave of innovation.

Get This Free Report

Like this article? Share it with a colleague.

Link copied to clipboard.